One thing I like to see during market rallies is strong leadership from three areas of the market at the same time; big cap stocks, small cap stocks (RUT), and the Nasdaq 100 (NDX).

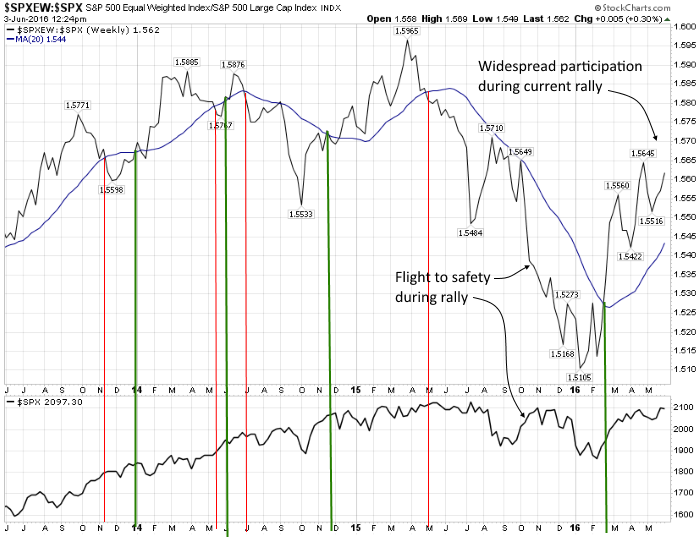

For big cap leadership, I like to see broad participation from a majority of stocks in the S&P 500 index (SPX). One way to measure large cap breadth is from indicators like the Bullish Percent Index or percent of stocks above their 200 day moving average. A few weeks ago, I highlighted their recent strength. Another way to measures large cap breadth is by comparing mega cap stocks to large cap stocks. I do this by comparing the S&P 500 Equal Weight index (SPXEW) against SPX. Long time readers know that I use a dip below the 20 week moving average in the SPXEW v. SPX ratio as a warning sign that some chop is ahead (and possibly danger). When this occurs it signals that money is rotating out of big cap stocks and into mega cap stocks, which is often a flight to safety. Take a look at the chart below and you’ll see that the rally out of the August lows wasn’t associated with widespread buying of large caps. Instead, there was a flight to the safety of mega cap stocks while the market rallied. The current rally has been much more healthy with money moving out of mega caps and into large caps. This is a good sign of leadership in the stocks owned by many funds.

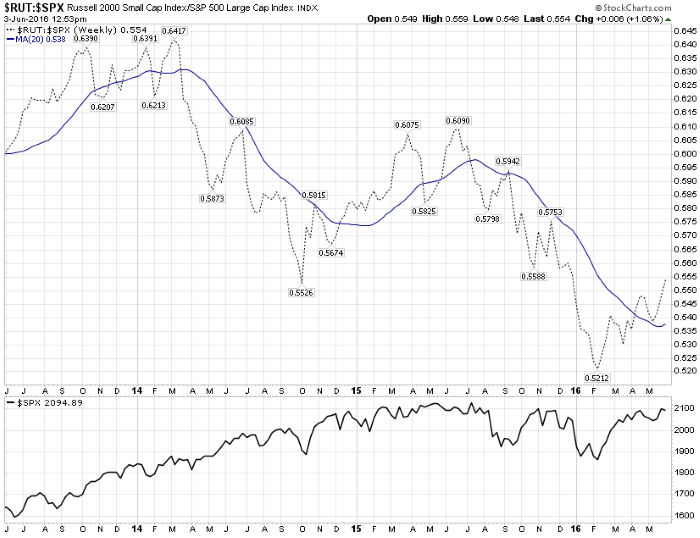

Small cap stocks lead the rally out of the October 2014 lows then stalled in July of 2015. They are now leading the current rally. This is another sign of healthy leadership.

Unfortunately the NDX is lagging SPX. This is one of the things holding the broad market back from reclaiming its all time highs. This chart is at an inflection point where it will turn over at the 20 week moving average or break up through it. If it can get a clean break higher then I suspect it will be accompanied by new all time highs in SPX. This is one of the charts I’m watching closely at the moment.

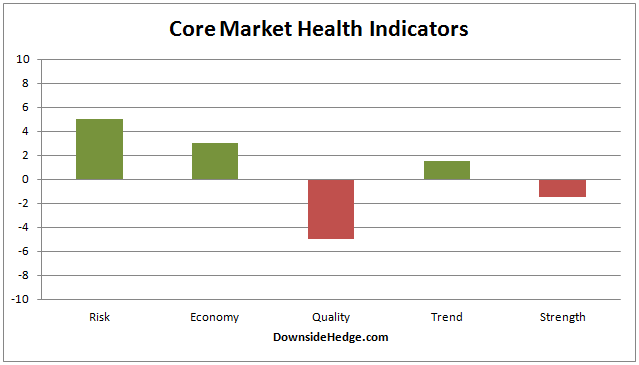

My core market health indicators remain mixed.

Conclusion

We’ve got several positive signs of broad participation from leading stocks in the current rally, but without leadership from NDX I doubt the market can sustain a rally and any new highs in SPX will be a fake out. Keep an eye on the ratio between NDX and SPX. If it breaks higher with the market we’ll likely see a sustained rally. A break to new highs in SPX without participation from NDX will likely be a head fake.