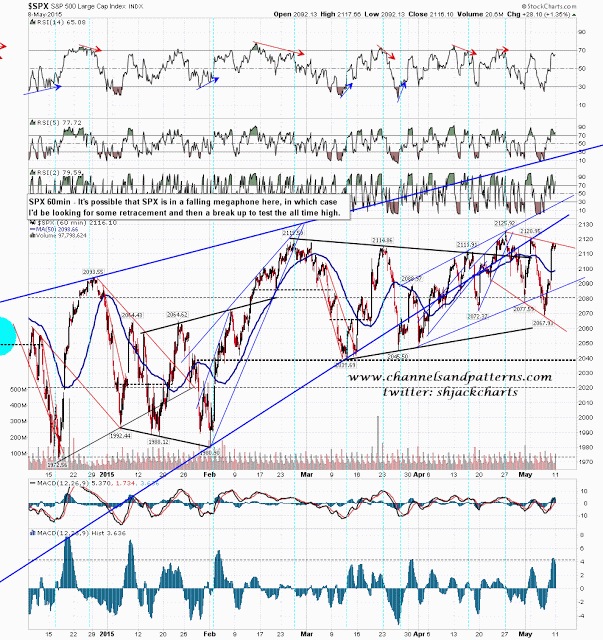

I think I now have the pattern for this wildly choppy action over the last few days, and it's a falling megaphone that looks likely to break up soon, though we may well see a decent retracement before any test of the all time high. SPX 60 min chart:

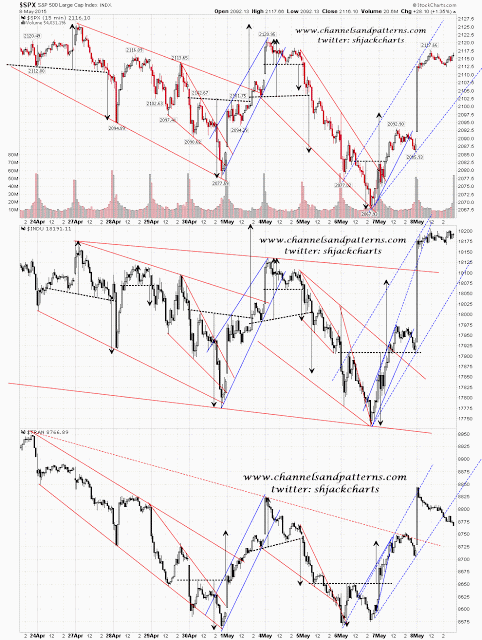

Looking at the scan charts TRAN is still the weakest with the obvious target for the current retracement on SPX at 2105 (rising target obviously). A break below that would open up targets lower down, with the daily middle band at 2102 and the 50 hour MA at 2099. On a significant break under the 50 hour MA we could see another of the hard spikes down that have dominated the last couple of weeks. Scan 3x SPX INDU TRAN chart:

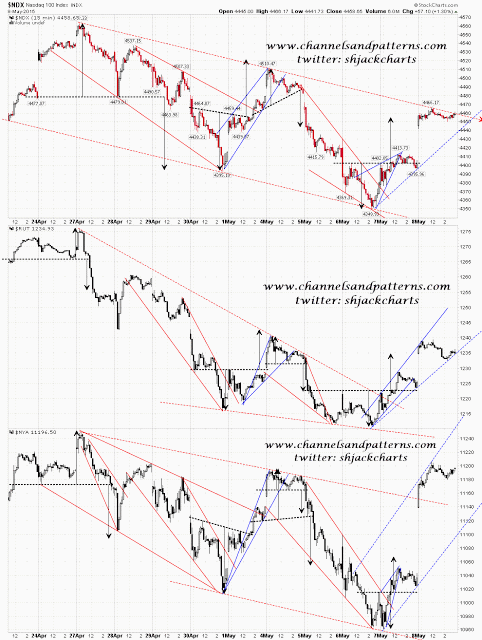

NDX and RUT are already testing rising support from the last lows. If that breaks that looks moderately bearish but I'd be looking for SPX to break hard before assuming another spike down had started. Scan 3x NDX RUT NYA chart:

This has been very spiky tape the last few days and it would be very nice to see it resolve into a decent trend move in either direction. Meantime we will just have to wait for this already lengthy topping process to complete.