Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Market Brief

It was a busy night for central bankers across the planet but the outcome of the BoJ and FOMC meeting was already priced in - for the most part. Indeed the greenback was little changed after the FOMC statement and press conference, while the Japanese yen appreciated sharply against all currencies.

In the US, Fed members adjusted their projections for the federal fund rates to the downside and still expect two rate hikes this year, however a growing number of members now expect only one rate hike in 2016. The statement was little changed compared to April and underlined that “job gains have diminished” since the previous meeting. The subsequent press conference held by Fed Chairwoman Yellen placed emphasis on the poor May jobs data, mentioned the Brexit risk and reiterated that more positive signs are required before lifting rates. All in all the outcome of the meeting was more dovish and made us doubt that the Fed will be able to make a move before the end of the year. The greenback moved slightly lower amid the press conference with EUR/USD hitting 1.1298 before stabilising at around 1.1275. However, with the Brexit vote next week, we expect the USD to hold ground against most currencies as traders will prefer to shun risky assets. The dollar downside is therefore limited for the next week.

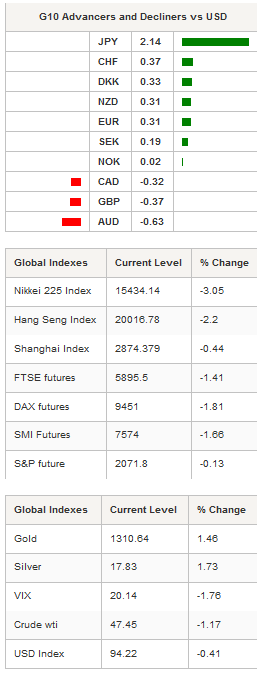

As widely expected by Swissquote and the market, the Bank of Japan kept its monetary policy steady and retained its optimistic view on the economy. The BoJ’s inaction resulted in a spike of the Japanese yen against all currencies (+2.70% vs AUD, 2.45% vs GBP, 2.38% vs CAD and 2.07% vs USD) and sell-off in Japanese equities as the Nikkei and Topix index dropped 3.05% and 2.78% respectively. We believe it is just a matter of time before the BoJ pushes the button on another round of stimulus as the strengthening yen jeopardizes the already weak economic outlook. USD/JPY fell as low as 1.0361, the lowest level since August 2014.

After a breather yesterday, the equity market is set for another tough day. Chinese’s stocks were edging lower with the CSI 300 down 0.59%. In Hong Kong, the Hang Seng was off 2.20%, while in Taiwan the Taiex slid 1.30%. In Europe, futures are off more than 1% with the FTSE 100 down 1.41%, the DAX -1.81% and the SMI -1.66%. Precious metals took advantage of the risk-off sentiment to gain ground with gold up 1.46% and silver up 1.73%.

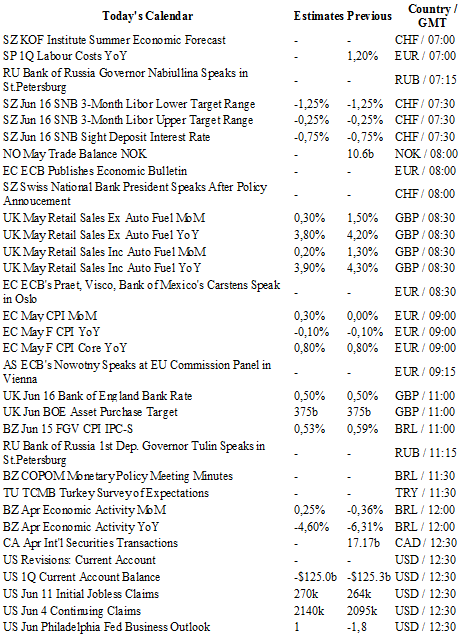

Today traders will be watching the release of the SNB’s quarterly report; retail sales and BoE rate decision from the UK; CPI from the euro zone; initial jobless claims and CPI report from the US; CPI and gold and forex reserves from Russia.

Currency Tech

EUR/USD

R 2: 1.1479

R 1: 1.1416

CURRENT: 1.1284

S 1: 1.1132

S 2: 1.1098

GBP/USD

R 2: 1.4660

R 1: 1.4328

CURRENT: 1.4147

S 1: 1.4006

S 2: 1.3836

USD/JPY

R 2: 107.89

R 1: 106.58

CURRENT: 103.73

S 1: 103.56

S 2: 100.78

USD/CHF

R 2: 0.9783

R 1: 0.9679

CURRENT: 0.9585

S 1: 0.9578

S 2: 0.9444