We expect wafer fabrication equipment provider, Lam Research Corporation (NASDAQ:LRCX) to beat expectations when it reports fourth-quarter fiscal 2017 results on Jul 26.

Why a Likely Positive Surprise?

Our proven model shows that Lam Research is likely to beat earnings because it has the right combination of two key ingredients.

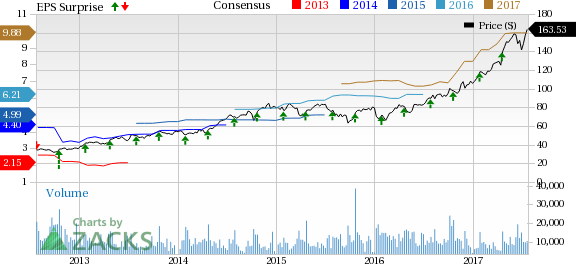

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is +1.33%. This is very meaningful and a leading indicator of a likely positive earnings surprise for shares. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Lam Research currently carries a Zacks Rank #1 (Strong Buy). It should be noted that stocks with a Zacks Rank #1, 2 (Buy) or 3 (Hold) have a significantly higher chance of beating earnings. Conversely, stocks with a Zacks Rank #4 or 5 (Sell rated) should never be considered going into an earnings announcement.

The combination of Lam Research’s Zacks Rank # 1 and Earnings ESP of +1.33% makes us confident in looking for an earnings beat.

Its shares have massively outperformed the S&P 500 on a year-to-date basis. While the index gained 10.7%, the stock returned 54.7%.

What is Driving the Better-than-Expected Results?

Lam Research continues to be the market leader in dielectric etches on successful products such as VECTOR Strata, ALTUS deposition, and its Flex and Kiyo etch products. The company sees strong demand for leading-edge silicon in the enterprise market driven by its long-term move to the cloud, storage and networking applications.

The company has been improving on the WFE market share significantly since 2013 and expects to continue making gains.

Lam Research continues to see increased adoption rates of 3D NAND technology, FinFETs and multi-patterning. The company has initiated cost reduction and density scaling for 3D NAND and new memory technologies, which is expected to positively impact its margins.

Moreover, Lam Research is making good progress with its customer support business and anti-trust agency reviews.

Other Stocks Worth Considering

Here are a few companies that you may also want to consider as our model shows that these have the right combination of elements to post an earnings beat in their upcoming release:

IPG Photonics Corporation (NASDAQ:IPGP) with an Earnings ESP of +3.07% and Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Kemet Corporation (NYSE:KEM) with an Earnings ESP of +11.11% and a Zacks Rank #1.

SBA Communications Corporation (NASDAQ:SBAC) with an Earnings ESP of +10% and a Zacks Rank #1.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

SBA Communications Corporation (SBAC): Free Stock Analysis Report

Kemet Corporation (KEM): Free Stock Analysis Report

IPG Photonics Corporation (IPGP): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Original post