Market Review

What the “heck” was that?

This past week seemed to be the story of Christmas coming early. Earlier this week the markets surged higher on hopes that “Ole’ St. Tax Cuts” would soon be here. But that dream seemed to be short-lived on Friday, at least at the open, as General Mike Flynn seems to embody the “Grinch” trying to steal Christmas.

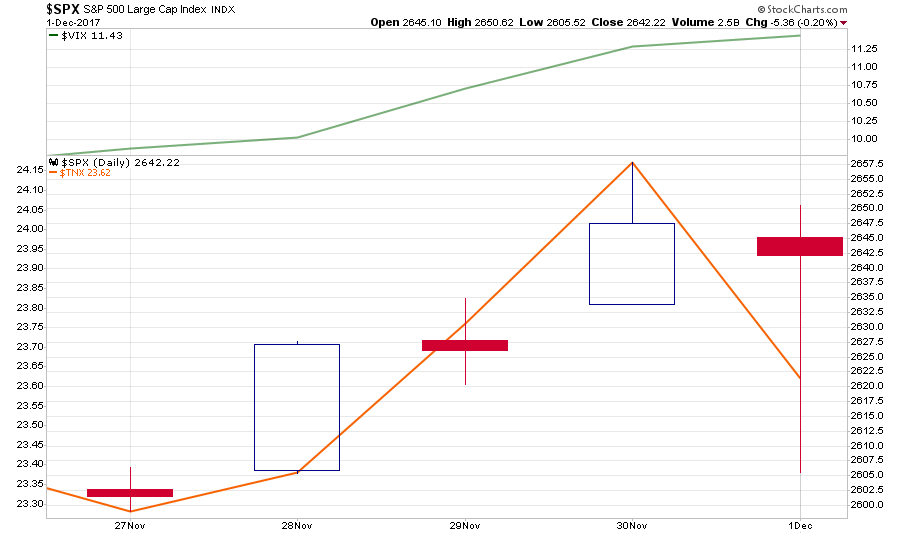

But at the end of it all, not much actually changed. Well, except for the fact that volatility not only made an appearance as stock prices swung wildly in both directions, but also in Treasury rates. As expectations of tax reform grew, rates spiked higher but then sank just as quickly as fears of turmoil in the Administration sent money into the safety of bonds.

As shown above, despite all of the “sound of fury” the S&P advanced 1.53% for the week while rates, not surprisingly as money rotated from “safety” to “risk,” ticked up from 2.3% to 2.4%. However, while volatility finished week only up mildly, intra-week we saw volatility jump to nearly 15 before settling back at 11.

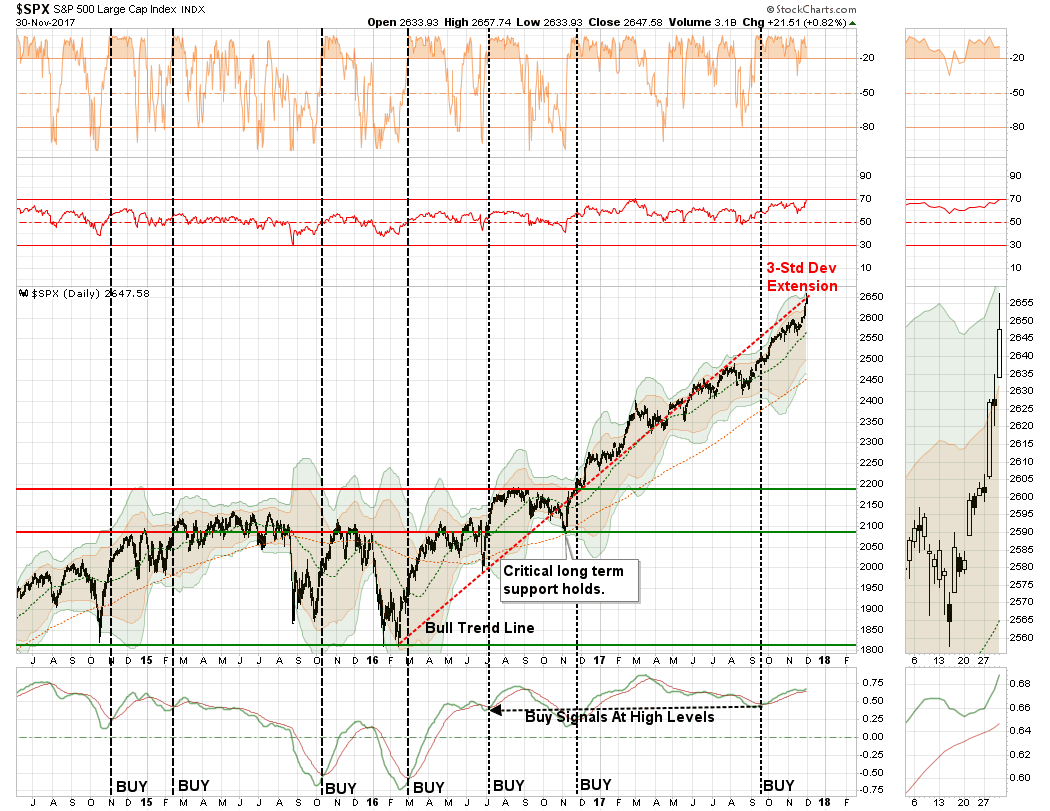

The sharp advance, as the market went all “bitcoin,” pushed well into 3-standard deviation territory above the longer-term moving average with overbought conditions pushing extremes. While the backdrop remains decidedly bullish, the sharp move higher has all the earmarks of an exhaustion move which suggests some profit-taking will cool things off over the next couple of weeks.

While the market is extremely overbought, the bullish trends remain intact. Furthermore, the month of December tends to bullish for equities which keeps portfolios allocated towards equity risk currently.

With the tax bill now out of the Senate, the real work begins as the House bill and Senate bill will go to conference to work out the rather substantial differences between the two bills. With neither bill even remotely approaching a “fiscally conservative” that will actually lead to stronger economic or reduced debts and deficits, it is a huge windfall for corporations.

This, of course, raises the question as to how much of the “tax cuts” are already priced into the markets.

One thing to be cautious of is the possibility this could well be a “buy the rumor, sell the news” event as we move into the New Year. As I stated last week, I see two potential outcomes:

- A tax bill clears Congress reducing taxes which leads to tax-related selling by money manager to lock in gains at a lower tax rate that will not have to be paid until 2019, or;

- The tax bill fails, a still likely scenario, which leads to tax-related selling by money manager to lock in gains on which taxes will not have to be paid until 2019,

Let me repeat from the last newsletter:

“As I see how December plays out, I will be seriously looking at adding a short-hedge to portfolios before year end. I will keep you apprised.”

This weekend, I am traveling to Florida to give a presentation on the markets and will be joined by some of my friends like Chris Martenson and Nomi Prins. It promises to be fun and I will fill you in on any great insights next week.

Market and Sector Analysis

Data Analysis Of The Market & Sectors For Traders

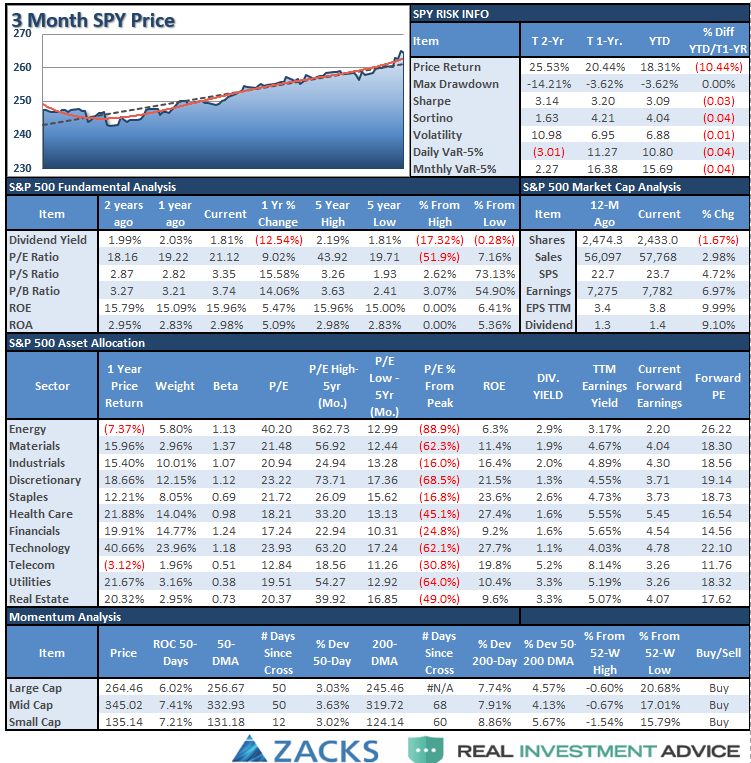

S&P 500 Tear Sheet

Performance Analysis

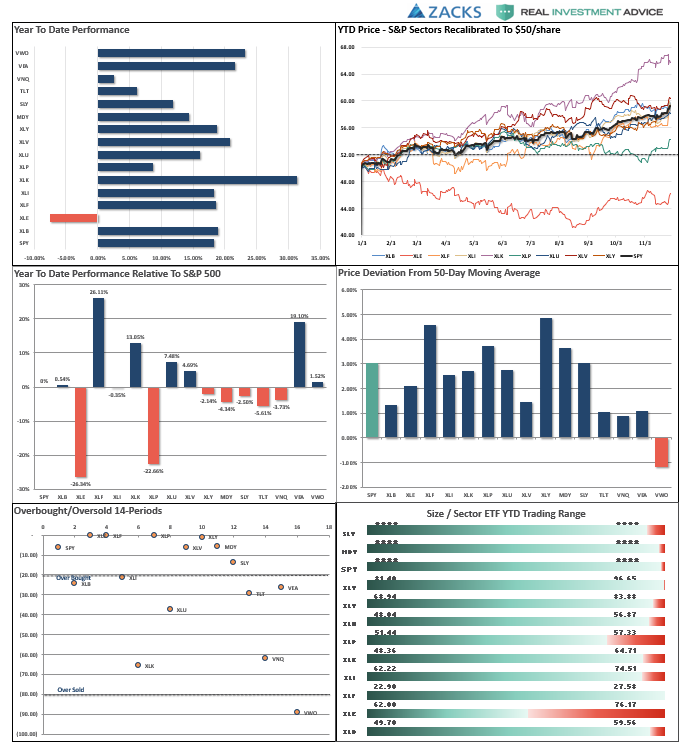

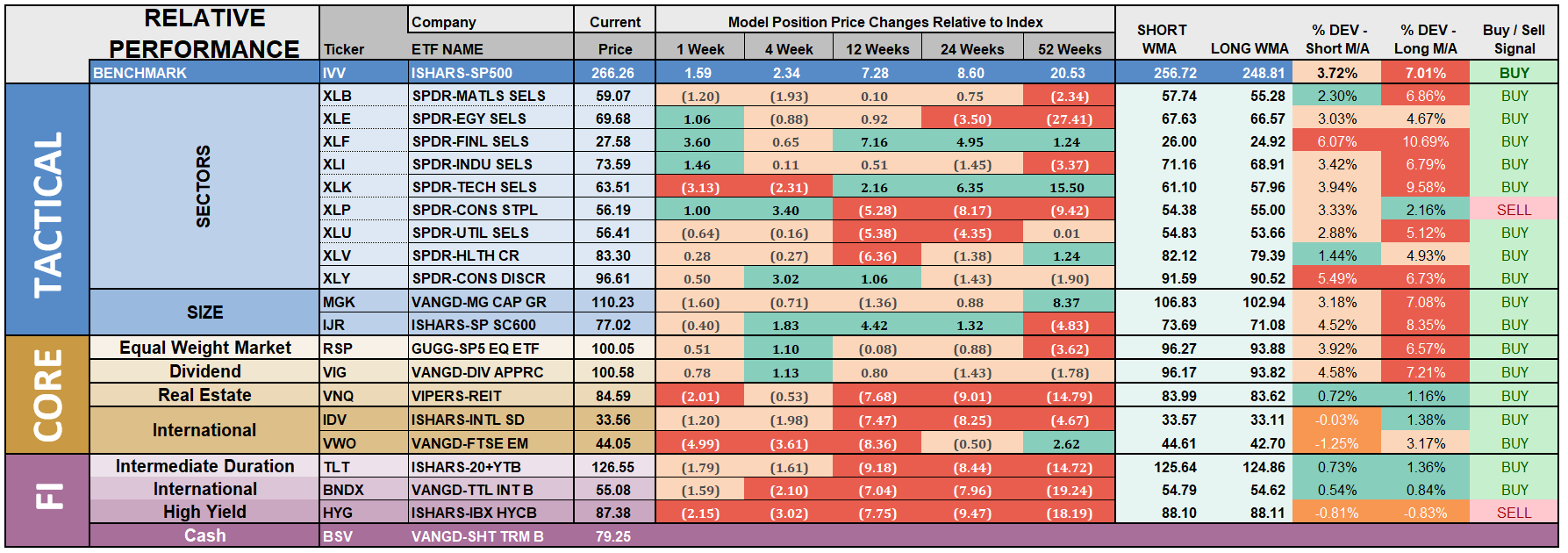

ETF Model Relative Performance Analysis

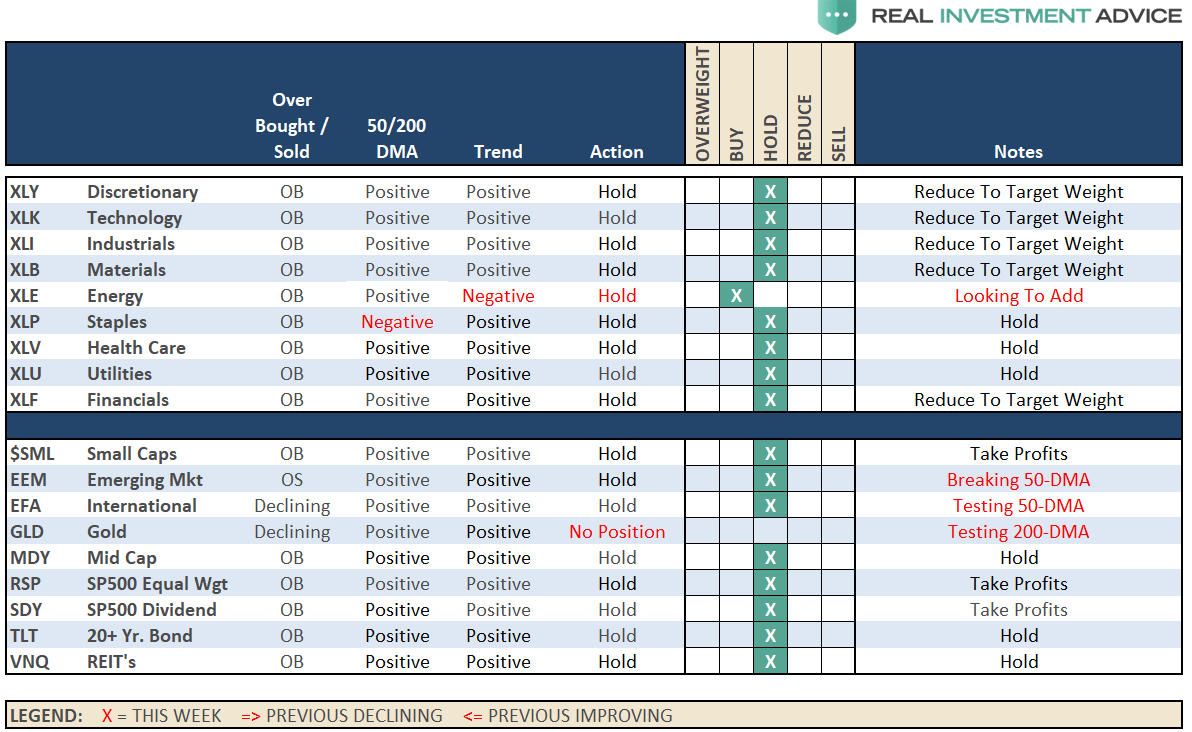

Sector and Market Analysis:

For a second week running, the market stumbled slightly. However, had it not been for the huge surge on Thursday with the passage of the GOP tax bill, the end result would have been worse. Nonetheless, there has been no change to the current trajectory of the market overall.

Discretionary, Staples, Industrials, Materials and Financials were the best performing sectors this past week as money chased, well, really everything but primarily clustered in the areas most affected by tax reform and recent commentary from the Fed that was extremely supportive for the banks. These sectors are now GROSSLY extended. Take some profits, rebalance holdings and move stops up to recent supports.

Technology has lagged over the past few weeks, but remains near highs. It appears Technology may have begun a consolidation or topping process. We will need to wait to see how the current price action resolves itself before taking action within the sector.

Health care as I noted previously, the sector had slipped below its 50-day moving average, however, the “buy everything” mode of the market over the last week resolved that situation keeping health care on hold in portfolios for now. Move stops up to recent lows.

Energy – as I noted previously, the energy sector had gotten trapped between the 50 and 200-dma. The positive backdrop, however, was the 50-dma having crossed above the 200-dma, We are looking to add energy back into portfolios after having been out of the sector since 2014 and the move higher last week sets us up for that addition. A bit of profit taking in the week ahead will likely allow us to begin adding some weight to portfolios.

Utilities, we remain long the sector and have moved stops up to the 50-dma. Trends remain positive and interest rates have likely peaked for the current advance.

Small and Mid-Cap stocks continued their strong rebounded off recent supports last week after threatening to break down. With the hopes of tax cuts to boost profitability, money is heavily chasing the sector into grossly overbought territory. We harvested some profits recently but remain long the sector. We are moving stops up again to protect gains.

Emerging Markets and International Stocks have shown some weakness as of late in terms of momentum, but remain in a bullish trend overall. We remain long these markets for now but have moved up stops accordingly.

Gold – Gold failed to hold above the 50-dma last week and remains confined in sideways trend. Importantly, with no catalyst to put “fear” into the market, the 50-dma starting to weaken putting the current risk back to the downside. We continue to watch the commodity currently, but remain on the sidelines for now.

NEW! S&P Equal Weight – In our “core portfolios” we carry an equal weighting of both the S&P 500 dividend index and the S&P 500 equal-weight index. This balance gives us historically better performance, lower volatility and a higher yield than just carrying the S&P 500 index. I have added this analysis permanently going forward. The equal-weighted index pushed surged higher last week to record highs. We continue to hold our positions for now married to the S&P Dividend sector.

S&P Dividend Stocks, The index pushed higher last week as dividend stocks take on more capital flows. I noted previously that we are holding our positions for now and have moved stops again to $92.50.

Bonds and REITs – With“tax reform” being passed by the Senate, rates did tick up last week slightly. However, given the makeup of the tax bill, the realization that this current iteration will not create surging inflation, growth and interest rates is becoming more apparent. The bullish trend in Bonds and REIT’s continues so we will continue looking for pullbacks to add additional exposure.

Sector Recommendations:

The table below shows thoughts on specific actions related to the current market environment.

(These are not recommendations or solicitations to take any action. This is for informational purposes only related to market extremes and contrarian positioning within portfolios. Use at your own risk and peril.)

Portfolio Update:

The market continued to hold its bullish trend this past week despite a pickup in volatility. This type of market is extremely dangerous as when markets break, and then immediately rebound, it lulls investors into a high degree of complacency that stocks “simply can’t go down.” While we are in the seasonally strong period of the year, we remain cognizant of the underlying risk.

Furthermore, as noted above, I stated the following at the beginning of November:

“I am now looking to begin building ‘Short S&P 500 and Nasdaq’ positions into portfolios over the next few weeks as a hedge against a January decline as noted above. I will keep you advised as to changes in portfolios ahead if my expectations begin to come to fruition.”

That analysis continues and I suspect we will be looking to add that position in portfolios by year-end. As the Senate and House tax bills enter “conference,” I think we will get a much better picture of the likelihood of passage and what it will actually look like. There is a rather high degree of risk that stocks will sell-off following any passage of a “tax reform” bill as much of the benefit has already been priced into the market. In other words, there is a much higher probability of “disappointment” rather than “surprise” at this juncture.

As always, we remain invested but are becoming highly concerned about the underlying risk. Our main goal remains capital preservation.