Investing.com’s stocks of the week

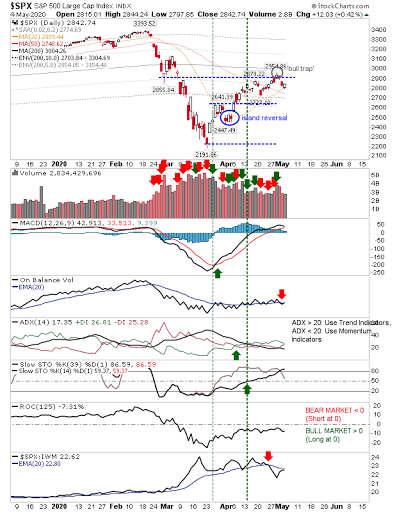

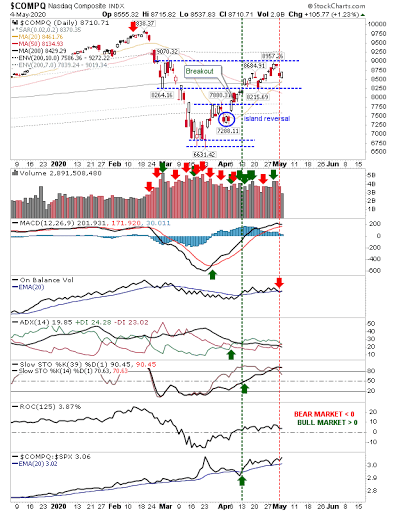

There were modest gains across the indices yesterday, as markets digested last week's losses. The 'bull trap' and gap down remains a major concern for the S&P as Monday's buying only made a small indent into those losses. Volume was lighter as On-Balance-Volume looks ready to whipsaw back into a 'buy' signal.

There were modest gains across the indices as markets digested last week's losses. The 'bull trap' and gap down remains a major concern for the S&P as yesterday's buying only made a small indent into those losses. Volume was lighter as On-Balance-Volume looks ready to whipsaw back into a 'buy' signal.

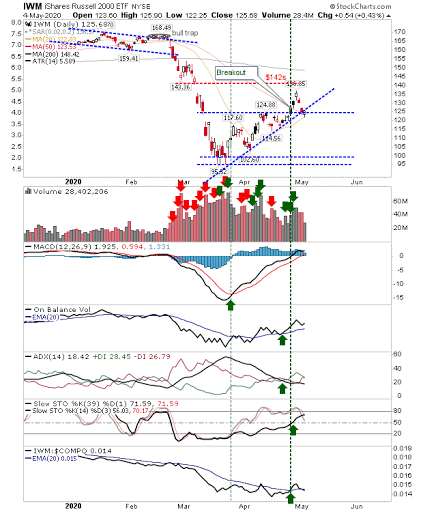

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) sits on a confluence of support. This is an important time for the index as it has long since lagged both the S&P and NASDAQ, but was seeing some relative improvement. On a positive front, technicals are all net bullish.

There is still much work for the indices to do to get back Friday's losses, but even with that, it's hard to see indices making new all-time highs until there is a vaccine. So, what is there left to gain? Not much. Which leaves the downward path as the easier route.