Driven by the real and anticipated divergence in economic performance and trajectory of monetary policy, the long anticipated US dollar recovery has begun. As is evident in the positioning of the futures market, and confirmed by anecdotal evidence, speculative participants have amassed a significant large US dollar position. Broader measures of portfolio flows are less timely, but those that track mutual fund and ETF flows also report foreign demand for US assets.

The two knocks against the currency market have been the lack of follow-through and the low volatility. The former has been exaggerated, and the latter may be changing. Perhaps what many say was the lack of follow-through was really about being on the wrong side of the trade. Rather than continue to rally, the dollar's advance against the yen stopped dead in its tracks at the start of the year. Sterling trended higher from around $1.65 in mid-March to $1.72 in mid-July and that back to $1.65 in late-August. Sterling's recent decline including a 7-week losing streak that ended last week (just barely). And with last week's losses, the euro itself has declined for seven consecutive weeks.

Volatility in the euro and yen has been moving higher. The three-month implied volatility of both the euro-dollar and dollar-yen spent last week above their 100-day moving averages after bottoming in mid-July. For the euro, it is the first time since the start of the year, and this is the longest the implied dollar-yen volume has stayed above its 100-day average since the middle of last year.

Sterling is an exception to the general pattern of a stronger dollar, higher volatility. Sterling peaking against the dollar in mid-July, but the implied volatility peaked a few weeks later in early August. Perhaps when sterling fell through a technical retracement objective near $1.68, the option players only then recognized that a top of some import was in place and were no longer looking to buy upside protection. As sterling has moved back into more familiar levels, volatility has continued to ease and is back to within striking distance of the multi-year low set in June, near 5%. That said, we can see how out-of-the-money options could offer attractive returns if the Scottish referendum in the middle of September surprises or if once passed this key event, sterling rallies.

Technically, the dollar looks stretched, but there is no compelling evidence to think that it has reached an important top against the yen, or that the euro is near a bottom. Sterling has been nesting in the $1.6540-60 area and is fundamentally positioned to out-perform the continental currencies and yen. However, it might struggle to recoup much ground against the dollar until the Scottish referendum is held.

The ECB meeting is key, and ahead of it, the euro could lose a cent, but remain above $1.30. We see a better chance of a rate cut than the unveiling of an ABS purchase program, or some other variant of QE that many other observers have emphasized. Many observers do think Draghi pre-committed ECB action in his Jackson Hole speech, especially the improvised additions.

We are bemused by the fact that many who have argued that QE was ineffective in the US, UK, Japan, and Switzerland are among those who advocate it for the ECB. In any event, we do see a heightened risk of either disappointment with the ECB's action or "sell the rumor buy the fact" type of activity that can potentially trigger a squeeze. Such a bounce can be anticipated by investors and used to help time the implementation of an allocation strategy.

It is interesting to consider who is selling the yen. We know speculators in the futures market has built a substantial short yen position. We know from the MOF weekly data that Japanese investors have stepped up their purchases of foreign assets. Japan's public pension fund appears to have stepped up the diversification out of JGBs, raising foreign bond allocations. Many suggest the carry-trade is back in vogue. While this is possible, we are skeptical. There are other reasons to sell the yen besides carry, like momentum and portfolio allocation optimization.

Moreover, Japan is no longer the low-interest rate country. Overnight money in the euro area briefly exchanged hands at less than zero. The German yield curve, out to three years, had a negative yield at the end of the week. None of the Japanese curve is negative. At the long-end, consider that Switzerland's benchmark 10-Year bond yield is a couple of basis points through Japan.

The point is not that it is not a carry trade because there is no yield pick-up, but rather because the yen is not the most attractive funding currency now. In addition, the fact of the matter is that the dollar-yen upside breakout was not a function of a wider US premium over Japan, which many, including ourselves, had expected.

The dollar-bloc currencies do look to be better-positioned technically. Since the end of the Q1, the Canadian and Australian dollars have been the best performers, gaining 1.7% and 0.8% respectively against the dollar. We suspect the Canadian dollar can continue to outperform. Both central banks meet next week. Neither will change policy, but the RBA is more likely to complain about the currency's strength.

Currently, we would argue, Canada draws a bigger benefit of being integrated into the US economy than Australia does, being tied to China. The recent data suggests that the Canadian economy has greater momentum than Australia. This is especially important for equity investors, where the Toronto Stock Index is up 14.5% compared with the ASX's 5.1% advance year-to-date. Australia does offer higher yields than Canada. We are also more inclined to see the RBA cut than the BOC (though not until late this year, or more likely, next year).

The US dollar found support ahead of CAD1.08. This is an important area, and a break would allow the greenback to complete the double top pattern carved out near CAD1.10 and has a minimal objective of CAD1.0720. The 5-day moving average crossed below the 20-day at the end of last week This is the first such crossing since mid-July that signaled a near-3% move.

The U.S.'s S&P 500 made new record highs last week, though spent most of last week consolidating. August was its best month since February (up ~1.5%, NASDAQ up near 3%). Volume was especially light during the last week and a half. With interest rates low and still falling, what many see as the ultimate fuel for equities would appear to remain in place. The U.S. 10-Year yield made new lows for the move before the weekend, while the 2-Year yield was pushed back below 50 bp. Lastly, we note that the price of oil (generic) rallied last week, snapping a six week declining streak. It is testing its 20-day moving average near $96. It has not traded above this average since July 22.

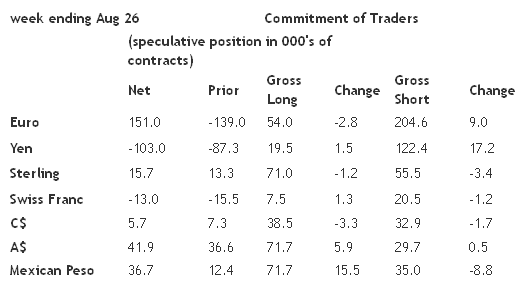

Observations from speculative positioning in the futures market:

1. There were two significant position adjustments in the CFTC reporting period ending August 26. The gross long yen position increased by 17.2k contracts to 122.4k. The gross long Mexican peso position grew 15.5k contracts to 71.7k.

2. Separately, we note that the gross short euro position rose by 9k contracts to 204.6. The record gross position was set in July 2012 near 244k contracts. Even though the risk of break-up of the euro area and the risk that a large country defaults have fallen sharply, sentiment is almost as extreme.

3. Many Treasury bears threw in the towel in the latest period. About 22% of the gross short position was covered. In numerical terms, this was 116.5k contracts. This brought the gross short position down to 410k contracts. The gross longs were pared by 65k contracts to 418k. This was enough to swing the net position to long for the first time in a year.