Thursday May 4: Five things the markets are talking about

In Europe, assets get a further boost from French centrist Emmanuel Macron, who retains the poll lead (59% vs. 41%) after last night’s TV debate with National Front leader Marine Le Pen. They face off in the second, and final, Presidential vote this Sunday.

The Fed did what was expected on Wednesday, kept rates steady. The accompanying FOMC statement cited recent economic data weakness, but did not change their current stance on the progression of interest rate increases.

The statement also mentioned that the U.S labor market continued to show signs of strength and that consumer spending was again solid, with inflation close to target.

In translation, the Fed remains on course for a further two rate hikes this year.

Currently, Fed-funds futures show that investors see a +71% chance that the Fed will raise rates at its next meeting in June. Over coming weeks, the key will be U.S economic data, starting with tomorrow’s non-farm payroll (NFP) print.

1. Global indexes mixed reaction

Asian stocks retreated overnight, taking their cues from a subdued session on Wall Street. With Japan closed for the Golden Week holiday, market activity was again relatively subdued.

In China, stocks pared their earlier losses to trade flat, as gains in small-caps offset a cooling in China’s services sector growth (see below) to its slowest in 12-months in April – fears of slower economic growth continues to dent business confidence.

In Hong Kong, the Hang Seng dropped -0.4%, while Aussie S&P/ASX 200 Index lost -0.3%, pressured by a fall in commodity prices, in particular iron ore on weaker China data.

In Europe, regional indices are trading a tad higher on the back of continued strong corporate earnings and continued confidence from the FOMC. Financials are supporting the Eurostoxx, while an uptick in commodity prices has the FTSE in the black in early trade.

U.S. stocks are set to open higher (+0.3%).

Indices: Stoxx50 +0.7% at 3611, FTSE +0.3% at 7258 , DAX +0.70% at 12615, CAC 40 +0.8% at 5341, IBEX 35 +0.8% at 10927, FTSE MIB +1.3% at 21036, SMI +0.4% at 8931, S&P 500 Futures +0.3%

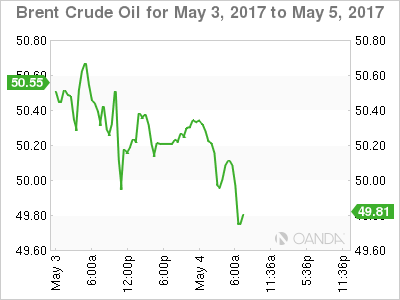

2. Oil down on lower than expected drop in U.S inventories.

Oil prices are on the back foot for a fourth consecutive session overnight, nearing their lowest level in two month after data showed a lower than expected decline in U.S. inventories.

Yesterday’s EIA data showed crude inventories fell -930k barrels in the week to April 28, against expectations for a decrease of -2.3m barrels.

Note: Stocks have steadily declined over the last month, but at +527.8m barrels they remain just -7m barrels off a record high.

Brent crude oil futures are down -32c at +$50.47 a barrel, while U.S West Texas Intermediate (WTI) futures are also down -32c at +$47.50 a barrel.

The market still expects OPEC and its non-OPEC partners to extend last November’s cut in production deal to keep up to -1.8m bpd off the market later this month, but failure to do so could see crude ‘bulls’ aggressively unwind their remaining long positions.

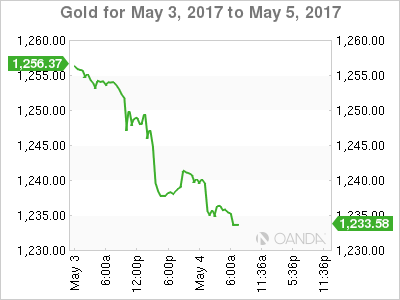

Gold prices (-0.3% to +$1,234.52 per ounce) trade atop of their six week low, pressured by the dollar’s rise on expectations that the Fed may raise interest rates as early as next month. It fell -1.5% yesterday – its worst single-day drop since late November.

3. Euro French yield spreads tighten

Ahead of Sunday’s second round French presidential vote the markets have already priced in a win by centrist Emmanuel Macron over Marine Le Pen and have started to concentrate on other drivers. Despite the small shift in polls after last nights live TV debate has not changed the picture materially, nor caused real new fears of an upset on Sunday. Euro analysts expect markets to show slightly more relief on Monday, but nothing compared to the post-first round results.

With French voters going to the polls, the spread between French 10-years (OAT’s) and the German 10-year Bund have now fallen to the lowest level since November after the debate. OAT’s now yield +0.40%, +1 bps more than Bunds, down from as much as +0.78% ahead of the first round of the election.

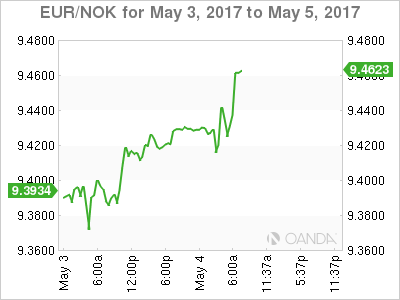

Elsewhere, Norway’s central bank (Norges) this morning left its benchmark interest rate unchanged (+0.5%), as expected, and signalled that it is in no rush to raise rates. Governor Olsen said that:

The outlook and the balance of risks for the Norwegian economy do not appear to have changed substantially since the March report.

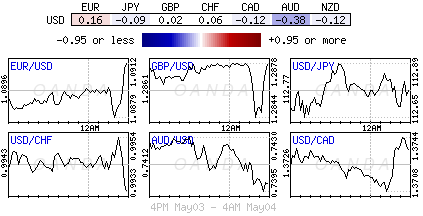

4. ‘Big’ dollar gives up some FOMC gains

The USD is a tad softer against the ‘majors’ after printing its two-week highs post FOMC rate decision yesterday – U.S policy makers have kept the door ajar for a June rate hike.

The EUR/USD is holding well above the €1.09 psychological level (€1.0930) and within striking distance of re-testing last week five-month highs of €1.0950. Through here, the single unit is expected to gather support to test €1.1025.

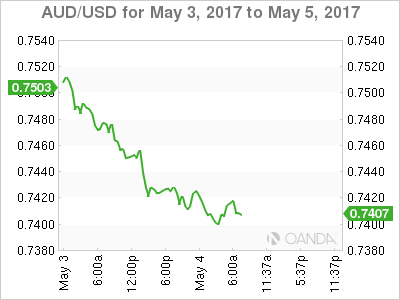

Sterling has found some support post service PMI data (see below), GBP/USD is hovering just below the £1.29 level. USD/JPY remains atop of its multi-week highs as the pair edges towards the ¥113 region. The AUD/USD (A$0.7411) remains under press from weaker commodity prices on the back of disappointing Chinese data (see below), in particular iron ore.

5. Mixed global PMI’s, Aussie trade stronger

Overnight, China Caixin Services PMI hit an eleven-month low with its fourth consecutive decline (51.5 vs. 52.2), pressured by new-orders rate of growth slowing. The employment component growth also eased to its weakest level this year, while cost pressures eased across all sectors.

Down-under, the Aussie Trade Balance saw its fifth straight month of surplus, with export growth edging higher to +2.0% from +1.5%, while imports were up +5% vs. a decline of -5% in prior month. Iron ore shipments rose to three-month high.

Earlier this morning, UK data for services PMI for April came in stronger than expected, rising to 55.8 from 54.6 in March, above the consensus forecast of 55.0. Coupled with the previously released measures for manufacturing and construction, which had also surprised on the upside, could suggest the UK economy is picking up early steam in Q2 after Q1’s sharp slowdown.

Finally, the composite PMI for the eurozone (activity in the manufacturing and services sectors) rose to 56.8 in April from 56.4 in March, hitting a six-year high.

Note: The April reading was raised from a preliminary estimate of 56.7.