Managing expectations and emotions with investing is probably one of the hardest things to do on a consistent basis. Let’s face it – in our busy daily lives we have come to expect fast results and instant gratification from the speed of information at our fingertips. I go out of my mind when a website takes more than 5 seconds to load and find myself frustrated when something doesn’t seem to be making any progress.

It’s also easy for those impatient feelings to leak over into our investing endeavors as well. The other day I received an email from a client that went something like this:

Hey Dave,

I made my IRA contribution the other day. How are things going? It seems like growth has been pretty slow lately.

Thanks,

Joe Client

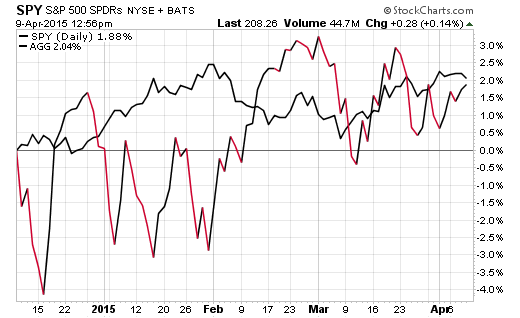

Tough to argue with that line of thinking because he is absolutely correct. It has been incredibly slow out there in the financial markets and gains have been tough to come by. Over the last four months the SPDR S&P 500 ETF (ARCA:SPY) has gained less than 2%. However, the frequent 1% daily price swings in the major indices have made it seem like we are just rambling sideways with no apparent direction. Depending on what day you look, the market may be up 4% on the year or totally flat.

On the fixed-income side of the ledger, the AGG has notched a similar return, albeit with far less overall volatility. On a plain vanilla 50/50 stock and bond portfolio your returns have likely been 2% or less over the last four months. Certainly nothing to be disappointed about, but probably starting to grate on the nerves of those that have come to expect double digit gains like we saw in 2013 and 2014.

Keeping Things In Perspective

One of the most important lessons I have learned over the last decade in this business is that patience and discipline are a far better strategy than feeling like you have to be doing something all the time. The market often experiences long periods of inaction followed by very swift moves. Trying to time every little gyration is going to lead to more frustration and likely far worse performance than sticking with a sensible and balanced solution.

Think about it this way – If you are on a sailboat in the middle of the ocean and the wind dies, you have to wait for it to come back. You can’t blow on the sails to make forward progress. Instead you can redouble your efforts on making sure your boat is ship shape for when the next move comes and consider making subtle adjustments to be in the sweet spot when it does.

As an active manager, I’m focused on following the longer-term trend of the market and making strategic adjustments as needed to rein in risk or increase our exposure as needed. Given the mostly sideways price action over the last several months, this has resulted in very little activity. However, my positioning in dividend paying stocks and fixed-income has allowed us to continue making steady progress despite the overarching malaise.

For my income clients, I own the Vanguard Dividend Appreciation (NYSE:VIG), iShares JPMorgan (NYSE:JPM) Em Bond Fd (NYSE:EMB) and PIMCO 0-5 Year High Y Corp Bond (NYSE:HYS) along with a variety of other ETFs and select mutual funds. These options provide suitable income and capital appreciation potential given the prevailing market currents. We are focusing on more credit sensitive areas rather than interest rates to boost portfolio yield and maintain positive market correlation.

For my growth clients, I have recently increased exposure to midcap stocks via the Vanguard Mid Cap ETF (NYSE:VO) and am pleased with the relative price action in the Vanguard Emerging Market ETF (ARCA:VWO). Both funds are showing strong momentum when compared to the relatively sideways action in the S&P 500 Index. Emerging markets in particular have been boosted by the strength in China and have broken out above key technical levels just this week.

The Bottom Line

The next big move in the market will be upon us before you know it. No one knows whether that will be higher or lower, but what you can control is how you attack it in order to reach your goals. Whether you are focused on growth, income, or capital preservation, make sure you have a sensible plan in place that you fully understand. That way you will be mentally prepared for either outcome without overreacting on a day to day basis.

Stay patient and good things will come.

Disclosure : FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.