Currently, there is much bullish commentary suggesting stocks can only go higher from here. Is the bullishness in the markets justifiable, or is it willful blindness?

John Stoltzfus, CIO of Oppenheimer, is clearly in the bullish camp:

“We remain very bullish on this market. You’re going to see money beginning to further move out of the bond market, and it makes all the sense in the world to be positioned in equities.”

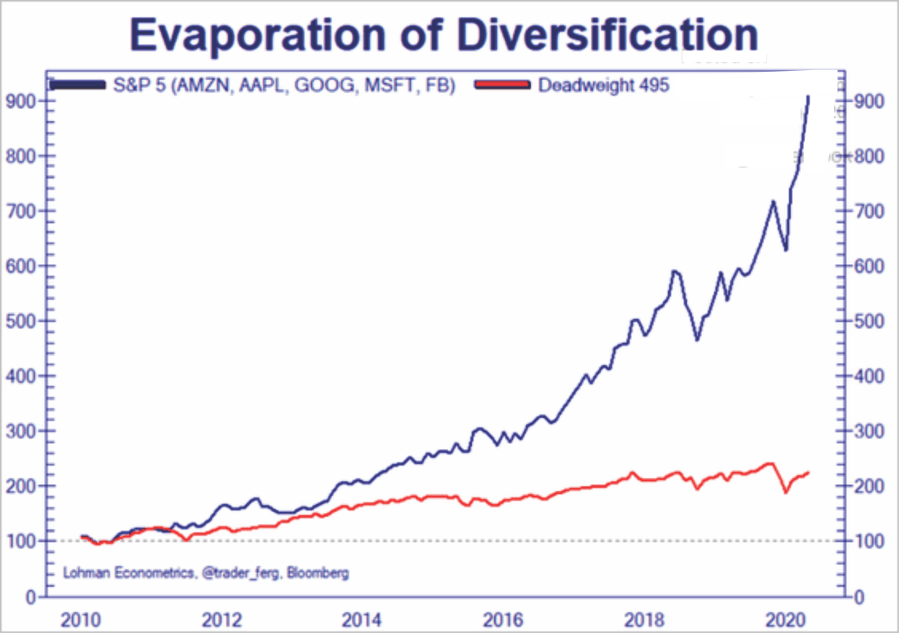

This seems a little optimistic given the amount of money that has already flooded into the 5-largest “mega-cap” stocks which have accounted for a bulk of this years market returns.

Nonetheless, it is an interesting question.

From the bulls viewpoint, the focus has been the ability for these companies to grow earnings.

The bearish view is the problem with valuations.

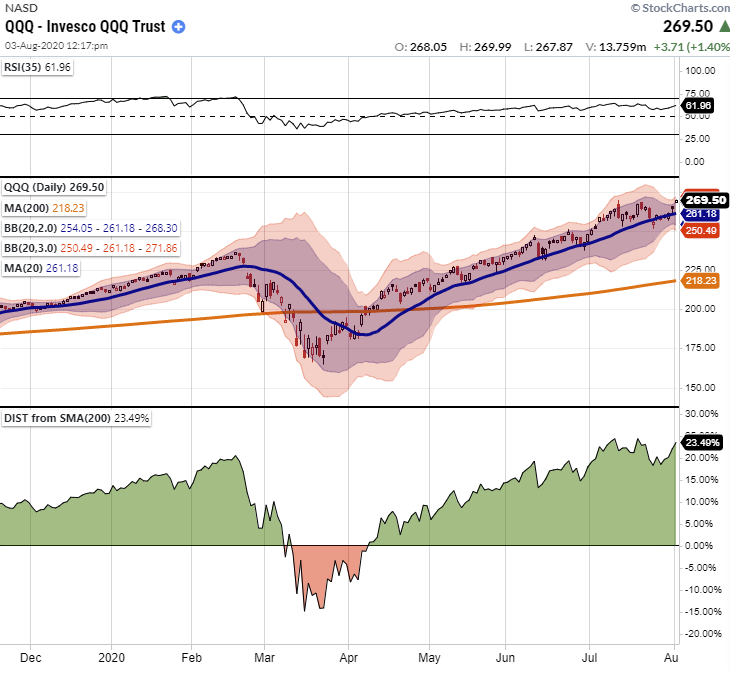

As noted in “COT Positioning – Back To Extremes,” the NASDAQ set repeated new highs in 2020, which is astonishing given the depth of the economic recession. To wit:

“While the S&P 500 is primarily driven higher by the largest 5-market capitalization companies, it is the Nasdaq that has now reached a more extreme deviation from its longer-term moving average.”

“Moving averages, especially longer-term ones, are like gravity. The further prices become deviated from long-term averages, the greater the “gravitational pull” becomes. An “average” requires prices to trade above and below the “average” level. The risk of a reversion grows with the size of the deviation.

The Nasdaq currently trades more than 23% above its 200-dma. The last time such a deviation existed was in February of this year. The Nasdaq also trades 3-standard deviations above the 200-dma, which is another extreme indication.”

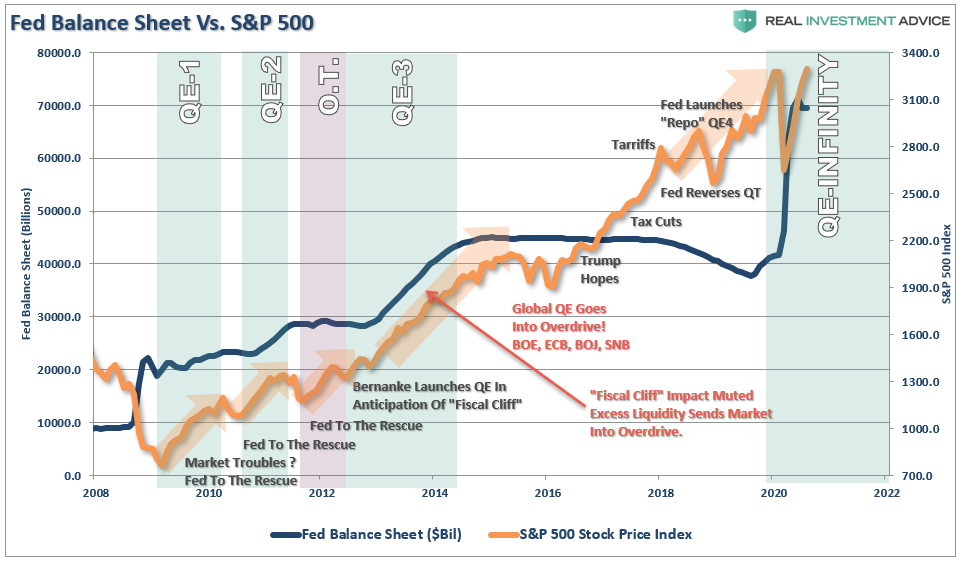

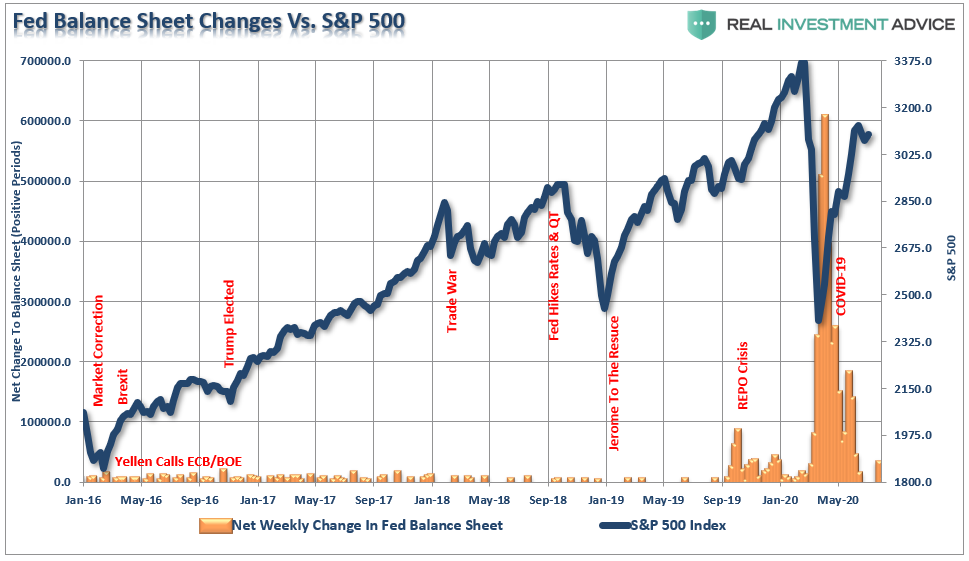

It’s The Fed Stupid

The immediate conclusion is the drive higher in the markets is a function of massive amounts of liquidity being injected into the financial markets by the Federal Reserve. As shown below that was certainly the case during March and April.

However, since then the tapering of the liquidity injections by the Fed has been marked as the slowing uptake of the various programs reduced demand.

While there is indeed truth to the Fed’s impact on the market, it is not solely responsible for the dislocation of prices from the underlying fundamentals.

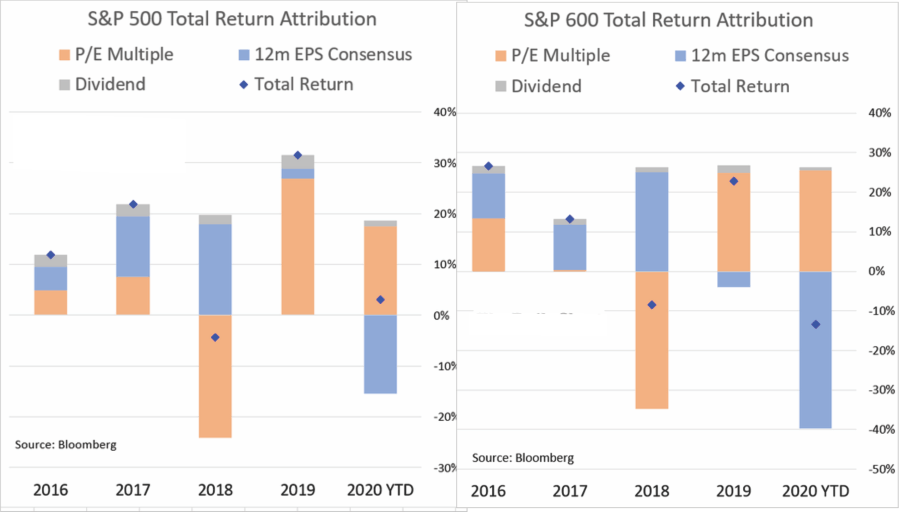

As shown, the decline in fundamentals didn’t start during the pandemic. The decline in earnings started in early 2019 as economic growth slowed, and accelerated during the pandemic. However, during that same period stock prices rose, which is almost entirely attributable to “valuation expansion.”

Dumb Money All In

E*Trade recently released survey data which showed that despite the market plunge in March, bullish sentiment has returned:

- Bullish sentiment returns. Half of surveyed investors (51%) are bullish, rising 13 percentage points since last quarter.

- Investors are more likely to believe the market will rise. Over half of investors (51%) believe the market will rise, skyrocketing 20 percentage points this quarter.

- But volatility will persist. More than half of investors (56%) believe volatility will continue, gaining nine percentage points since last quarter.

- And investors expect a long road to recovery. More than half (54%) believe it will take more than one year to recover from the pandemic, and just one out of five investors (23%) would give the economy an “A” or “B” grade.

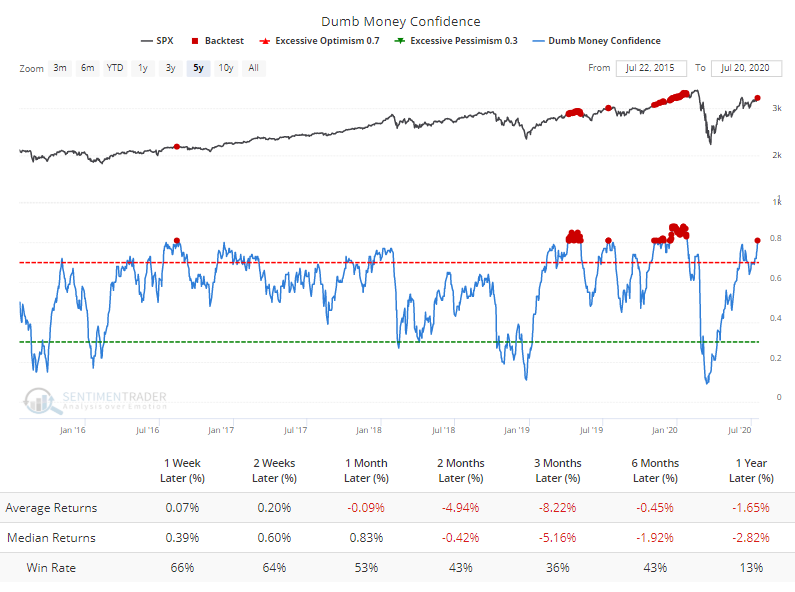

You get the idea. Just one quarter after panic selling lows, investors are once again “back in the pool.” Despite the economy just printing a nearly 40% decline in Q2, and earnings having dropped by nearly 40% from their peak, the “dumb money” is back to chasing stocks.

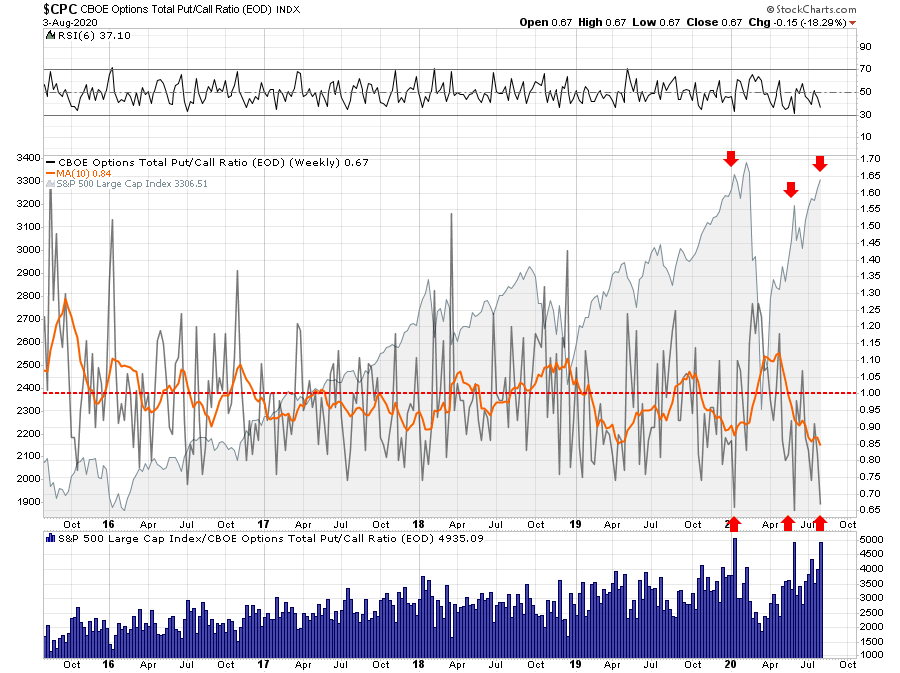

In particular, not only are “retail investors” chasing stocks, they are doing it with increased leverage by using options. As noted by CNBC recently:

“Investors have reentered the market at a record rate following the coronavirus-induced sell-off in March, and as traders look to profit, options volume has soared to an all-time high.

The average daily value of options traded has exceeded shares for the first time, with July single stock options volumes currently tracking 114% of shares volumes.

In other words, the options market is now larger than the shares market.”

We have seen record lows in the Put/Call ratio three times in 2020. All three lead to corrections.

Willful Blindness

Willful blindness, also known as willful ignorance or contrived ignorance, is a term used in law. Being “willfully blind” describes a situation in which a person seeks to avoid civil or criminal liability for a wrongful act by keeping themselves unaware of the facts that would render them liable or implicated.

Although the term was originally used in legal contexts, the phrase “willful blindness” has come to mean any situation in which people avoid facts to absolve themselves of their liability.

“‘Willful blindness’ is most prevalent in the financial markets. Investors regularly dismiss the ‘facts’ which run contrary to their current opinion. In behavioral investing terms this is also known as ‘confirmation bias.'”

As markets rise, investors take on exceedingly more risk with the full knowledge that such actions will have a negative consequence. However, that “negative consequence” is dismissed by the “fear of missing out,” or rather F.O.M.O.

As “greed” overtakes “fear,” investors become more emboldened as rising markets reinforce the conviction that “this time is different.” Ultimately, when the negative consequence eventually occurs, instead of taking responsibility for their actions, they blame the media, Wall Street, or their advisor.

This currently where we are in the markets today.

Value Proves It

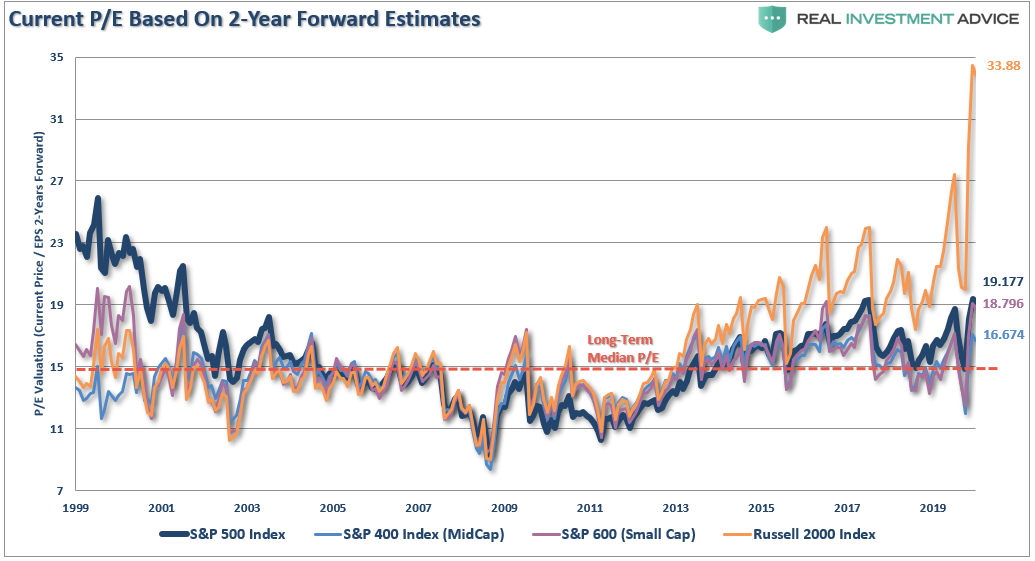

Investors know there is a rising risk of loss, but, they are willfully ignoring the facts and piling into risk because the narrative has simply become “fundamentals don’t matter.” In 2020, investors are again chasing “growth at any price” and rationalizing overpaying for growth.

“Such makes the mantra of using 24-month estimates to justify paying exceedingly high valuations today, even riskier.”

This is also where there is the greatest disparity between growth and value on record.

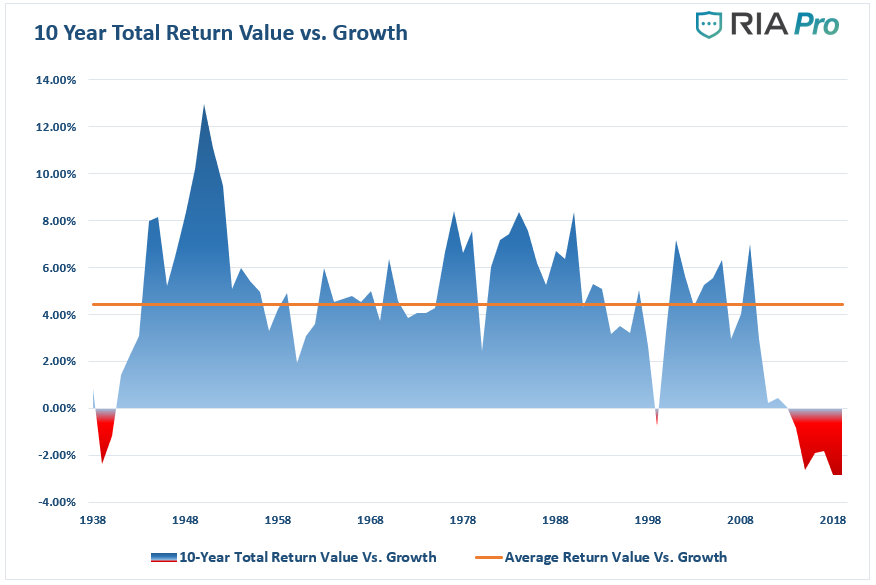

There are two critical takeaways from the graph above:

- Over the last 90 years, value stocks have outperformed growth stocks by an average of 4.44% per year (orange line).

- There have only been eight ten-year periods over the last 90 years (total of 90 ten-year periods) when value stocks underperformed growth stocks. Two of these occurred during the Great Depression and one spanned the 1990s leading into the Tech bust of 2001. The other five are recent, representing the years 2014 through 2019.

In other words, there is high probability that investors chasing “growth” are going to pay a heavy price in the future..

It’s The Economy

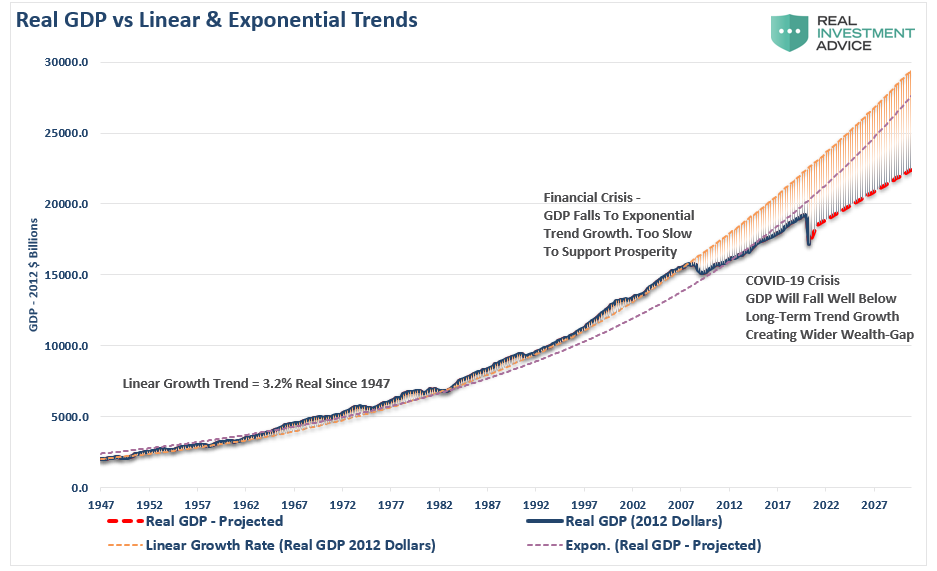

The problem, as discussed previously is the ability for stocks to continue to grow earnings at a rate to support high valuations will be problematic. Such is due to rising debts and deficits which will retard economic growth in the future. To wit:

“Before the ‘Financial Crisis,’ the economy had a linear growth trend of real GDP of 3.2%. Following the 2008 recession, the growth rate dropped to the exponential growth trend of roughly 2.2%. Instead of reducing the debt problems, unproductive debt, and leverage increased.

The ‘COVID-19’ crisis led to a debt surge to new highs. Such will result in a retardation of economic growth to 1.5% or less.”

Slower economic growth, combined with a potential for higher taxes, increases the probability that “risk” may well outweigh “reward” at this juncture.

Such doesn’t mean that stocks can’t go higher in the near term, and despite some wiggles along the way, it is quite likely they will simply because of momentum and lot’s of “bullish bias.”

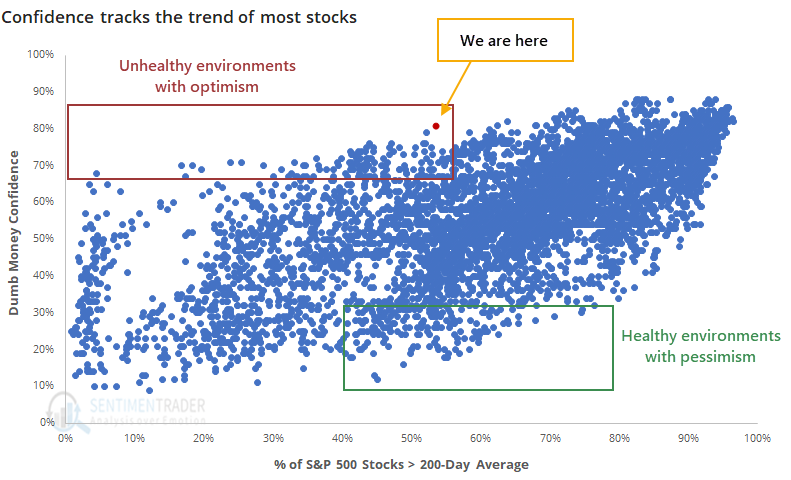

“We’ve often noted that during times of unhealthy market environments, when fewer than 60% of stocks can hold above their 200-day averages, that periods of high optimism tend to lead to below-average forward returns.

We’re seeing that now, to a historic degree. Since we’ve been tracking this data, just over 20 years, there has never been a day when Dumb Money Confidence was at or above 80% while fewer than 60% of stocks in the S&P 500 were trading above their 200-day averages. Until now.” – Sentiment Trader

The Problem Of Eternal Bullishness

The problem of “eternal bullishness” is it leads to the “willful blindness” of risks, rather than having a healthy respect for, and recognition of, those risks. This leads to the unfortunate problem of being “all-in” on every hand which has a devastating consequence when a mean-reverting event occurs.

Our job as investors is to navigate the waters within which we currently sail, not the waters we think we will sail in later. Higher returns come from the management of “risks” rather than the attempt to create returns by chasing markets.

I recently quoted Robert Rubin, former Secretary of the Treasury, in “This Is Nuts,” as it defined our philosophy on risk.

‘As I think back over the years, I have been guided by four principles for decision making. The only certainty is that there is no certainty. Second, every decision, as a consequence, is a matter of weighing probabilities. Third, despite uncertainty, we must decide and we must act. And lastly, we need to judge decisions not only on the results but also on how we made them.

Most people are in denial about uncertainty. They assume they’re lucky, and that the unpredictable can be reliably forecasted. Such keeps business brisk for palm readers, psychics, and stockbrokers, but it’s a terrible way to deal with uncertainty. If there are no absolutes, all decisions become matters of judging the probability of different outcomes, and the costs and benefits of each. Then, on that basis, you can make a good decision.’” – Robert Rubin

Focus On Risk

It should be evident that an honest assessment of uncertainty leads to better decisions.

The problem with “Eternal Bullishness” and “Willful Blindness” is that the failure to embrace uncertainty increases risk, and ultimately loss.

We must be able to recognize and be responsive to changes in underlying market dynamics. If they change for the worse, we must be aware of the inherent risks in portfolio allocation models. The reality is that we can’t control outcomes. The most we can do is influence the probability of specific outcomes.

Focusing on risk not only removes “willful blindness” from the process, it is essential to capital preservation and investment success over time.