London Forex Report:

Another slide in equities and crude oil prices could continue to cloud global growth and inflation prospects, hence reaffirming that global monetary policy will remain ultra loose in the wake of uncertainties in the world economy and financial markets. Reflecting low inflationary pressure globally, producers’ prices in the Euro area shrank 3.0% YoY in Dec mostly dragged by energy prices. Prices were down 3.2% YoY in Nov.

On a brighter note, unemployment rate fell 0.1% to 10.4% in Dec, the lowest since Sept 2011. Record low unemployment in Germany offset sluggish print from Spain and Greece. USD rose as demand returned to the fore amid declines in equities and commodities. Nonetheless, the USD Index dipped 0.13% to 98.87 as major composition of the index Euro, CHF and JPY rallied.

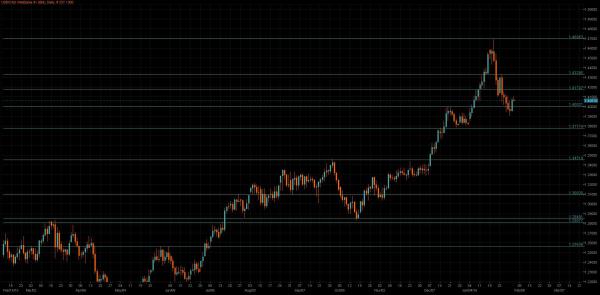

EUR/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: EUR climbed to an intraday high of 1.0940 as risk sentiment deteriorated due to a slump in oil prices and equity markets. The Euro may go up further if stock markets continue to grind lower. Today we will have Eurozone Retail Sales and Germany Services PMI.

Technical: Trading upper range. A breach of 1.0990 trend resistance opens a broader 1.1240 symmetry corrective objective.

Interbank Flows: Bids 1.08 stops below. Offers 1.0950 Stops above.

Retail Sentiment: Bearish

Trading Take-away: Play the range, buy dips to 1.07 sell rallies to 1.10

GBP/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: GBP surged to a 3-week high at 1.4445 on Tuesday as a draft proposal unveiled that Britain does not have to compromise with other countries in EU on some political issues, relieving the Brexit crisis. Cable had earlier fallen to as low as 1.4324 after Britain’s construction sector showed bad performance in January. Apart from Brexit issue, markets are also waiting for the BoE meeting and the inflation report due tomorrow.

Technical: Over 1.4450 eases immediate downside pressure and sets up a broader correction. Broader corrective bias remains intact while 1.4280 supports intraday downside reactions failure at 1.4250 suggests false upside break and resets bearish tone.

Interbank Flows: Bids 1.4250 below. Offers 1.4450 stops above

Retail Sentiment: Bearish

Trading Take-away: Buy pullbacks against 1.43

USD/JPY

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bearish

Fundamental: JPY was strengthened in tandem with euro due to risk aversion sentiment. USD/JPY broke down at 120.00 handle and it is now trading at around 119.70. NIKKEI 225 Index dropped more than 3 percent overnight. Shrugging off the impact of BoJ’s negative interest rate, markets turned their focus to risk sentiment. Besides, markets await non-farm data due this Friday .

Technical: 121.66 is initial resistance an upside breach here opens a move to test 123.64 next, bulls have the ball while 119 supports intraday downside reactions. A failure at 119 opens 118 on the downside

Interbank Flows: Bids 119.50 stops below. Offers 122 stops above

Retail Sentiment: Bullish

Trading Take-away: Sidelines

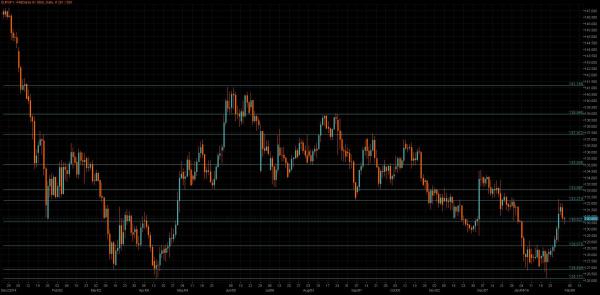

EUR/JPY

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: The Kuroda trade has seen further unwinding in the past 24 hours as bearish external forces dominate, and EUR/JPY has given back the 131 level and has added to losses this morning in spite of further dovish speak from Kuroda (along with the Nikkei shedding 3pct at the time of writing).

Technical: While 130.40 supports intraday downside reactions expects a retest of 132.30 offers and stops above, a close above 132 opens a test of 134 next.

Interbank Flows: Bids 130.50 stops below. Offers 132.50 stops above

Retail Sentiment: Bearish

Trading Take-away: Buy pullbacks against 130.30 for 134

AUD/USD

Outlook: Short Term (1-3 Days): Bearish – Medium Term (1-3 Weeks): Bearish

Fundamental: Aussie slipped against USD on Tuesday, after Reserve Bank of Australia (RBA) remained rates unchanged at 2 percent, but left the door open to further easing measures. A risk-off theme extended overnight amid falling oil prices. The drop in oil hit commodity currency like the Aussie. Australia released Trade Balance of December in early Asian session today, which was -3535m versus the previous of -2906m.

Technical: While .7000 caps intraday downside expect a test .7200. Only a closing breach of .7150 eases immediate downside pressure.

Interbank Flows: Bids .7000 stops below. Offers .7150 stops above

Retail Sentiment: Neutral to bullish

Trading Take-away: Sidelines

USD/CAD

Outlook: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks): Bullish

Fundamental: USD/CAD rose back above 1.40 handle, stretching to fresh weekly highs of 1.4080s on the back of lower oil prices. Crude oil prices fell for a second day in a row, below US$30 a barrel for the first time in nearly 2 weeks.

Technical: While 1.4160 caps upside reactions expect a broader corrective phase to test AB=CD corrective swing target at 1.3750 support. Only above 1.4330 eases immediate downside pressure and opens a retest of 2016 highs.

Interbank Flows: Bids 1.3950 stops below. Offers 1.4150 stops above

Retail Sentiment: Neutral

Trading Take-away: Sidelines