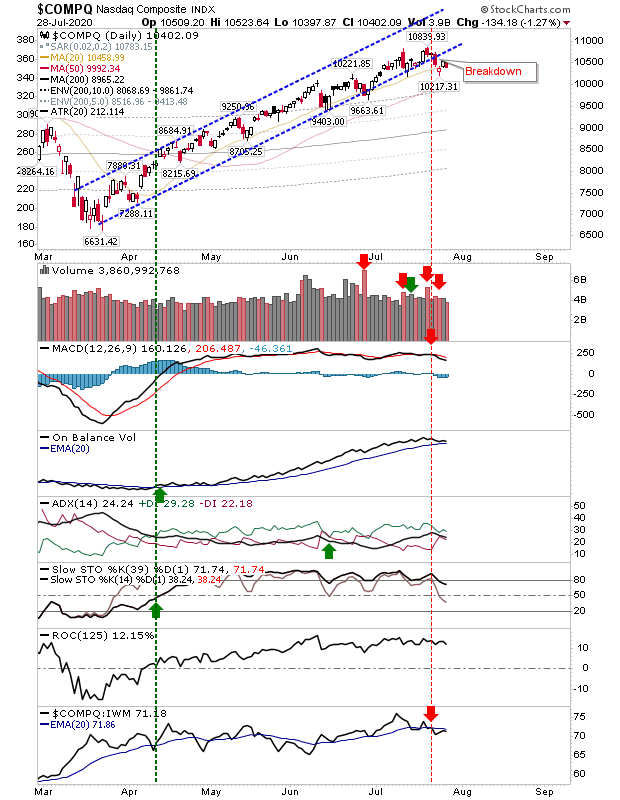

Aside from the NASDAQ which broke through rising channel support yesterday, other indices remain caught along breakout support.

The NASDAQ is on a 'sell' trigger in the MACD and a relative underperformance against the Russell 2000, but it has already moved outside of its rising channel where an opportunity to accelerate losses has not yet been taken.

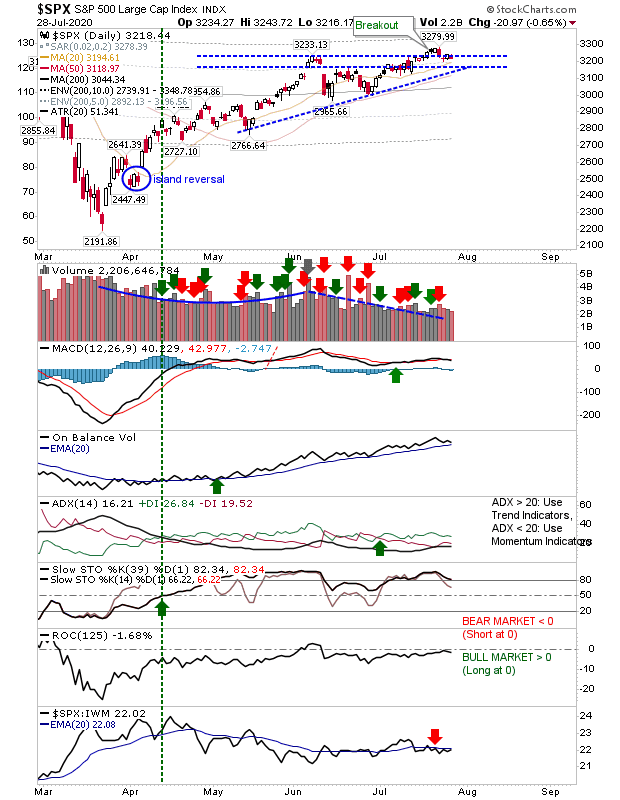

The S&P had registered a small breakout before it drifted back to support. However such support remains in play despite yesterday's loss and with technicals still net bullish there has yet to be a 'sell' trigger which could encourage a more pronounced downside.

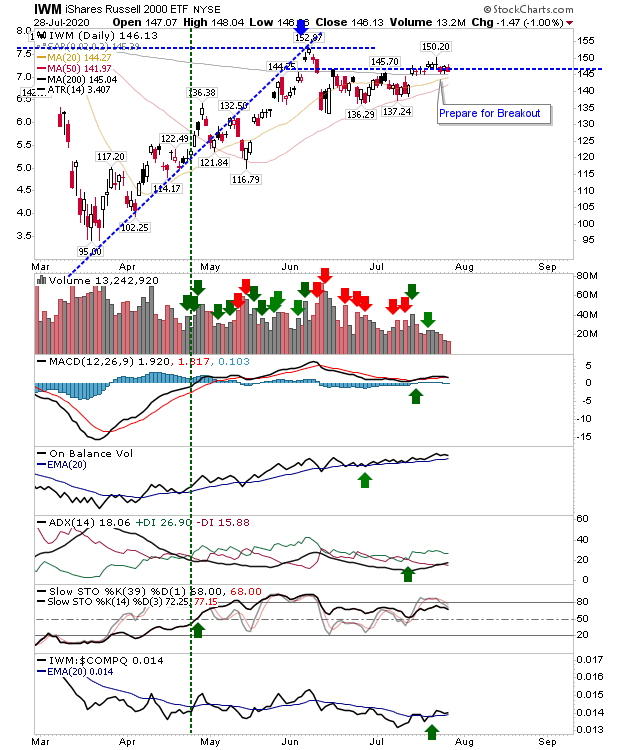

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) is holding to support which is also its 200-day MA. The breakout hasn't yet materialized but it remains in a good place to do so. Tuesday's loss did not reverse the relative outperformance for this index relative to its peers.

We have another day to wait for a reaction in the indices, but we have seen an extended period of flat action in the index which matters most to secular bulls, the Russell 2000.