Market Review and Update

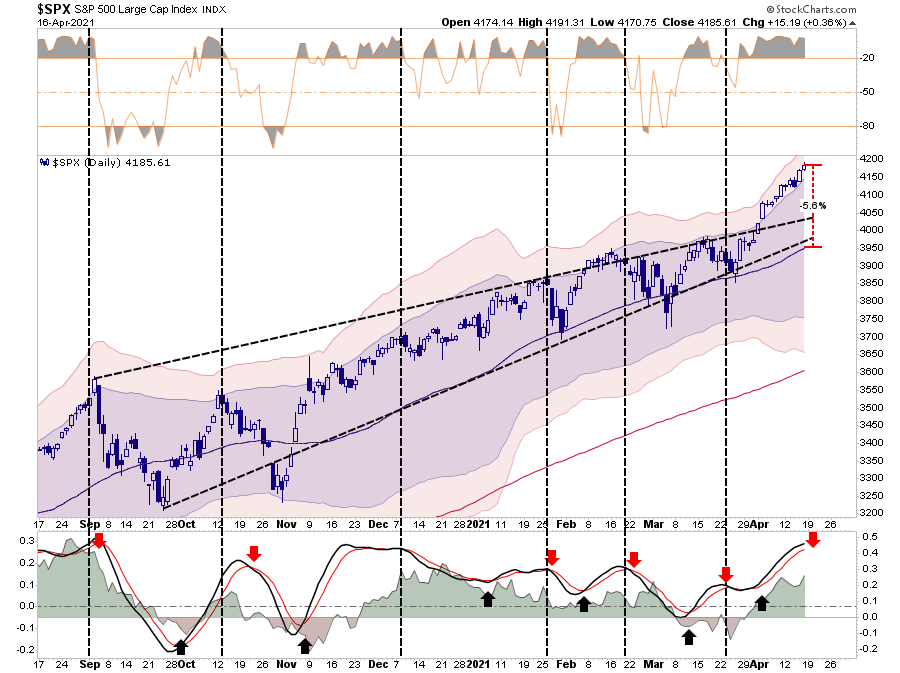

Last week, we discussed that while the rally was strong with the breakout to new highs, it also sent our “money flow buy signal” back to levels normally associated with the end of “buying stampedes.” With “money flows” turning lower on Thursday and Friday, we will likely get a “sell signal” next week.

Specifically, I stated:

“The market is trading well into 3-standard deviations above the 50-dma, and is overbought by just about every measure. Such suggests a short-term “cooling-off” period is likely. With the weekly “buy signals” intact, the markets should hold above key support levels during the next consolidation phase.”

It is worth noting that “key support” is the 50-dma which is currently almost 6% lower than Friday’s close. Again, with all indicators extremely extended, S&P 500 correction of some sort is likely.

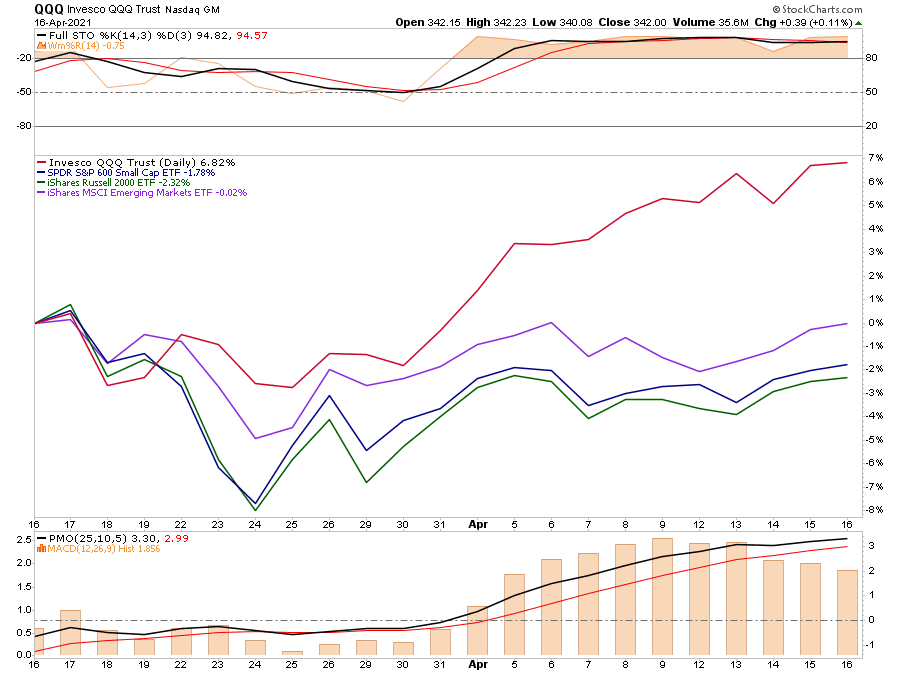

Importantly, over the past couple of weeks, the “value” trade starting late last year, has rotated back to growth. As shown, while the NASDAQ has rallied sharply over the last month, Emerging Markets, Small Caps, and the Russell 2000 lagged rather markedly.

While this may be a temporary rotation in the markets, it may also be a realization that interest rates and inflationary pressures may be more of a headwind than many realize. Such may also lower current optimistic economic and earnings growth expectations.

We continue to keep a close watch on both the dollar and interest rates, but also export and import prices which are rising sharply. Such will impact the economy and earnings in the future if they persist.

For now, the market trend remains bullish and doesn’t suggest that a decrease of risk exposures is required. However, the management of risk is always a prudent exercise as there are concerns that continue to persist.

China Is A Risk

China has been a leading driver of global economic growth for the last decade-plus. Fueling the growth are exports, massive infrastructure projects, urbanization, and extreme leverage.

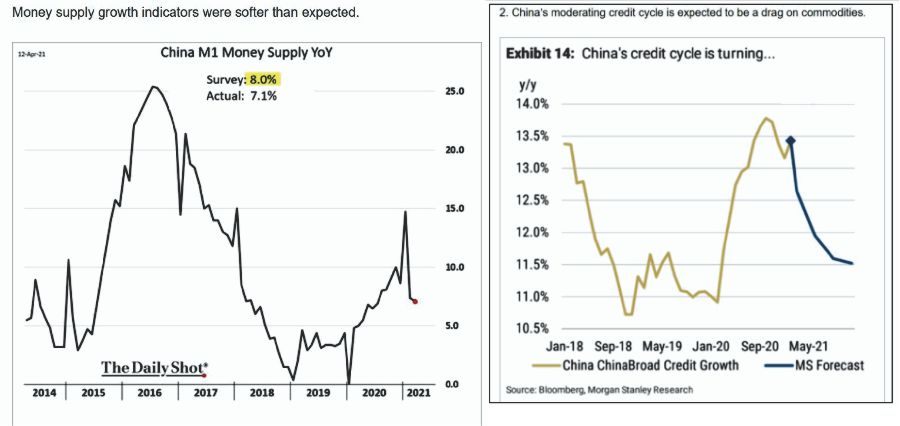

U.S. economists pay close attention to their money supply or so-called “credit impulse” to gauge how much financial and economic leverage is being generated. As shown below, M1 has been growing at a relatively tepid rate despite the Pandemic.

The PBOC (central bank) is making a concerted effort to limit further expansion of leverage in hopes of making economic growth more sustainable over the longer term. While prudent, it will weigh on short-term economic growth for not just China, but the U.S. and the rest of the world.

The graph to the right shows Morgan Stanley’s expectation for reduced credit growth resulting from the PBOC’s actions to reduce leverage. As they note, commodity prices are likely to feel the sting as China is the world’s largest consumer of many commodities.

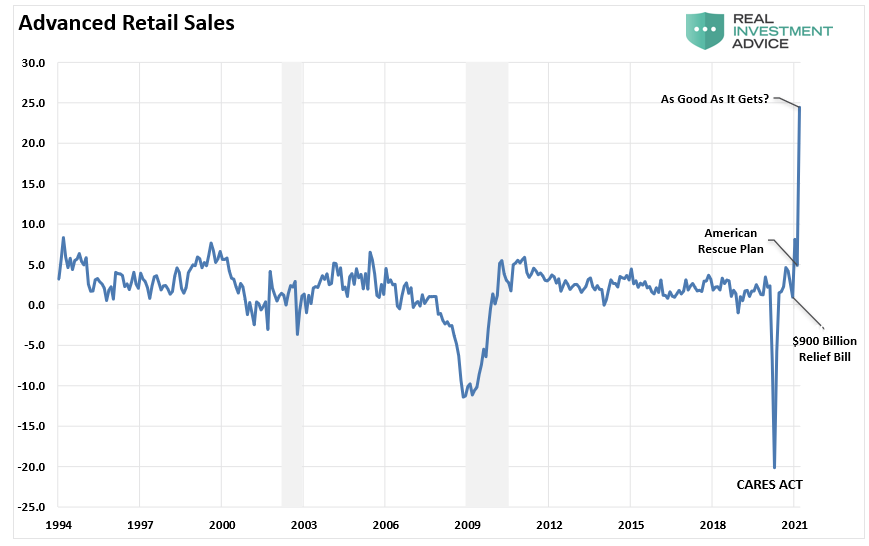

Speaking of peak impulses, such may have also been the case with retail sales.

About Those Retail Sales

Retail sales surged 9.8% in March, which was well below the 11% surge many economists were expecting. However, the numbers were strong, but may also represent the peak of stimulus-driven consumption. As Mish Shedlock noted on Thursday:

“The Census Bureau reports Advance Retail Sales jumped 9.8% percent from February, and 27.7% above March 2020. Total sales for January 2021 through March 2021 period were up 14.3% from the same period a year ago. Total sales jumped 9.8% and excluding vehicle sales jumped 8.4%.”

“If you hand out free money, especially to those who are working and suffered no job loss, people will find a way to spend it. Then what?

The surge in online sales and work at home is a big disinflationary if not deflationary force.”

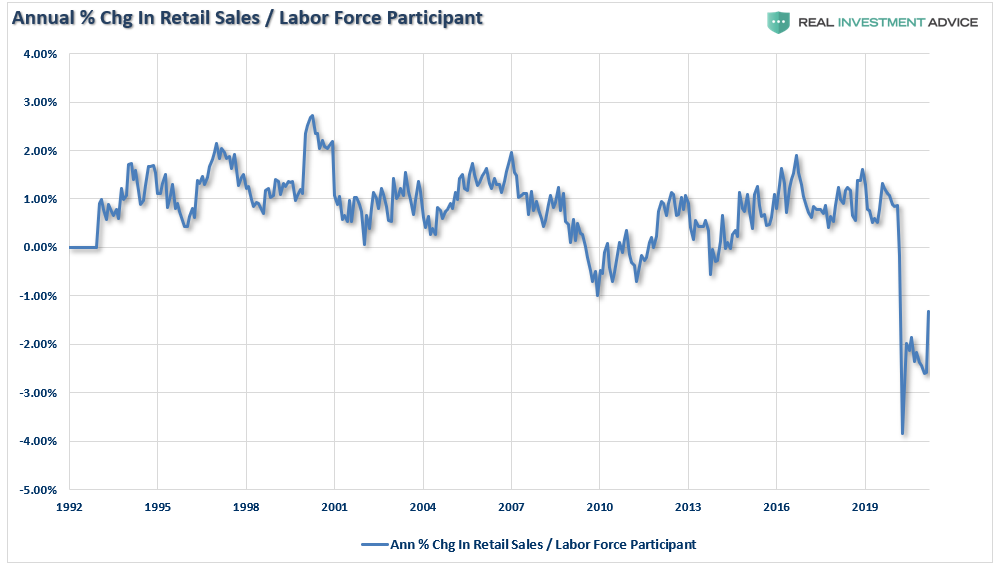

Mish is correct. While expectations for future economic growth remain very elevated, there really is very little “pent up” demand in the system after 3-massive stimulus programs.

As Good As It Gets

The problem now is that with economic growth “pumped up,” there is little appetite in Congress for more stimulus programs. As Avalon noted on Friday, the bond market may have already figured this out.

“Yields are not moving higher. In fact, longer-term yields have moved lower in the face of the best data seen in years. Why? None of the great data is all that surprising. While better than expected, it is not that much better than expected. ‘Too good to be true’ comes to mind. But it’s more like ‘too good to be sustained.’”

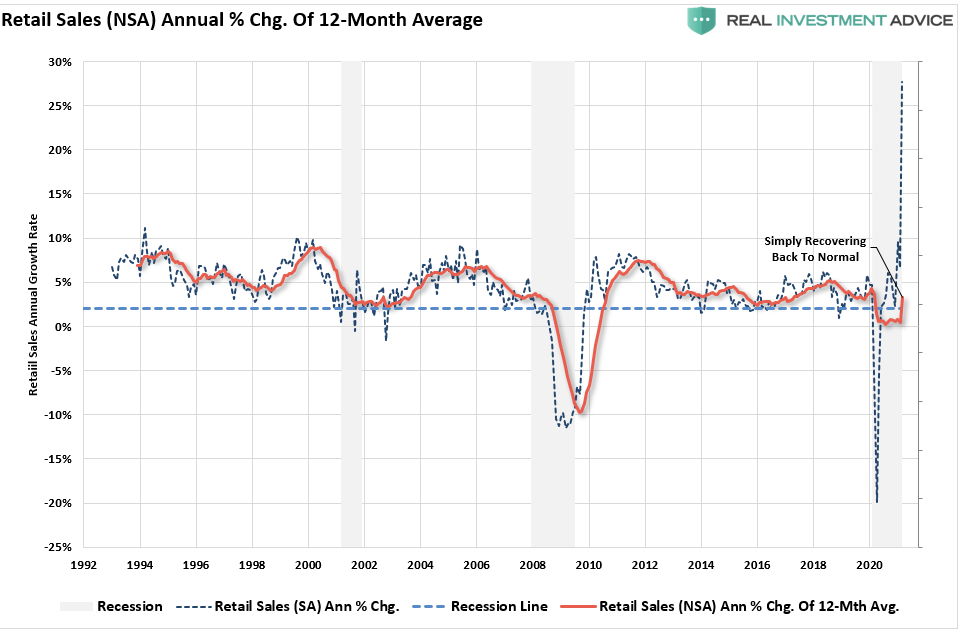

If we use the 12-month average of the non-seasonally adjusted data a different picture emerges. (The average strips out the “mathematical manipulations” and smooths historically volatile data.)

Instead of a “booming economy,” we actually see an economy just returning to normal. Retail sales will fall sharply over the next months as spending returns to those who are actually working.

Hard To Justify

Corporate profits come from “revenue or sales.” Roughly 70% of GDP is driven by consumption. It will become harder to justify valuations as the economy peaks and begins to slow.

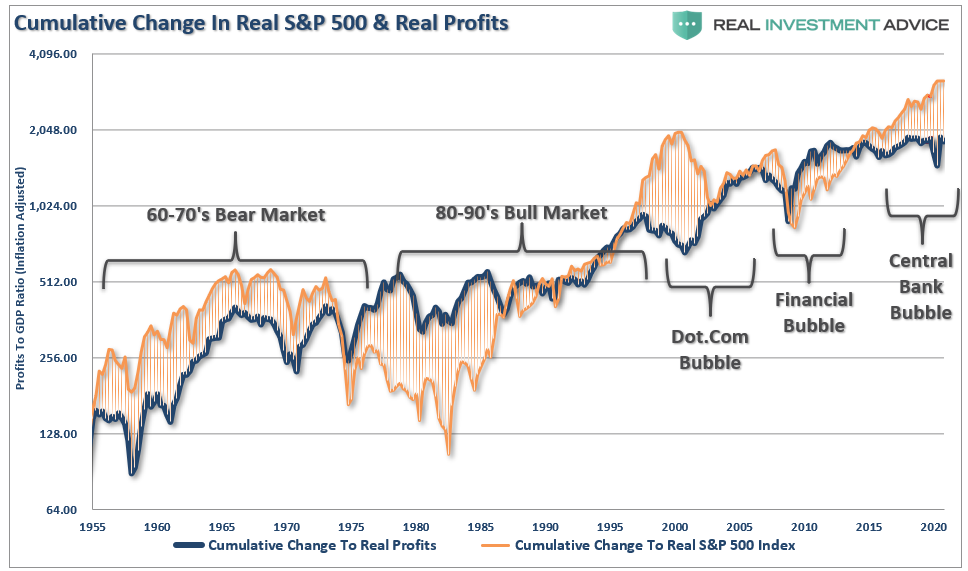

The chart below shows the real, inflation-adjusted profits after-tax versus the cumulative change to the S&P 500. Here is the critical point—when markets grow faster than profitability, eventually, a reversion occurs as excesses get cleared. Such must occur before the next “organic” growth cycle can occur.

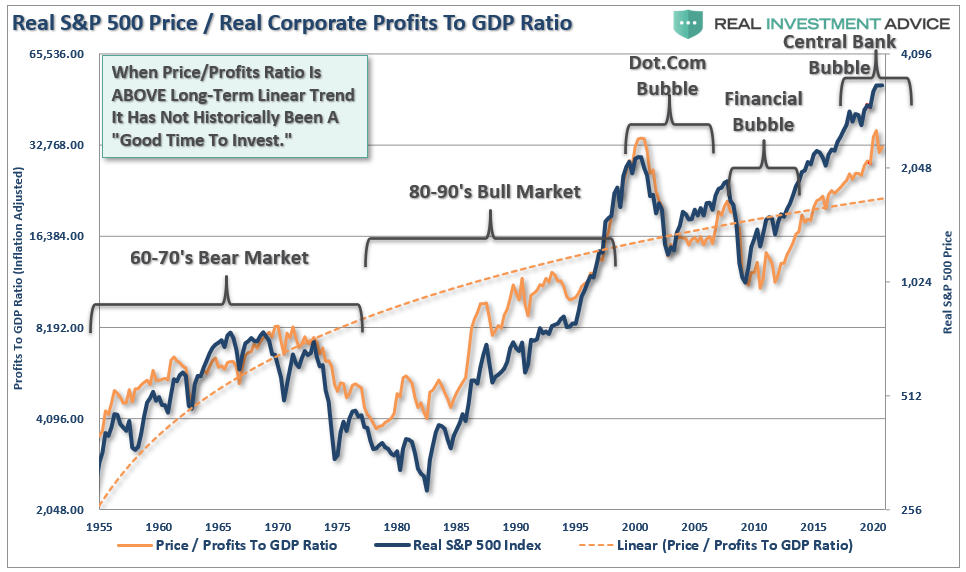

As stated, since corporate profit growth is a function of the economic growth longer term, we can also see how “expensive” the market is relative to corporate profit growth as a percentage of economic growth. Once again, we find that when the price to profits ratio is trading ABOVE the long-term linear trend, markets have struggled and ultimately experienced a more severe mean-reverting event. With the price to profits ratio once again elevated above the long-term trend, there is little to suggest that markets haven’t already priced in a good bit of future economic and profits growth.

It seems to be a simple formula for investors that as long as the Fed remains active in supporting asset prices, the deviation between fundamentals and fantasy doesn’t matter.

It is hard to argue that point. However, with investors paying more today than at any point in history for each $1 of profit, the subsequent mean reversion will likely be a humbling event.

Portfolio Update

For now, we remain allocated to the market but are watching our indicators closely for a signal to start reducing exposure. When that time comes, in the next few days or next couple of weeks, we will fall back on our process. “As discussed previously, ‘risk happens fast.’

It is essential not to react emotionally to a sell-off. Instead, fall back on your investment discipline and strategy. Importantly, keep your portfolio management process as simplistic as possible.

- Trim Winning Positions back to their original portfolio weightings. (ie. Take profits)

- Sell Those Positions That Aren’t Working. If they don’t rally with the market during this recent rally, they will decline more when the market sells off again.

- Move Trailing Stop Losses Up to new levels.

- Review Your Portfolio Allocation Relative To Your Risk Tolerance. If you have an aggressive allocation to equities at this point of the market cycle, you may want to try and recall how you felt during 2008. Raise cash levels and increase fixed income accordingly to reduce relative market exposure.

Portfolio management is not an “all or none” endeavor. It is a “game of inches.” Making small changes, adjusting exposures, and repositioning holdings can reduce overall portfolio risk. Such will keep you from spending a lot of time making up previous losses.

Yes, Babe Ruth was indeed the “Home Run King.” He was also a king of getting struck out. When it comes to your portfolio, swinging for the fences may cost you a lot more than you think.

Just remember, you can win the “game” by just regularly getting base hits.

Okay, enough sports metaphors for this week.