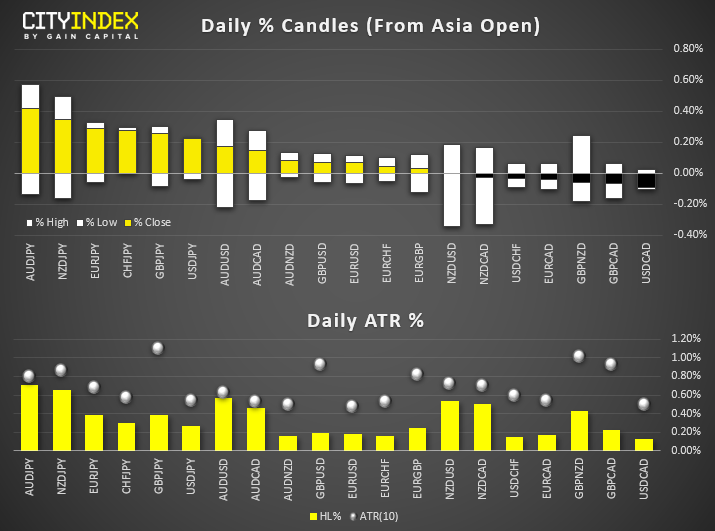

- Currency markets remained within tight ranges due to a lack of top-tier news or headlines. Tomorrow’s ECB meeting is also suppressing volatility.

- Reuters report that BOJ could be considering further easing, via an unnamed source at their upcoming meeting at 18-19 September.

- RBA said they’re unlikely to implement unconventional policy measure’s (QE) but will consider them if necessary.

- AUD and NZD are the strongest majors, JPY is the weakest during a cautiously risk-on session. AUD/JP broke its bearish trendline from the April high, USD/JPY moved to a 7-week high. EUR/USD remains around 1.1050 ahead of tomorrow’s ECB meeting.

- National Australia bank revised their forecast for RBA to cut 50 bps by February 2020 (up from one cut).

- Australian consumer’s looked past rising house prices and turned pessimistic, according to a Westpac survey. Compared to a year ago, sentiment is down by -2.3%. Current conditions also fell by -2.7% in September.

- Tom Watson, Labour’s deputy leader is to demand a Brexit referendum before the election.

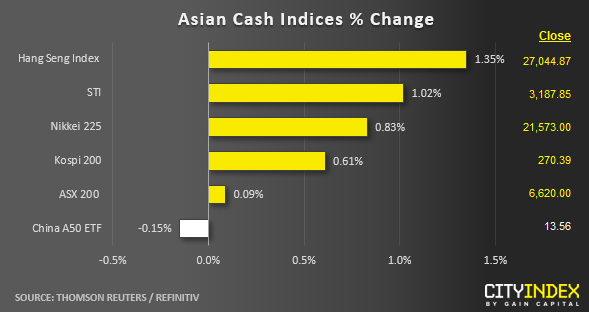

- Most Asian stock markets are showing pockets of strength in line with rising yields seen on key benchmark government bonds. The 10-year U.S. Treasuries yield has continued to extend its gains seen since last week where it has rallied by more than 10 bps in yesterday, 10 Sep U.S. session to print a 4-week high of 1.745%. The recent up move seen in the 10-year U.S. Treasuries yield has removed the much “feared” 2-10 yield curve inversion where the yield on the 10-year U.S. Treasuries is now trading more than the 2-year U.S. Treasuries.

- In addition, rumours of more stimulus measures from China have added fuel to the on-going optimism. An influential state-backed newspaper editor from Global Times, Hu Xijin has tweeted that “China will introduce important measures to ease the negative impact of the trade war”

- Outperformers as at today’s Asian mid-session are Hong Kong’s Hang Seng Index, Singapore’s STI and Japan’s Nikkei 225 which have recorded gains between 0.80% to 1.35% led by their respective financial and banking stocks on the backdrop rising yields seen in major government bonds.

- The S&P 500 E-mini futures has continued to extend its gains seen from the last hour of trading in yesterday, 10 Sep U.S. session. It has traded up slightly by 0.10% to print a current intraday high of 2987 in today’s Asian session.

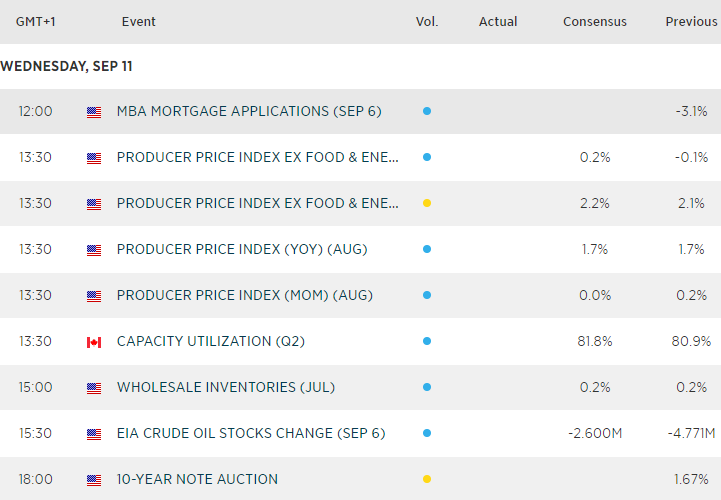

Up Next:

- No first-tier data throughout the European or US session could make for another quiet session.

- Producer prices are expected to stay flat at 0% in August, although PPI excluding energy is forecast to expand by 0.2% from -0.1% prior. Yet with both headline annual reads having topped late 2018, downside pressures persist.