It looked like the bulls would run away with Wednesday, and I’m not sure what happened in the last 10 minutes, but the market gave back a significant portion of its gains. It was as if all the buyers vanished, the short-covering was done, or the guys that took the repo money from the Fed who spiked the S&P mid-afternoon had no one to sell their buying spree to. No matter how you slice and dice it, the buyers vanished. It resulted in the S&P 500, moving down 50bps in a straight line in the final minutes.

We closed at 3,115, which was a significant level all day, and a battleground. It makes today perhaps the most important day of the third quarter. If the market breaks out, it will be set up for a nice run higher. If the market fails, it probably takes a trip back to 3,000 and lower. It may be that easy at this point. To push the drama to another level, we get the jobs data tomorrow.

If that weren’t enough, Apple (NASDAQ:AAPL) is closing more stores, and McDonald’s (NYSE:MCD) says it is putting reopening plans on hold. There will be more to follow.

This market is in a dangerous spot. Like in February, the market didn’t care. Coronavirus cases were rising; it didn’t care. Apple cut its guidance; it didn’t care. Then all of a sudden, it cared and in a meaningful way. None of what is taking place right now is good for anyone.

At some point, if the reopening stalls, it doesn’t matter what business line you are in, at home, cloud, or retail, if you have fewer customers, your sales are going to take a hit. At some point, the market will care, and it will care in a big way.

So my 2-cents makes sure you understand what you own, why you own it, and how much pain you are willing to take should things go south.

Oh, tomorrow is the final day of the week. We get a nice long weekend!

1. Semiconductors

The Semis (SMH) did not have a good day, and there is an issue at the $154 level in the SMH. The weakness comes in the face of Micron (NASDAQ:MU) and Xilinx (NASDAQ:XLNX), which both gave positive outlooks this week. Strange!

2. Micron

I guess technicals work even for earnings. Notice how Micron rose to resistance and failed at $52.75 as it should, and is now trading back down to $49.80. I still think this one goes back to $45.50.

3. Amazon

It looks like Amazon (NASDAQ:AMZN) in the final phases of this advance. Well, see…

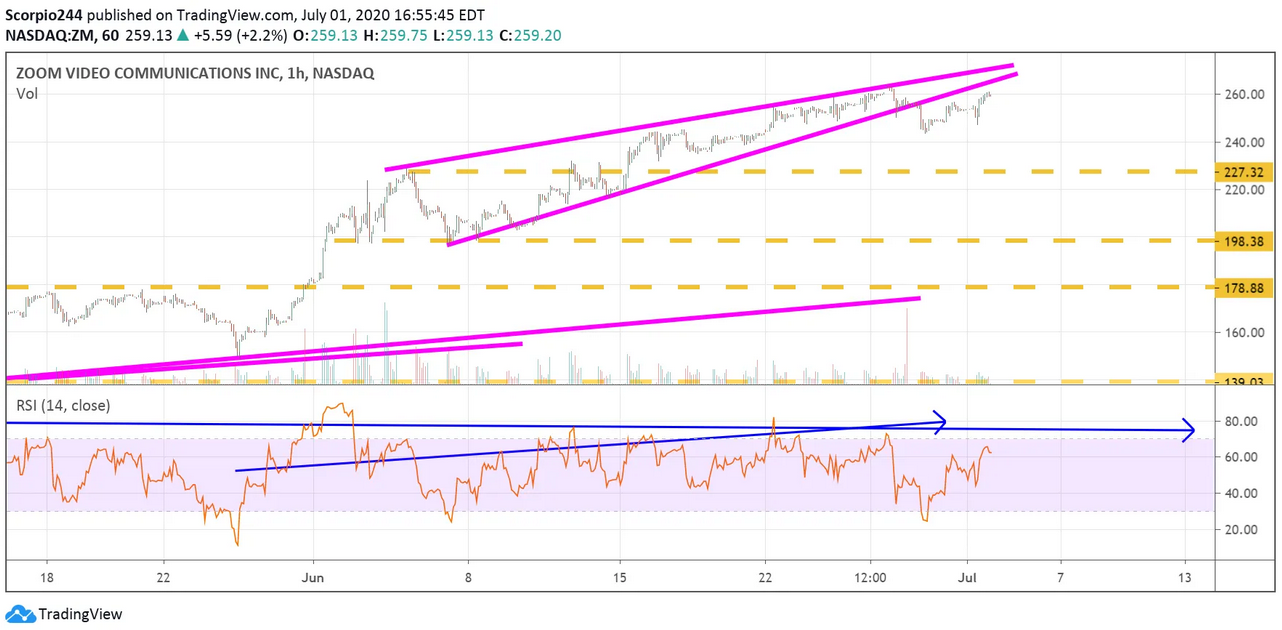

4. Zoom

Zoom Video Communications (NASDAQ:ZM)rose today, retesting its breakdown from the rising wedge.

5. AMD

AMD is not looking particularly strong here. The RSI suggests the downdraft isn’t over yet.