Prime Day ’17 was a massive hit for Amazon.com, Inc. (NASDAQ:AMZN) with the company’s sales surpassing that of previous Cyber Monday and Black Friday. The company declared it as “the biggest day ever in Amazon history”.

According to Adobe, last year’s Cyber Monday and Black Friday recorded sales of a respective $3.45 billion and $3.34 billion.

As expected, we saw notable improvements from the numbers achieved in 2016 with more hours and countries included. Sales were up 60% and orders surged 50% over last year.

We have tried to delve deeper into this year’s Prime Day to understand how it unfolded for buyers, sellers, investors, and Amazon itself.

Here are our findings.

Investors First

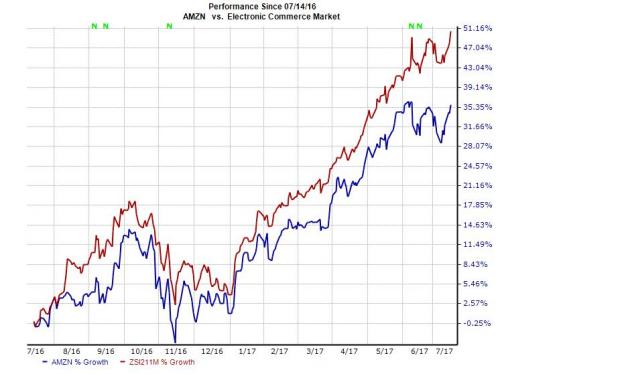

In 2016, Amazon outperformed the S&P 500 in the period between the announcement of Prime Day and the event itself. The stock returned 4.6% against the index’s gain of 2.5%. This year’s Prime Day carried the momentum forward with the stock returning 3.1% compared with the index’s gain of just 0.2%.

Over the last one year, Amazon’s share price has increased nearly 36%, thanks to its solid loyalty program in Prime, Fulfillment By Amazon, Amazon Web Services (AWS) and initiatives around Internet of Things (IoT). We believe, investors will see far more growth if Amazon could repeat its domestic success internationally.

Device Strategy Gaining Ground

Echo Dot, the scaled-down version of the popular Echo device was the bestseller this year. It was also Amazon’s bestselling product across manufacturers and categories worldwide. In addition, Echo, Kindle and Fire tablets achieved record sales, making Prime Day ’17 the biggest ever sales event for Amazon devices in the U.S. and the rest of the world.

The achievement gives Amazon the confidence that it is heading in the right direction with its Alexa powered devices. Artificial intelligence (AI) driven Alexa has already been integrated into a host of everyday devices for the digital home. This has converted the nascent smart home market into a potential area of growth in a very short time.

Alexa powered Echo devices are going great guns and help the company sell products and services. The company is racing to build an ecosystem around Alexa to make sure that it stays well way ahead of Alphabet (NASDAQ:GOOGL) subsidiary Google's smart assistant, Apple’s (NASDAQ:AAPL) Siri and Microsoft's (NASDAQ:MSFT) Cortana.

Small Businesses Hold the Key

E-commerce, with a large user base worldwide, has turned out to be a sweet spot with more and more companies jumping on the bandwagon. Therefore, small businesses and entrepreneurs are increasingly gaining significance.

This year, the retail giant has seen participation from even more small businesses and entrepreneurs who benefited from increased traffic, new product launches and enhanced sales. This underscores Amazon’s success in attracting more small business to its website.

More interestingly, this year, the company allowed Prime members from China and Mexico to shop local as well as select deals from other countries through Amazon Global Store. The focus on Chinese customers along with small businesses in the U.S. seems to be Amazon’s answer to Alibaba’s increasing push to attract U.S. small businesses.

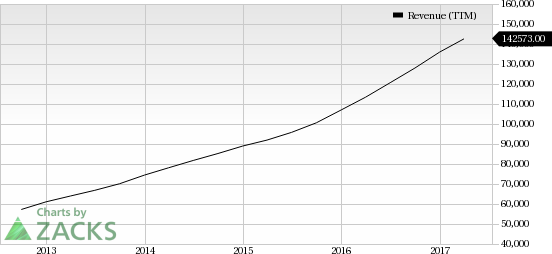

Amazon.com, Inc. Revenue (TTM)

Prime Leads the Way

A solid loyalty system in Prime has kept Amazon’s retail business unbeatable on price, choice and convenience. Prime memberships help in repeat sales of not just general merchandise but also media (books, music, video, etc).

But Prime saturation is apparent in the U.S. due to Amazon’s increased penetration rates. Mounting competition and slow e-commerce growth are other forces to reckon with. The inclusion of more hours and countries into the game of discounts underscores Amazon’s push to expand Prime internationally.

International Expansion

Expanding Prime internationally could help Amazon strengthen its foothold in international markets and create a launch pad for its other business. It could complement the company’s current expansion efforts such as investments (in India) and acquisitions (like that of Souq.com).

The popularity of Prime is undoubtedly a weapon in hand for Amazon in its attempt to conquer the rest of the world. Inclusion of more countries to this year’s Prime Day is an effort to establish a strong foothold outside the U.S.

Amazon currently carries a Zacks Rank 5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

"More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Zacks Investment Research