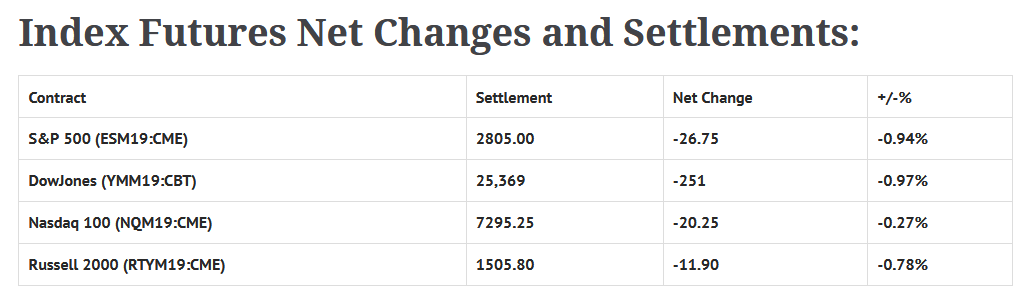

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Comp +0.16%, Hang Seng -0.57%, Nikkei -1.21%

- In Europe 12 out of 13 markets are trading lower: CAC -1.76%, DAX -1.32%, FTSE -1.29%

- Fair Value: S&P +0.50, NASDAQ +5.72, Dow +1.20

- Total Volume: 1.63 million ESM & 269 SPM traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, Redbook 8:55 AM ET, Richmond Fed Manufacturing Index 10:00 AM ET, and the State Street (NYSE:STT) Investor Confidence Index 10:00 AM ET.

S&P 500 Futures: Inverted Yield Curve And Global Rebalance Kill The Rally

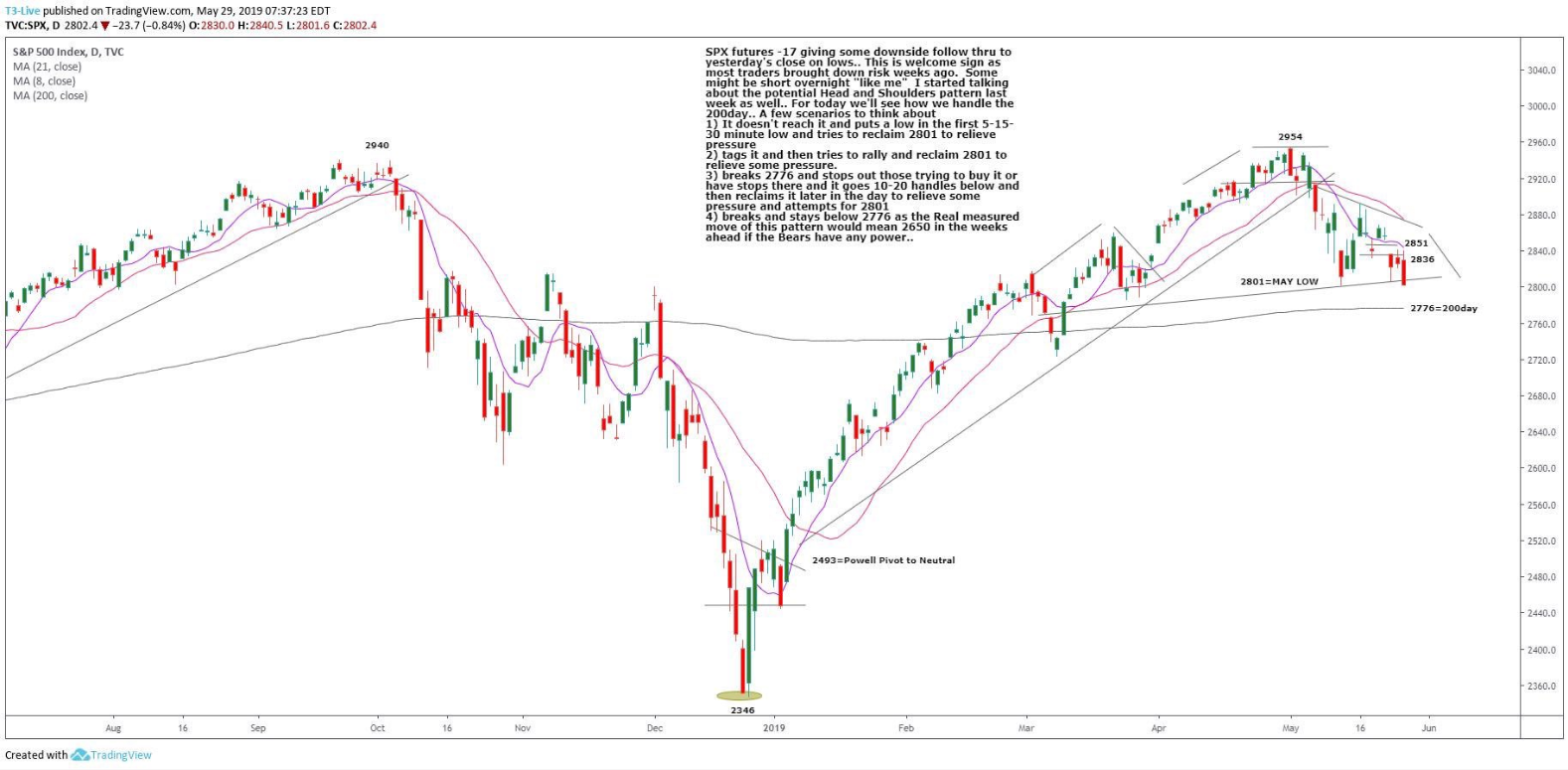

During Monday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2840.00, a low of 2822.00, and opened Tuesday’s regular trading hours at 2830.75.

After a flat overnight trade, the ES saw some early strength after the 8:30 CT bell, and rallied up to a new high at 2841.25 in the first 15 minutes of trading. From there, the buying dried up, and over the next hour the futures slowly drifted down to 2825.25.

The ES went on to do a little back-n-fill up to 2833.75, then consolidated in a 9 handle range for the next 4 hours, before once again turning lower, this time setting its sights on the Globex lows.

By 2:30, the futures had broken through the Globex lows, and when the 2:45 cash imbalance reveal came out showing close to $2 billion to sell, it had traded all the way down to 2800.50. The ES closed on its lows, printing 2801.50 on the 3:00 cash close, and 2804.75 on the 3:15 futures close, down -27 handles on the day.

The markets were firm early, but as the day wore on, the ES got weaker. Why did the S&P 500 futures selloff? Three reasons: 1) The Russell 2000 was weak all day, 2) The MSCI $96 billion dollar rebalance and, 3) inverted bond yields. All three teamed up on the broader market.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.