Brown-Forman Corporation BF.B looks impressive backed by its sturdy portfolio, solid strategies and stellar first-quarter fiscal 2018 results, along with robust outlook for the year. Additionally, this Louisville, Kentucky-based company is poised to gain from its industry growth trends.

This Zacks Rank #2 (Buy) stock has rallied 10.8% in the past month, outperforming the Zacks Alcoholic Beverages industry’s growth of 4.5%. Currently, the industry is placed at the top 8% of the Zacks classified industries (21 out of 256). In fact, the company’s shares have also outpaced the broader Consumer Staples sector’s gain of 0.4%, which is placed at the top 44% of the Zacks classified sectors (7 out of 16).

Let’s Find Out More

Robust Q1 & Estimate Revisions

Brown-Forman posted solid fiscal first-quarter results with both earnings and sales beating the Zacks Consensus Estimate. In fact, the bottom line reflected a turnaround from the dismal earnings reported in the prior quarter, benefiting from sturdy operating income growth and lower tax rate.

Consequently, management raised earnings view for the fiscal year, reflecting reduced tax rate and diminished foreign currency headwinds. The company now expects earnings of $1.85-$1.95 per share compared with the previous guidance of $1.80-$1.90.

Moreover, Brown-Forman remains confident of persistent growth in underlying net sales and operating income in fiscal 2018. Hence, it continues to project 4-5% rise in underlying sales mainly backed by growth of its premium American whiskey and tequila brands, comprising innovation for Jack Daniel’s RTDs. Also, growth is likely to come from new product launches including the Jack Daniel's Tennessee Rye and Slane Irish Whiskey. (Read: Brown-Forman Q1 Earnings Top on Strong Sales, Stock Up)

Notably, these factors led to an uptrend in the company’s earnings estimates over the last 30 days. The Zacks Consensus Estimate of $1.91 for fiscal 2018 and $2.05 for fiscal 2019 has climbed 6 cents and 8 cents, respectively.

Strategic Endeavors

Armed with a sturdy portfolio of globally recognized brands, Brown-Forman is a major producer and distributor of premium alcoholic beverages in the world. We expect the company’s continued focus on pricing, product innovation and expanding operations in emerging markets to boost its operational performance and further strengthen market position.

Going forward, Brown-Forman plans to expand Jack Daniel's market share in the developed markets as well as emerging markets, where the whiskey category is in the early stages of development. Additionally, it is on track to expand the sphere of other brands, alongside entering the fastest-growing spirit category — the Irish Whiskey — with the purchase of all shares of Slane Castle Irish Whiskey Limited in Ireland. Meanwhile, the company concluded the sale of its Southern Comfort and Tuaca trademarks to Sazerac as part of its portfolio management and prioritization of strategic brands.

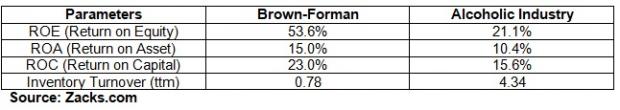

Brown-Forman Vs Industry

Gaining From Industry Trends

Albeit the prohibitions on drinking, recent observations unveil that alcohol sales trends have been witnessing a change with a higher demand for flavored products as well as tequilas. In fact, the industry has recently seen the spirits segment gathering momentum, accounting for about 36% of the total alcohol market.

Markedly, the Alcoholic Beverages industry has gained 16.3% in the last six months, ahead of the S&P 500 market’s growth of 3.8%.

We believe Brown-Forman is well-positioned to gain from these ongoing industry trends driven by strength in its premium American whiskey and tequila brands along with its Jack Daniel’s trademark.

Looking for More? Check These Three Trending Stocks

Some other top-ranked stocks in the same industry include The Boston Beer Company, Inc. (NYSE:SAM) , Craft Brew Alliance, Inc. (NASDAQ:BREW) and Constellation Brands, Inc. (NYSE:STZ) .

Boston Beer has pulled off an average positive earnings surprise of 50% in the last four quarters. The stock currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Craft Brew, a Zacks Rank #1 stock, has delivered an impressive average positive earnings surprise of 222.7% in the trailing four quarters.

Constellation Brands has a long-term earnings growth rate of 18.2% and carries a Zacks Rank #2. Also, its earnings have outpaced the Zacks Consensus Estimate in each of the last four quarters, with an average of 11.7%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Brown Forman (NYSE:BFb) Corporation (BF.B): Free Stock Analysis Report

Constellation Brands Inc (STZ): Free Stock Analysis Report

Craft Brew Alliance, Inc. (BREW): Free Stock Analysis Report

Boston Beer Company, Inc. (The) (SAM): Free Stock Analysis Report

Original post

Zacks Investment Research