As Christmas approaches there wasn't a whole lot to add about yesterday's trading. Indices were mostly able to add a little on to Monday's bullish reversals, although most of the games were booked at the open and stayed there for most of the day. Only Large Caps suffered some weakness, but it was pretty modest.

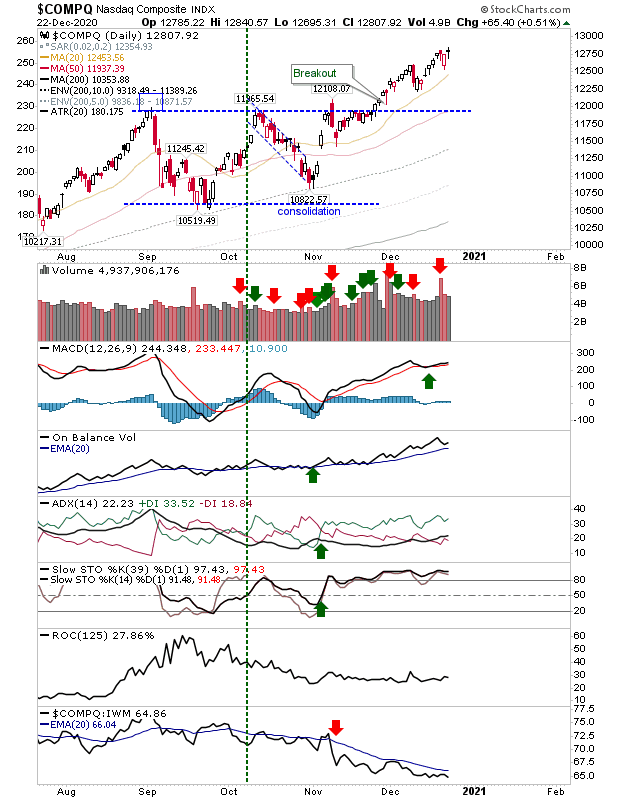

The NASDAQ managed a new closing high on lighter volume. Technicals remain nest positive, although the index is still underperforming relative to the Russell 2000.

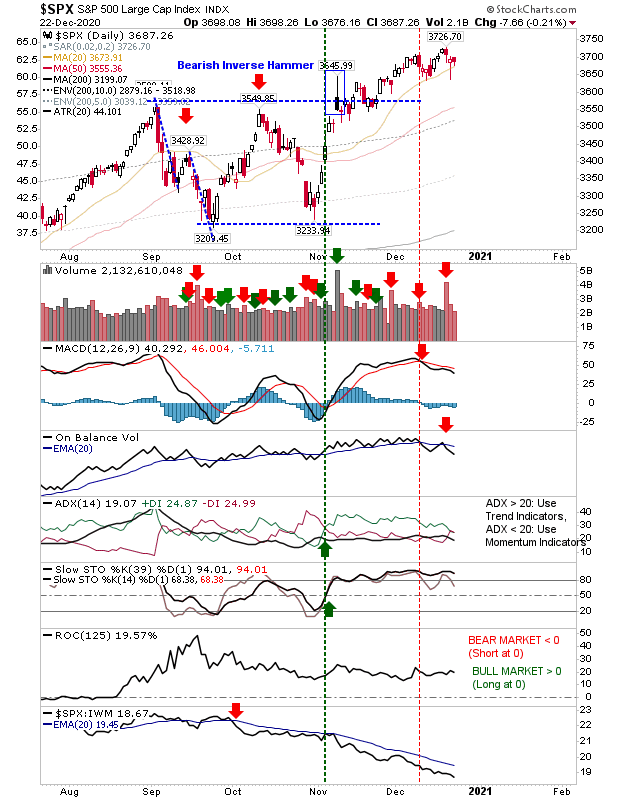

The S&P wasn't quite as lucky, and we need to be careful that losses don't push more into Monday's spike low as it would threaten the bullish validity of the 'hammer'. The index continues to suffer continued underperformance to Small Caps, not to mention 'sell' triggers in the MACD and On-Balance-Volume.

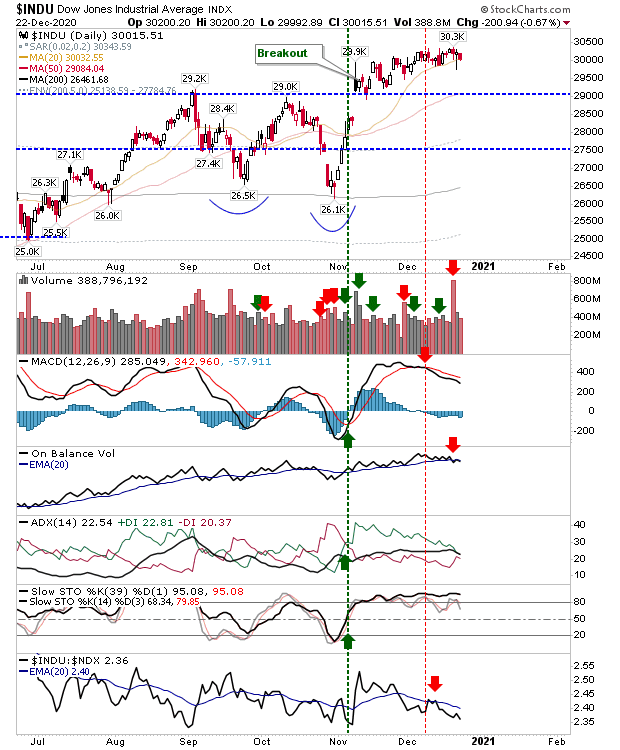

The Dow Jones Industrial Average is in a similar predicament. It's the first of the lead indices to test significant support of its 20-day MA as it pushes into the spike low. If there is an undercut of this 20-day MA I would next be looking for a test of the 50-day MA which is next to breakout support.

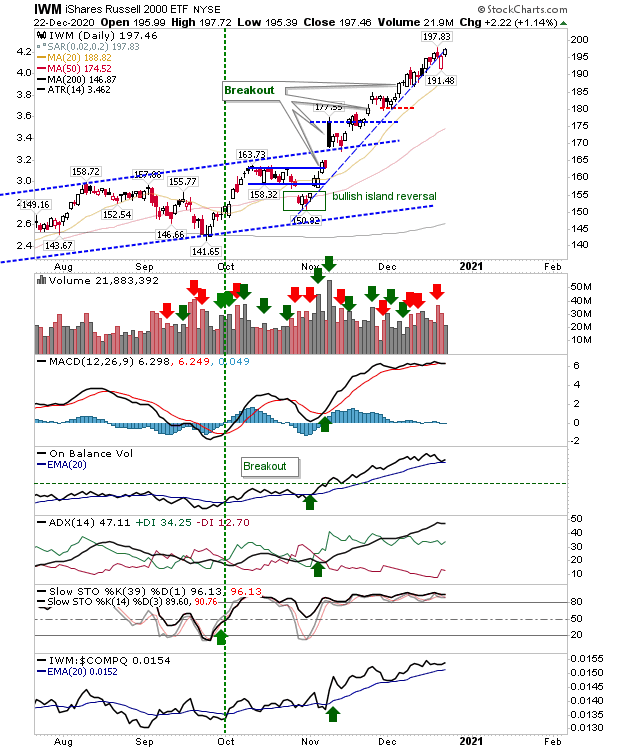

The Russell 2000 (via IWM) continued to hug rising support, although Monday's open was the first break of this line. The MACD is on the verge of a new 'sell' trigger, but remains well above the bullish zero line.

Today, we will want to see action in the S&P and Dow Industrials improve. Further weakness here would only threaten to pull the other indices down with it.

If sellers were able to undo Monday's bullish hammers for these indices it would likely mean some significant gaps down and accelerated losses across the board in sympathy with such declines.