London Forex Report: Eyes On ECB & BOE

London Forex Report: Continuous slide in oil prices that raised global growth concerns continued to unnerve markets, shrugging off a much slower contraction in China exports. In the US, the Fed Beige Book maintained that most districts expanded at a moderate pace but wage growth remained flat in spite of a resilient job market. In line with weakness seen in recent manufacturing data, the Beige Book said most manufacturing sectors weakened with some citing negative drag from a strong dollar. The USD Index slipped in US morning to settle 0.04% lower at 98.93 amid an absence of positive catalyst to drive further gains.

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR modestly rebounded from a day-low of 1.0803 to high of 1.0887 as global risk-off sentiment dominated the markets following another slide in oil prices and a sharp fall in US stock markets. Looking ahead, today the ECB will release the minutes of its most recent rate decision meeting, which, the markets generally expect, should reaffirm that the door is still open for further easing.

Technical: While offers at 1.0930 contain upside reactions expect rotation to retest bids at 1.08, a breach of 1.0930 opens a retest of 1.0990 trend resistance.

Interbank Flows: Bids 1.08 stops below. Offers 1.0950 Stops above.

Retail Sentiment: Bearish

Trading Take-away: Sidelines

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Against the backdrop of poor British industrial output data released on Tuesday, GBP dropped to a five and a half year low at 1.4378 against USD. Most investment banks and research agencies have already pushed back their forecasts for UK rate hike that no increase would come before the end of this year. Markets await the BoE meeting today.

Technical: While 1.45 caps upside reactions expect a grind lower to retest yesterday’s lows en route to 1.43. Only over 1.46 eases immediate downside pressure.

Interbank Flows: Bids 1.4350 stops below. Offers 1.45 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: JPY strengthened across the board amid risk aversion during the American session and trimmed losses suffered in the Asian Session. Despite starting the day with gains, Dow Jones fell by 2.21% while the NASDAQ tumbled 3.41% at close.

Technical: While 118.30 caps intraday upside attempts expect a grind lower en route to test 116.35 as the next downside objective. Only above 119.30 eases immediate downside pressure.

Interbank Flows: Bids 116.50 stops below. Offers 118.50 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines

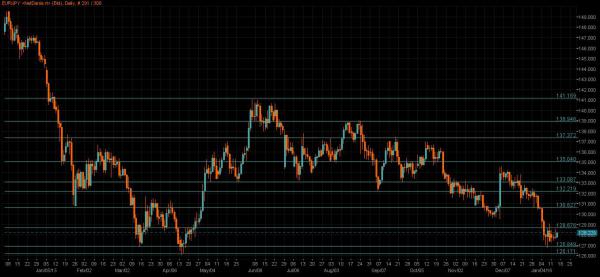

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Japan’s core machine orders fell 14.4% m/m in Nov vs. expectations of -7.3% and Oct’s 10.7%. The weak core machine orders – an indicator of future capital spending – suggests softness in the economy and that more fiscal and monetary measures could be needed.

Technical: While 129.10 caps intraday upside reactions, expect a grind lower to retest Thursdays lows at 126.70’s a failure here opens a test of bids at 126. Only over 130 eases immediate downside pressure.

Interbank Flows: Bids 126.50 stops below. Offers 128.50 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines

AUD/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Aussie surged to an intraday high of 0.7048 at Asian session on Wednesday due to an improved risk sentiment in the markets. However, AUD/USD dropped heavily due to the poor performance of SSE Composite (L:SSE) index and Dow Jones index. Australian Unemployment Rate was 5.8%, beat the market forecast of 5.9%. The employment change was -1k, better than the forecast of -10k. AUD/USD recovered from lows shortly after the figures were released.

Technical: While .7050 caps intraday upside expect a grind lower to test 2015 lows. Only a breach of .7150 eases immediate downside pressure.

Interbank Flows: Bids .69 stops below. Offers .7050 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines

USD/CAD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: CAD fell to a fresh 12-year low against USD as a sell-off in stocks weighed on the risk-sensitive commodity currency and crude oil prices remained weak. USD/CAD closed above the psychological 1.43s threshold for the first time since April 2003 while speculation intensified that the Bank of Canada will cut interest rates as early as next week.

Technical: Bulls have the ball while 1.4315 supports, expect a grind higher to test stops above 1.44. Only below 1.42 eases immediate bullish pressure

Interbank Flows: Bids 1.4250 stops below. Offers 1.44 stops above

Retail Sentiment: Bearish

Trading Take-away: Sidelines