Market Brief

Light news flow keep risk-taking alive

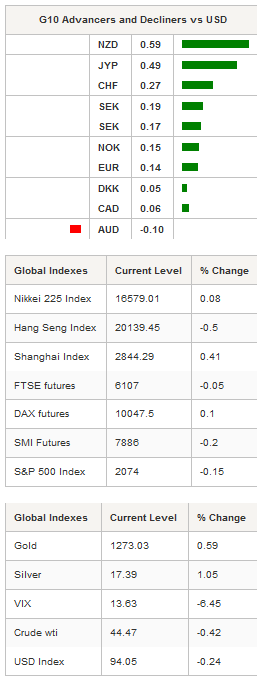

The lack of news provides traders with the opportunity to loosen FX safe-haven trades, while taking some marginal risk. Data from the US indicates that the labor market remains solid as JOLT job openings came in higher then excepted, while China provided further evidence of stabilisation despite disappointing trade data. Regional Asian equity markets were mixed, following the impressive US rally, as the Nikkei and Shanghai composite rose marginally, while the Hang Seng dipped -0.67%. The big mover was the Philippines exchange, which continued its post presidential election rally, rising 3.36%. The strong recovery in asset prices indicates that the election of populist Rodrigo Duterte is viewed as an opportunity by investors.

USD was weaker against G10 and EM Asia but selling pressure was light. Japan's April foreign reserves increased $410 mln to 1.262.509 bln, while the MoF confirmed that no direct FX intervention took place in Q1 2016. With USD/JPY solid rebound to the 109 levels we do not anticipate direct FX intervention despite heightened rhetoric. Australia's May Westpac/MI consumer confidence index rose 8.5% m/m to 103.2, reaching the highest level since January 2014 and reversing the decline of the last two months. The positive result gave AUD/USD a slight bump off the 0.7300 low to 0.7391. Crude oil remained weak, bouncing around the $44.50 handle despite unrest in Nigeria and wildfires in Canada. Brazil's senate will vote today on whether to put President Dilma Rousseff on trial. Surprisingly, despite the social unrest and political uncertainty the BRL actually saw a marginal gain against the USD. BRL traders should stand ready for rogue and amplified volatility in the currency.

In New Zealand, the latest bi-annual Financial Stability Report indicated that risk to outlook was threatened by the rapid rise of the housing market. RBNZ’s Wheeler suggested that macro prudential measures would be used to rein in house price inflation rather than monetary policy (by tightening interest rates). By directly addressing the bubble in housing the RBNZ indirection has opened the door for further interest rate cuts. We remain bearish on the NZD based on the monetary policy outlook.

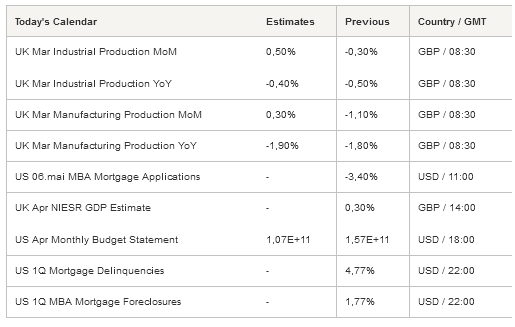

With a very light calendar FX trade will remain subdued and non-directional. The highlight of the European session should be the UK March industrial production. Markets anticipate industrial production to print at 0.5% m/m, with manufacturing output expanding by 0.3% m/m. However, due to Brexit-induced weakness abundantly seen in UK data, risk is skewed to the downside.

Currency Tech

EUR/USD

R 2: 1.1714

R 1: 1.1465

CURRENT: 1.1396

S 1: 1.1217

S 2: 1.1144

GBP/USD

R 2: 1.4959

R 1: 1.4668

CURRENT: 1.4643

S 1: 1.4300

S 2: 1.4132

USD/JPY

R 2: 112.68

R 1: 111.91

CURRENT: 106.94

S 1: 105.23

S 2: 100.78

USD/CHF

R 2: 1.0093

R 1: 0.9913

CURRENT: 0.9621

S 1: 0.9476

S 2: 0.9259