Market Brief

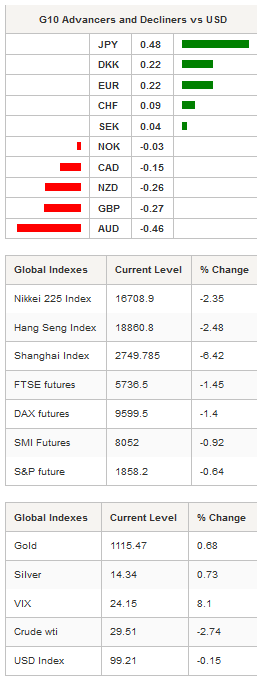

The rally initiated on Friday proved to be short-lived as Asian equities joined the global rout on Tuesday as crude oil dip below $30 a barrel. Mainland Chinese stocks were leading the charge with the Shanghai and Shenzhen Composite down 6.42% and 7.12% respectively. In Japan, the Nikkei 225 fell 2.35% while the Topix index retreated 2.33%. In Hong Kong, the Hang Seng was down 2.48% as rumour concerning the removal of the USD/HKD peg fade away. Indeed, the HKD peg has been extremely positive for Hong Kong’s prosperity by providing stability and allowing the nation to become a hub of international finance. HKD’s effective exchange rate and inflation differentials with the US does not warrant significantly higher USD/HKD. Hence, we do not see the Hong Kong Monetary Authority abandoning the peg any time soon.

Once again, the yen took advantage of the overwhelming risk-off sentiment by appreciating sharply against all the G10 currencies. The Japanese currency rose 0.65% against the Aussie, 0.60% versus the GBP, 0.52% versus the kiwi and 0.50% against the loonie. However, we remain rather cautious on the Japanese yen as its current strength is more due to the investors’ appetite for safe haven assets rather than a market’s response based purely on fundamentals.

In Europe, after last week’s short recovery, the pound sterling is back in turmoil, down 0.27% against the US dollar as a result of a stronger demand for US treasuries - 2-year was down 3bps, 5-year is down 3.5bps while the 10-year fell 2.6bps. GBP will remain weak on economic outlook and Brexit risks – With economic data weakening, the absence of domestic inflation pressures, an increased global risk and fear of Brexit; we do not see the BoE raising rates before 2017. The UK referendum must take place before the end of 2017 and it is likely that PM Cameron will fast track the vote indicating a March announcement.

For the third time in less than 24 hours, EUR/CHF took off on the assault of 1.10 on a softer trade surplus with a reading of CHF 2.54bn.The market was a expecting a surplus of CHF 2.90bn in December. The demand for Swiss watch contracted 3.8% in December 2015 compared to a year ago with the biggest diminution from Hong Kong where exports collapsed by 21.1%y/y. The exports in the Jewellery sector (including watches) was the only one that was able to growth in 2015 against the backdrop of weak global demand, falling oil prices and strong Swiss franc.

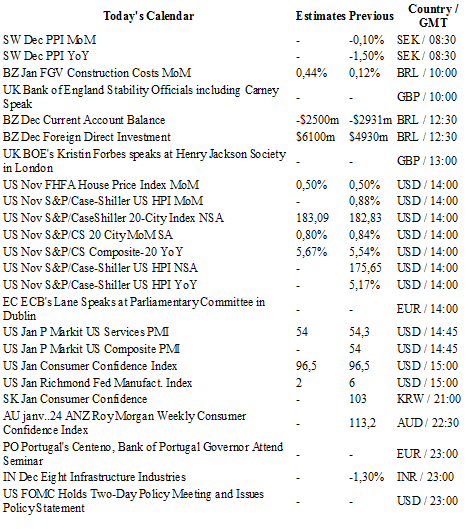

Today traders will be watching PPI report from Sweden; current account balance and foreign direct investment from Brazil; FHFA house price, S&P/CaseShiller index, Markit services and composite PMIs from the US.

Currency Tech

EUR/USD

R 2: 1.1387

R 1: 1.1095

CURRENT: 1.0859

S 1: 1.0458

S 2: 1.0000

GBP/USD

R 2: 1.5242

R 1: 1.4969

CURRENT: 1.4180

S 1: 1.3657

S 2: 1.3503

USD/JPY

R 2: 125.86

R 1: 123.76

CURRENT: 117.82

S 1: 115.57

S 2: 105.23

USD/CHF

R 2: 1.0676

R 1: 1.0328

CURRENT: 1.0131

S 1: 0.9786

S 2: 0.9476