Three overriding catalysts were driving the market correction this past week:

- The market had gotten a good bit ahead of fundamentals.

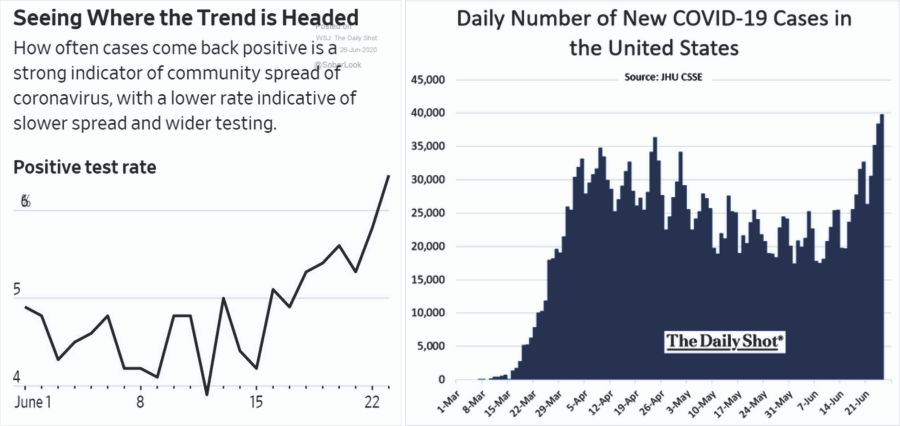

- The surge in COVID cases is undermining the V-shaped recovery narrative.

- End of the quarter portfolio rebalancing, which managers postponed in March.

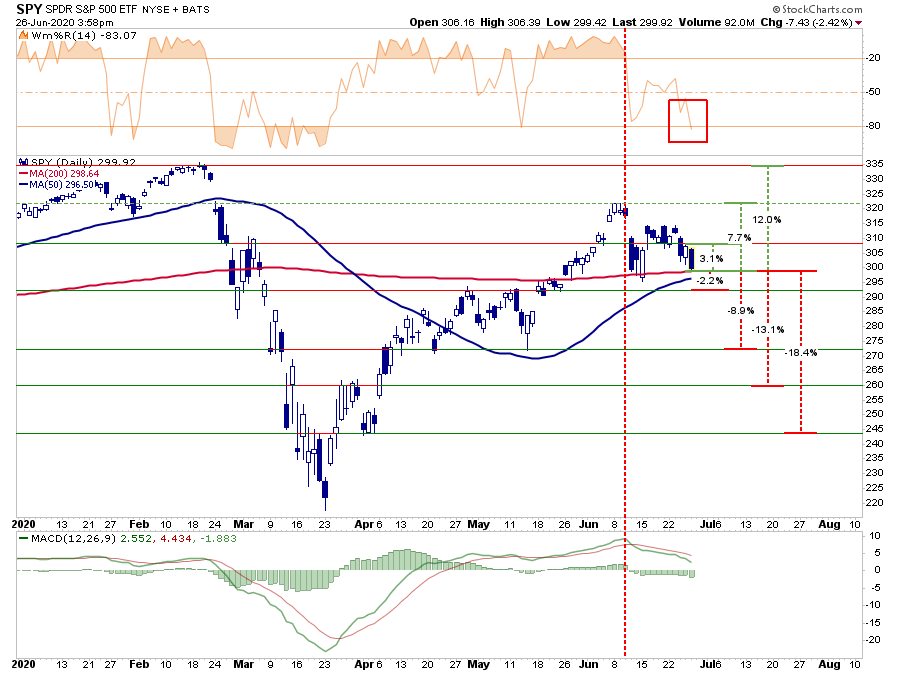

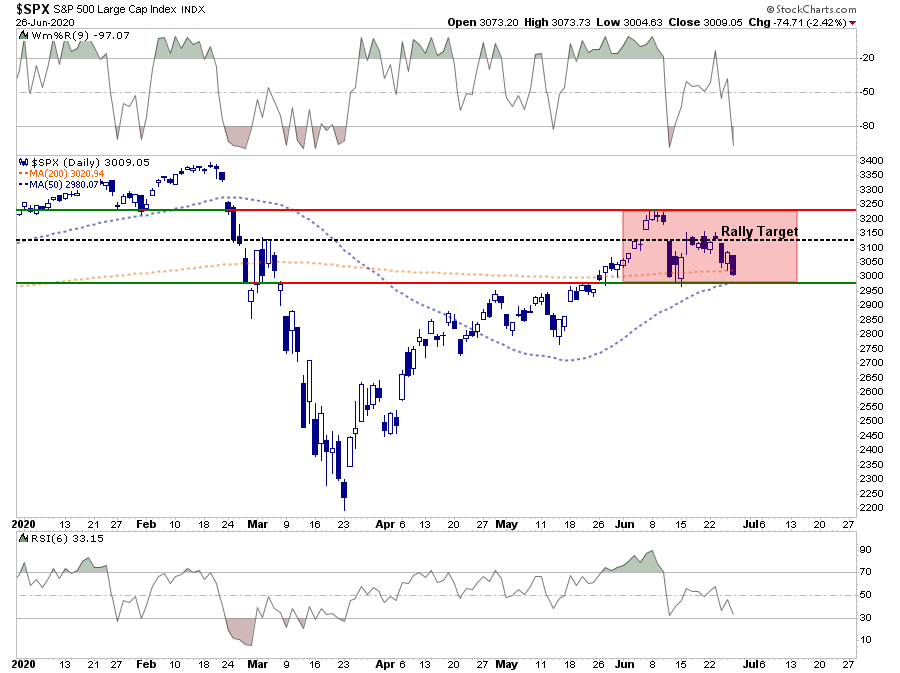

We will go through each of these in more detail. However, let’s start with where we left off last week and update our risk/reward ranges (via SPDR S&P 500 ETF (NYSE:SPY)).

Currently, the risk/reward dynamics have become slightly less favorable. The good news is that the 50-dma and 200-dma are so close there is strong support short-term. Such should give the bulls a bit of optimism. However, a breakdown below that level and things will get ugly quickly.

- -2.2% to consolidation highs vs. +3.1% to the top of the current downtrend. (Positive)

- -8.9% to previous consolidation lows vs. +7.7% to previous rally peak (Negative)

- -13.1% to March bounce peak vs. +12% to all-time highs. (Negative)

- -18.4% to April 5th lows vs. +12% to all-time highs. (Negative)

As shown, with the sell-off on Friday, the short-term oversold condition, a reflexive rally next week would not be surprising. Given that COVID concerns are escalating, it may be wise to use any rally to reduce risk further and increase hedges.

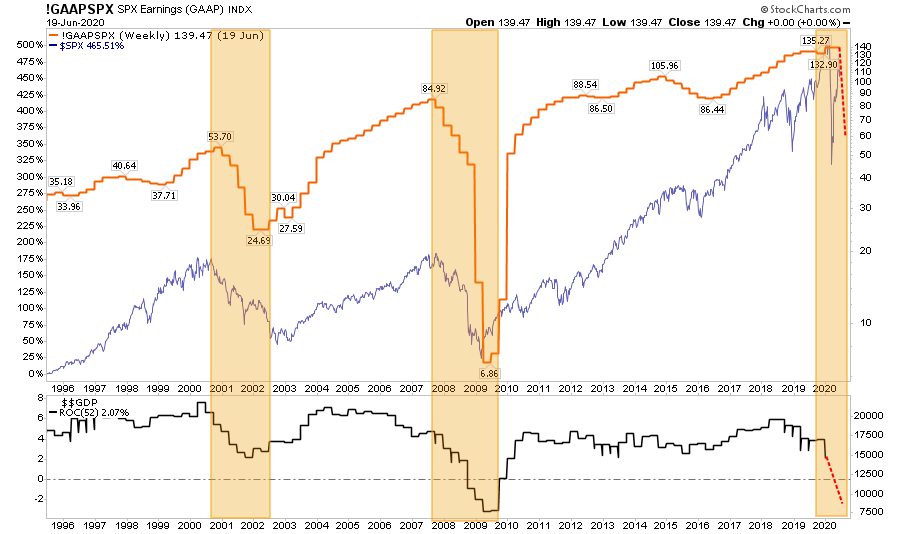

The Market Is Well Ahead Of Fundamentals

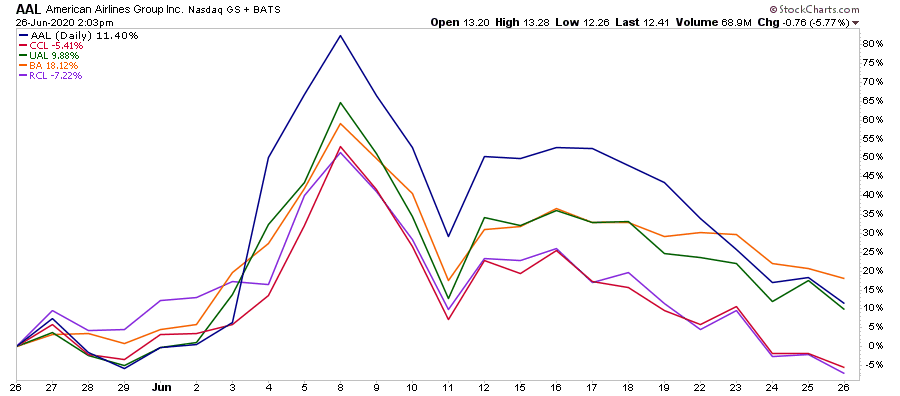

Part of the correction over the last two weeks is coming partially from the realignment of stocks back to reality. We specifically mentioned some of the more visible issues last week, but it was interesting to watch the “Daytraders Favorites” crash back to Earth (No pun intended.)

As we addressed on Tuesday, it is hard to justify paying current valuations.

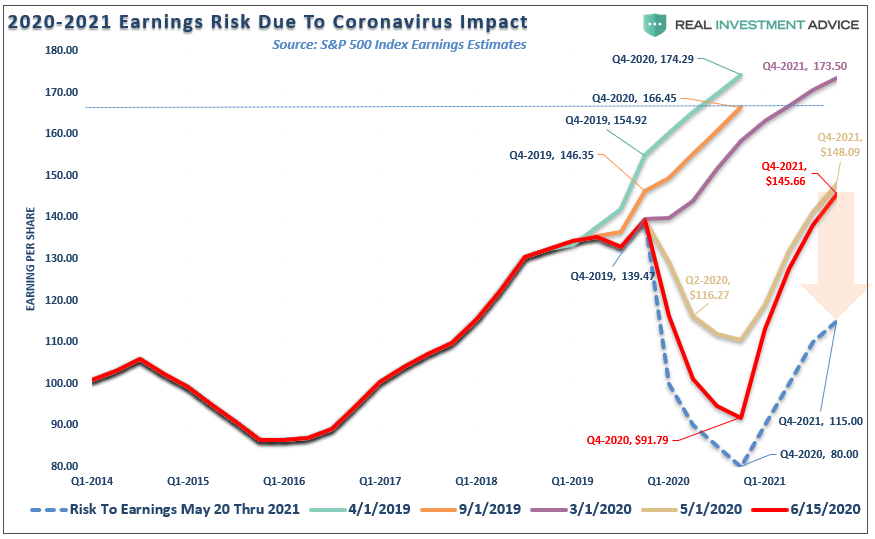

“Furthermore, given the depth of the economic crisis, 49-million unemployed, collapsing wages and incomes, and a resurgence in the number of COVID-19 cases, estimates are still too high. During previous economic downturns, earnings collapsed between 50% and 85%. It is highly optimistic, given the current backdrop, that earnings will only decline by 20%.”

6-Downside Risks

With States now beginning to back off of reopening plans, it is highly likely current earnings estimates will need to be guided lower over the next couple of months.

The most significant risk to investors currently is a “reliance on certainty” about future outcomes, when, in reality, there is no certainty at all. As Mike Shedlock pointed out just recently, there are numerous risks still present.

Six Downside Risks

- The future progression of the pandemic remains highly uncertain.

- The collapse in demand may ultimately bankrupt many businesses.

- Unlike past recessions, services activity has dropped more sharply than manufacturing—with restrictions on movement severely curtailing expenditures on travel, tourism, restaurants, and recreation and social-distancing requirements and attitudes may further weigh on the recovery in these sectors.

- Disruptions to global trade may result in a costly reconfiguration of global supply chains.

- Persistently weak consumer and firm demand may push medium- and longer-term inflation expectations well below central bank targets.

- Additional expansionary fiscal policies— possibly in response to future large-scale outbreaks of COVID-19—could significantly increase government debt and add to sovereign risk.”

Again, the market is trading well ahead of underlying fundamentals. While the “Fed Put” may indeed put a “floor” below stocks, that doesn’t mean they can’t correct to realign with economic and fundamental realities.

COVID Makes A Second Appearance

As we discussed previously, the market rallied from the March lows based on 4-underlying premises:

- There would be no second-wave of the virus.

- There would be a vaccine available by year-end.

- The economy would fully recover back to pre-pandemic levels.

- And, of course, “The Fed.”

While the bullish fantasy indeed prevailed over the last couple of months, suddenly, the world has shifted. The hope was that cases in the U.S. would slow into the fall before the potential onset of a “second wave” during a more traditional “flu season.” Unfortunately, the spike in cases in the still ongoing “first wave” will delay economic recovery longer.

In Texas, where I live, the Governor has shut-down bars again, is keeping businesses at reduced capacity, and potentially will reverse more if needed.

My wife went to the doctor recently for a test, and she received the “ole’ swab up the nose.” While the test came back negative, the doctor told my wife that COVID lives in the lungs and not the nasal cavity. Therefore, while her test was negative, it could be a false negative. If the doctor is correct, the real numbers of infected could be 10x higher. Such confirms a recent Reuters article:

“Government experts believe more than 20 million Americans could have contracted the coronavirus, 10-times more than official counts, indicating many people without symptoms have or have had the disease, senior administration officials said.

The estimate, from the Centers for Disease Control and Prevention, is based on serology testing used to determine the presence of antibodies that show whether an individual has had the disease, the officials said.”

If true, the ramifications could substantially impair the bullish thesis.

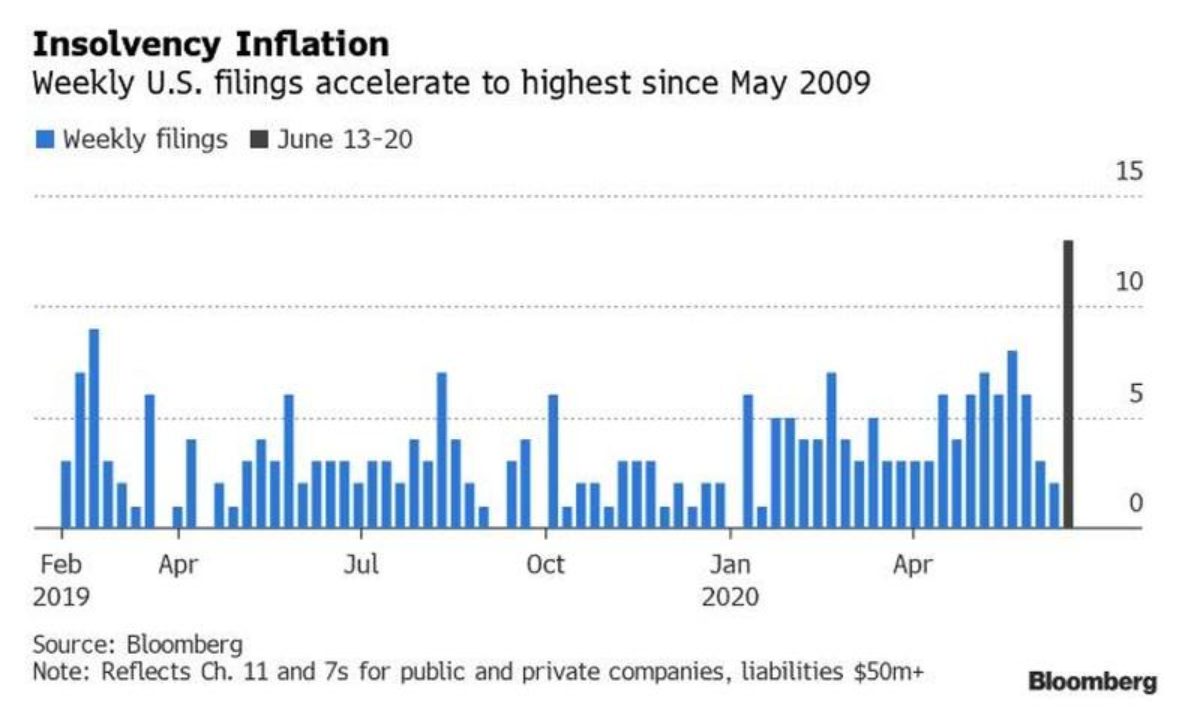

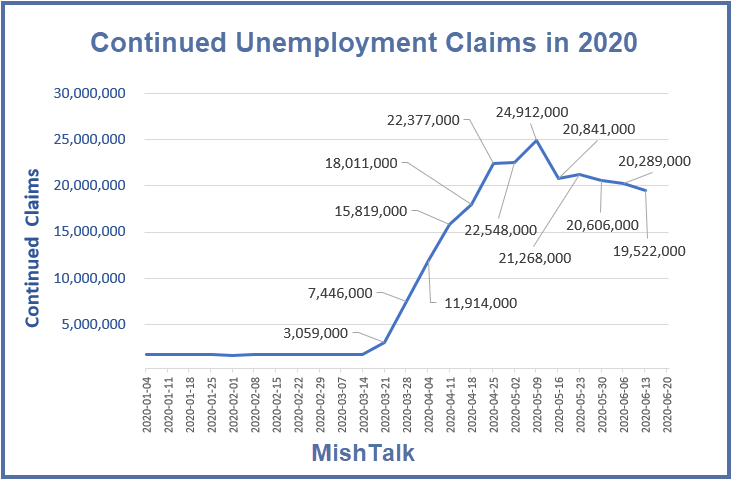

Timing Couldn’t Be Worse

Without a bill to extend more Federal Aid via Payroll Protection Programs and increased unemployment benefits, the ongoing restriction on trade will likely lead to a further surge in bankruptcies and layoffs.

“According to Bloomberg data, no less than 13 U.S. companies sought bankruptcy protection last week, matching the global financial crisis’s peak. The filings, led by the perennially weak consumer and energy sectors, were the most for any week since May 2009.”

There is a virtual spiral between job losses and bankruptcies. As more individuals lose their jobs, they have less to spend. Since consumption is what drives earnings for businesses, they have to lay off workers to stay in business. Pay attention to the “continuing claims,” which will tell the story of the economic recovery. (That doesn’t look like a “V”)

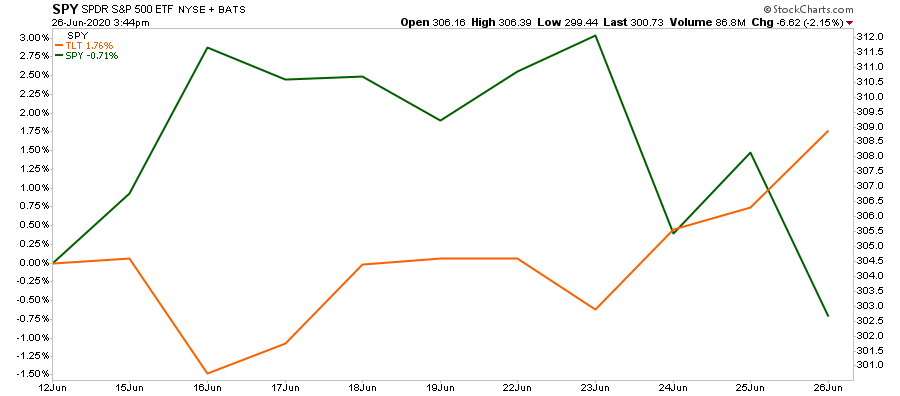

End Of The Quarter Rebalancing

There was one other factor which has weighed on stocks this past week, which was noted recently by Zerohedge:

“When adding all the other possible sources of the month- and quarter-end forced rebalancing, the total amount ‘for sale’ soars to an unprecedented $170 billion according to calculations by JPMorgan.

In the latest Flows and Liquidity report from JPM’s Nikolas Panagirtzoglou, writes that after correctly pointing out at the market lows on March 23rd that there is a massive $1.1 trillion in rebalancing flow into equities, all of that has since balanced out, and three months later, we are looking at a substantial outflow of about $170BN before month-end, resulting in a ‘small correction.'”

This rebalancing of portfolios was postponed by pension and mutual funds in March as they did not want to sell at market lows. That decision worked out well then, but now they need to rebalance portfolios by selling equities and buying bonds. We can see this action by looking at the performance between the S&P 500 index and Treasury Bonds over the last two weeks.

This rotation is either likely close to completion, or will complete early next week. As we stated previously, this is why we hedge our equity portfolios with fixed income. The risk offset reduces downside volatility and allows the portfolio to weather tough patches in the market.

With the market very oversold short-term, it would not be surprising to see a reasonably decent reflexive rally into the start of July. However, that rally will likely be an excellent opportunity to rebalance risk and rethink exposures accordingly.

Portfolio Positioning Update

As stated last week, with our portfolios almost entirely allocated towards equity risk in the short-term, we remain incredibly uncomfortable.

Our positioning in fixed income and gold has hedged the portfolio against the latest decline in the very short-term. Still, with the market getting very oversold short-term, as shown below, we expect a reflexive rally off of current support next week.

Most likely, we will use any counter-trend bounce to reduce equity risk a bit, rebalance exposures, and focus our attention on capital preservation for the next couple of months. With the virus resurfacing, the potential risk of disappointment to the earnings and economic recovery story has risen.

While it is easy for the mainstream media to write articles and post comments about the markets, it is an entirely different matter when you manage money. Currently, there is a battle raging between the fundamental and “hope” driven narratives.

On the one hand, it’s easy to see the fundamental problems in the market and the economy, which argues for much less risk exposure. However, on the other, you have the Fed and a Government, ready to throw money at, and “jawbone,” the markets at a moment’s notice.

Trying to navigate the two is like trying to thread a needle, in a moving car, on a bumpy road, with your eyes closed. Given we aren’t prescient, we will have to resign ourselves to doing the best job we can for our clients with the information we have available.

That is a fancy way of saying, “we are going to give it our best guess.”

The goal remains the same as always, protect our client’s capital, reduce risk, and try to come out on the other side in one piece.

Sometimes, however, it just gets messy.