Traders are always trying to decipher the underlying risk appetite of markets. So, if several gauges of sentiment all turn at once, it’s worth paying attention.

BoJo’s Brexit setback has certainly dampened spirits for traders, although it remains unclear whether it’s a mere blip in the road or the beginning of a broad reversal of risk appetite. For that, only time will tell (and Brexit and trade deal developments, or lack-off, are likely drivers going forward) but for now, we should pay attention to how risk appetite flipped in the U.S. session.

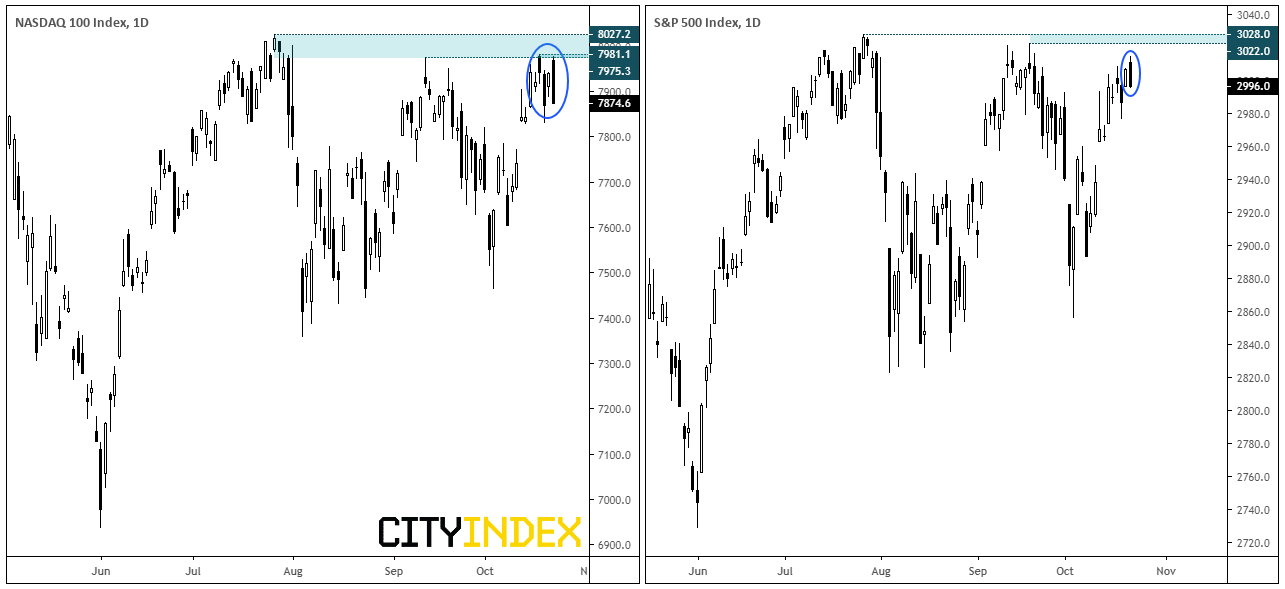

US Indices produced bearish candles near key resistance levels:

Bojo’s Brexit Backstep (pun intended) and soft earnings weighed on equities in the U.S. session.The (US Tech 100 CFD/DFT) produced an elongated, bearish outside day and its third bearish candle over the past four.Whilst the magnitude of the on the (US 500 CFD/DFT) was not as severe, it was a bearish engulfing candle nonetheless.Several JPY pairs printed reversal candles to suggest exhaustion:

produced a bearish hammer just below 83.24 resistance, which is not too far from its bullish channel. Whilst the daily structure remains bullish overall, a correction appears to be underway produced a 3-bar reversal around 121.34 resistance and is reminiscent of an evening star reversal. is back below 140 after producing a bearish engulfing candle. Resistance was found around 141 after hitting resistance at the Feb low and, given an 8.5% rally over just 7 sessions recently, a retracement is arguably overdue. – the classic barometer of risk for FX traders has taken out yesterday’s lows after producing a dark cloud cover reversal around the September high.It’s worth noting that price action on the above crosses are in an uptrend, so any reversal from these levels points towards a correction and, therefore, a temporary bout of risk-off. Besides, has hardly budged and remains anchored to the 1490 area in a minuscule range. However, in the case of , there is a case to be made for a larger downside move.

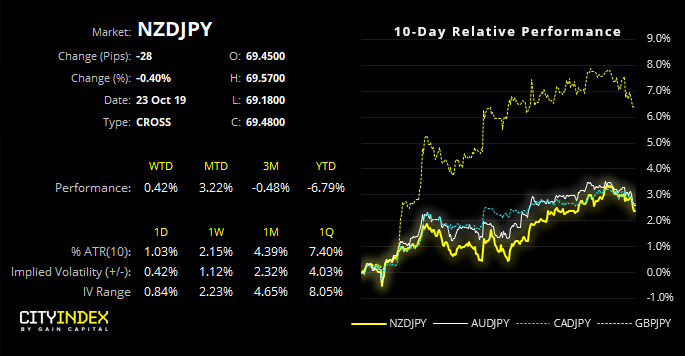

remains within a broad, bearish channel. Admittedly, there is still upside potential for it to retest the upper trendline, yet the rally from recent lows has been the weakest compared with its peers. And through the yes of a bear, wondering whether history will repeat, or at least rhyme.

Yesterday’s bearish pinbar is reminiscent to the pinbar at the September high, which was the tip of a 4% decline.Furthermore, the oscillations since the August low are also similar to the bearish triangle seen from mid-May through to late July. Whilst there’s no clear triangle in this case, the oscillations do not appear constructive for a change in trend like seen elsewhere.Bias remains bearish below yesterday’s high (call is 70) and for a run towards the 67.80-68.20 area, along the lower retracement line.Original Post