Global markets continue to slide down. Investors bought back a significant part of the drawdown, but the trend for decline is still in force. On Monday morning, the Hang Seng loses 0.4%, although it remains above Friday's intraday lows. The Shanghai index of the 50 largest companies in China A50 fell by 4% to the area of local lows, completely playing back the rebound last week on speculation about incentives.

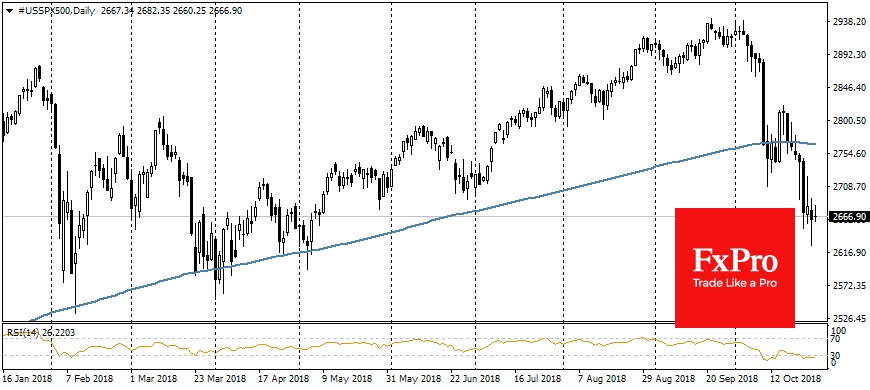

Thus, the clouds in the financial markets continue to thicken, although it will be an exaggeration to talk about global and general sales. Futures on S&P 500 fall from the start of the day by 0.4%. At the same time, it should be noted that American indices remain above Friday’s intraday lows. At some point they lost about 3.5% within the day, dropping to their lows since May. But at the end of the trading session the purchase of shares helped to significantly recoup the initial drawdown.

This dynamic is a vivid evidence that the markets still have faith in the global continuation of the stock market growth, and the current levels are already attractive for purchases on downturns in some papers that did not disappoint investors in the reporting season.

Nevertheless, it is worth paying attention to the Asian stock exchanges. Weak reporting by local companies indicates a negative impact of US-introduced tariffs, coupled with a cyclical slowdown in the economy. Under these conditions, Chinese companies are losing the traditional basis for growth in the form of exports, while domestic consumption is not yet able to fully become the engine of the economy: the companies’ profits have been falling for the fifth consecutive month, and sales of raw materials are falling.

As a result, the demand for risks may continue to decline in the coming days, keeping the trend on caution. At the same time, buying stocks in the downturns and maintaining relatively high rates of US statistics suggest that the current correction is short-lived and is hardly a sign of an impending economic crisis. In the currency market, the dollar remains close to local highs, confirming the thrust towards the defensive assets.

An important level to observe is the area 96.60, to which the dollar index can rise from the current level of 96.20. Closing higher - may be evidence of increased demand for the dollar, giving rise to a new rally of the US currency after many months of fluctuations in the sideways range.

For EUR/USD, key levels are near 1.1300. In August, the pair found support in the downturn in this area, but since the end of September, it again went to decline, bargaining on Monday morning at 1.1400.