Following the trends of the market is often easier said than done. When things are going your way, it’s natural to become enamored with the “trend is your friend” phraseology that jives with your directional bias. Nevertheless, there will always be periods of volatility that test your resolve and reaffirm the notion that investing is anything but easy.

If you are new to trend following, I wrote an article last November titled: 3 Reasons to Love and Hate Stock Market Trends. This may be worth a quick study to become further acquainted with the benefits and risks of this style of technical analysis.

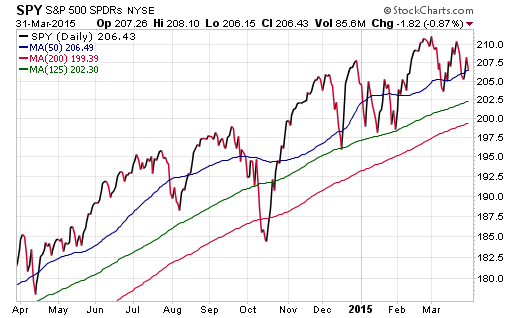

Bringing this concept forward to more current and actionable intelligence, I have been examining a chart of the SPDR S&P 500 ETF (ARCA:SPY) on the last day of the quarter (March 31). Several key points stand out to me as I overlay various trend lines and obvious support levels that may be tested over the next several months.

The 1-year chart below includes 50, 125, and 200-day simple moving averages as guideposts to understanding the historical price trend over various time frames. As you can see, all three of these averages are continuing to slope higher, which bodes well for bullish directional momentum despite the volatility over the last quarter.

The 125-day moving average (smooth green line) has been a robust area of support during the forceful down moves in December and January. This intermediate-term trend line will be an important level to watch as we make our way into April and May as well. Any sell-offs that slip convincingly below this level may warrant additional cautionary moves within your portfolio.

One nexus of potential discomfort for trend followers will be the 200-day moving average on SPY. This smooth red line is nearing the $200 price level, which is above the lows of the year established in January. From a risk management standpoint, some may prefer to stick with a traditional trend following model that sells on a dip below the long-term average. Others may be more inclined to wait for a break below those January (or even December) lows before they consider taking risk off the table.

There is no right or wrong answer when it comes to making the tough decisions on managing risk in your investment portfolio. Some prefer to be more conservative in selling under tight circumstances, which can lead to loss of upside potential during a whipsaw. Conversely, those that give the market too much leash will find themselves wishing they had sold earlier to avoid a steep drop.

Either way, evaluating this technical data may help in determining a game plan for your stock allocations as we make our way into a seasonally tumultuous period near the middle of the year. Reducing volatility should be a primary consideration at this stage of the market cycle. That may include strategic shifts in asset allocation, security selection, or managing risk using a sell discipline.

Disclosure : FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.