Investing.com’s stocks of the week

This post was written exclusively for Investing.com.

The S&P 500 closed at an all-time high on June 20, recouping all of its losses from the steep sell-off in May. The index is still on pace to potentially reach 3,200 in 2019—about 8.5% higher than its current level. The last time I wrote on this topic was in April, and since that time, yields have dropped dramatically, and this should allow for greater risk-taking, pushing up PE ratios.

Risk taking has suddenly become popular again. Since the beginning of June, it has been the high-risk sectors of the equity market that have been leading the charge higher, rising by as much as 10.5%. It follows what had been a dreadful May, when these high risk sectors fell by as much as 15%.

Looking for Greater Returns

The move into higher risk sectors of the market suggests that investors are feeling more confident about the outlook for stocks. This new found appetite for risk may be widely due to the lower interest rate environment. With investors in search of greater returns, they will need to take on more risk to reach their expectations. As a result, it's likely that these sectors will not only continue to rise but will probably also lead the market higher, should this low rate environment persist.

Earnings Outlook Remains Stable

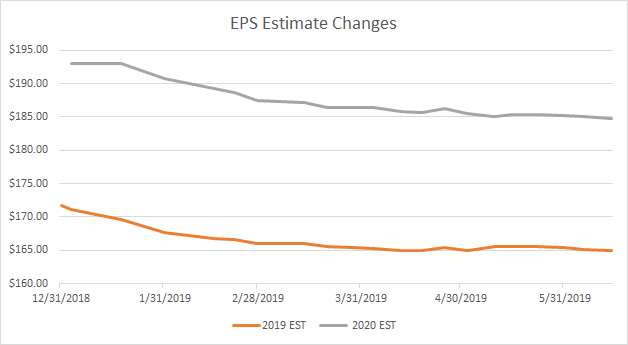

Earnings estimates have held fairly stable over the past month. Based on estimates by S&P Dow Jones, earnings for 2019 are set to come in at $164.92 per share and at $184.82 in 2020. That is roughly in line with estimates at the beginning of May for $164.89 and $185.52, respectively. Overall, the S&P 500 is still trading below its historical one-year forward average PE ratio of around 17 to 18 at approximately 16. Should the S&P 500 return to a PE ratio of 17.5 based on 2020 estimates, the index could rise to 3,230.

(Data from S&P Dow Jones)

Rates Plunge

As mentioned above, what may help lift stocks higher is the significantly lower interest rate environment. Since April 15, the rate on the 10-year U.S. Treasury has fallen from around 2.6% to 2%, a reduction of about 60 basis points. However, the PE ratio for 2020 on the S&P 500 has remained relatively unchanged.

Risk-on

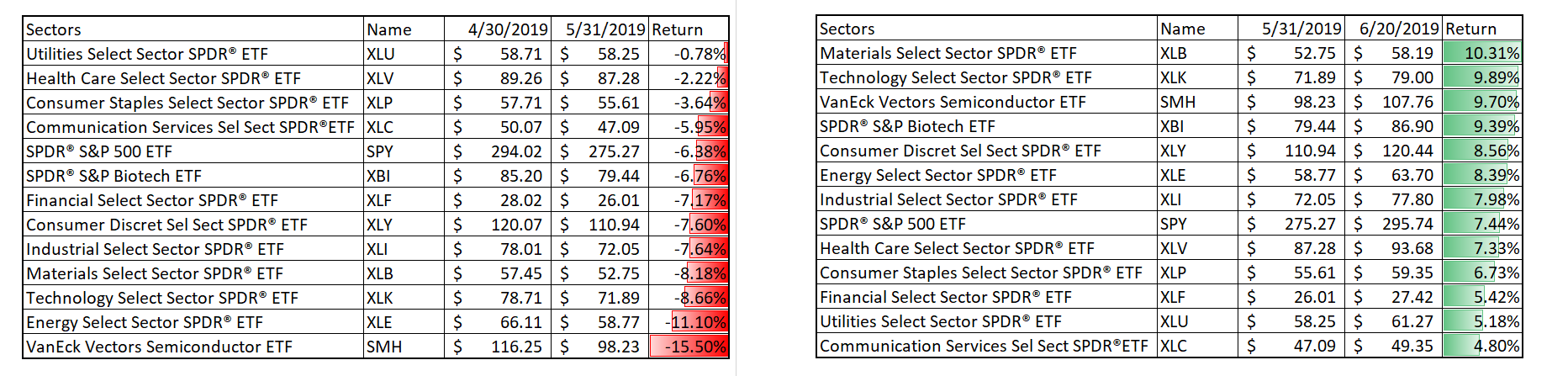

One sign that may be pointing to higher equity prices and the expansion of PE multiples is the recent sector rotation that has started to take place in the equity market. In May it was the semiconductors, energy, technology, and material stocks—as measured by their ETF proxies—that fell sharply. The VanEck Vectors Semiconductor ETF (NYSE:SMH)) fell by about 15.5%, while the Energy Select Sector SPDR ETF (NYSE:XLE) fell by over 11%. Conversely, the Utilities Select Sector SPDR ETF (NYSE:XLU) was the best performing group, falling by just 0.78%. Overall, the SPDR S&P 500 ETF (NYSE:SPY) fell by almost 6.5% in May.

June has been the complete opposite, with the risky (Materials Select Sector SPDR (NYSE:XLB)) rising by almost 10.5%, while the Technology Select Sector SPDR ETF (NYSE:XLK) and the Semiconductor ETF (NYSE:SMH) jumping by 10%. That is better than the S&P 500 ETF’s increase of over 7%.

If the risk-on mentality in the market place sticks, it should lead to further risk-taking over the balance of 2019. This is likely to lead to a higher PE multiple as investors become willing to pay higher prices for future earnings growth. It could even help to lead the S&P 500 towards 3,200.