(Tuesday Market Open) Judging by U.S. stock market performance this week, it appears that at the moment, when investors have relatively little solid news to trade on, their bias seems to be on the optimistic side.

The latest round of corporate earnings reports and commentary by company executives is now in the rear-view mirror.

On the trade front, although fresh U.S. tariffs on Chinese imports, and retaliatory Chinese duties, are set to take effect this week, that’s been a known quantity for some time. The new levies come during a week when representatives from the two nations are reportedly scheduled for talks. But it remains to be seen whether the world’s two largest economies can make substantive progress on a trade dispute that has had many market watchers on edge about global economic growth prospects.

The other main recent geopolitical concern has been surrounding recent weakness in Turkey’s currency, but worries on that front seem to have died down.

In addition to the calendar of companies reporting earnings results being relatively light this week, economic reports are also relatively sparse. So investors may have more time to focus on Federal Reserve comments about monetary policy, the economy, and inflation.

Fed Watch

Minutes from the August Fed meeting are scheduled for release tomorrow afternoon. And the Fed’s annual Economic Policy Symposium begins the following day in Jackson Hole, Wyoming. Fed Chair Jerome Powell is scheduled to speak Friday morning.

If he says anything about cost pressures and wage growth, investors may want to consider zooming in on those comments and comparing them with what company leadership has said in the recent earnings season about higher materials and pay costs as inflation has climbed above the Fed’s long-term goal of 2%.

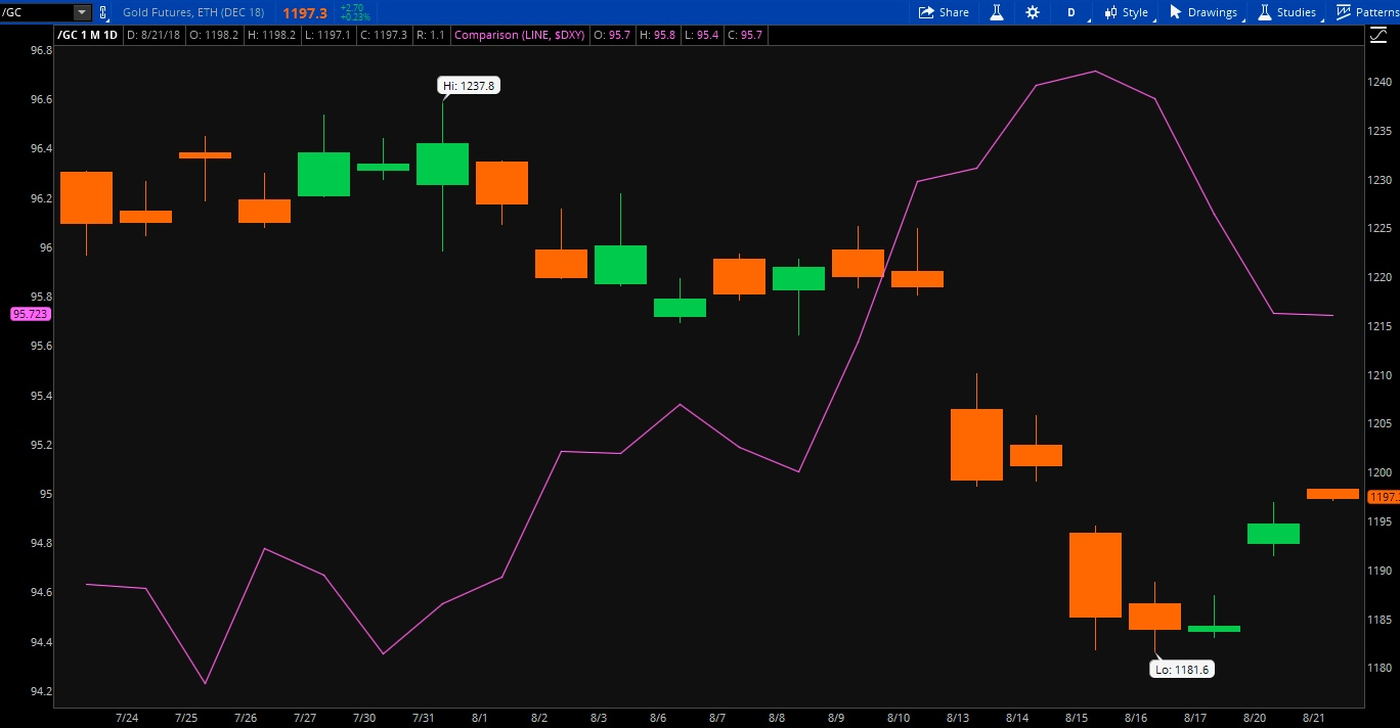

In other Fed news, President Donald Trump in an interview with Reuters said he would continue criticizing the Fed if it keeps raising interest rates. The comments appear to have pressured the dollar (see Figure 1 below).

Market Roundup

U.S. equities started off the week in classic late-summer fashion. Trading volumes for stocks on the three main indices were below average, with volume for S&P 500 equities roughly half of what it averages.

Lower volumes can be typical for this time of year as many traders take time off for vacation. While those lower volumes can exacerbate the stock market moves either up or down, Monday’s gains for the three major indices were relatively muted, especially for the NASDAQ Composite (COMP), which gained just 0.06%.

The backdrop for the modest gains in stocks appeared to be a lessening in worry about global trade and the Turkish economy. While trade tensions between the U.S. and major trading partners have been dogging Wall Street for some time, the worries about the Turkish currency have flared up more recently. The trade issue has led to worry about global economic growth while the Turkey situation has generated fears about banks with exposure to the nation, which is suffering from high inflation. But those concerns appeared to take a back seat Monday.

Oil and gold also posted gains. The dollar fell a bit against a basket of other major currencies. And in a reflection of the relatively chill mood on Wall Street on Monday, the CBOE Volatility Index (VIX), often referred to as the market’s fear gauge, dropped.

In earnings news, Target (NYSE:TGT) is scheduled to release its earnings report before market open tomorrow. For Q2, TGT is expected to report adjusted EPS of $1.40 on revenue of $17.29 billion, according to third-party consensus analyst estimates. That estimate is right in the middle of management’s guidance for adjusted EPS between $1.30 and $1.50. In the same quarter last year, adjusted EPS came in at $1.23 on revenue of $16.43 billion.

FIGURE 1: Figure 1: Gold Awakens: After falling precipitously over the last three weeks to well below $1,200 an ounce, gold started to show signs of life this week. The dollar (purple line) could be playing a role in that, as it’s leveled off after relentlessly climbing to one-year highs. A strong dollar can often help push gold prices lower. Data Source: ICE (NYSE:ICE), CME Group (NASDAQ:CME). Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

US, International EPS Forecasts: One question that may be on investors’ minds is how long the boost from Washington’s tax cut may continue helping the market. S&P 500 earnings per share growth this year is projected to hit 23%, according to investment research firm CFRA, citing benefit from the tax cut. But the lofty earnings this year mean that estimates have been reduced for 2019 because of the high bar to hurdle, the research firm said. That’s not the case outside of the U.S. though, as CFRA said the trend is reversed overseas, citing S&P Capital IQ consensus estimates of 4.6% growth in 2018 operating EPS for the S&P Developed ex-US BMI (Broad Market Index) compared with 8.7% next year.

Headwinds for Existing Home Sales: One piece of economic data the market is expecting this week is July existing home sales, scheduled for release Wednesday morning. According to Wells Fargo (NYSE:WFC) Securities, low inventories remain the main problem holding sales back even though total inventories rose in June. “Shortages remain a barrier to sales, especially in the South and West,” Wells Fargo said in a note. Meanwhile, the median price of an existing home hit a fresh all-time high in June. “Higher home prices and rising mortgage rates risk putting homeownership out of reach for more households,” according to Wells Fargo.

Good News On Dividend Front: Despite worries about global economic growth that have dogged the market of late, company payouts to shareholders have been on the rise. Globally, dividends grew 12.9% year-on-year in Q2 to a record $497.4 billion, while U.S.-company payouts rose 4.5% to a record $117.1 billion, according to Janus Henderson. “Reading the headlines in the financial press, investors might assume that times are tough and getting tougher,” Janus Henderson said in a report. “Trade wars, political uncertainty and an aging U.S. bull market are among the common themes of late. Dividend payouts paint a far more upbeat picture, one of strong corporate balance sheets, continued management confidence and, consequently, significant dividend growth.”

Disclaimer: TD Ameritrade® commentary for educational purposes only. Past performance does not guarantee future results. Member SIPC. Options involve risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options.