Johnson & Johnson (NYSE:JNJ) is a global medical, pharmaceutical and consumer goods manufacturer, founded in 1886. The company’s stock, listed on the New York Stock Exchange under the symbol JNJ, is a component in the S&P 500 as well as in the Dow Jones Industrial Average index.

This is a blue chip company with a long and profitable history, so hardly anyone is surprised when JNJ stock is rising. The price jumped from $81.79 a share on August 24th, 2015, to as high as $137.08 in July, 2017.

On the other hand, when JNJ stock plunges, it often comes as a shock to shareholders. Unfortunately, even the strongest of businesses cannot escape the market’s vagaries.

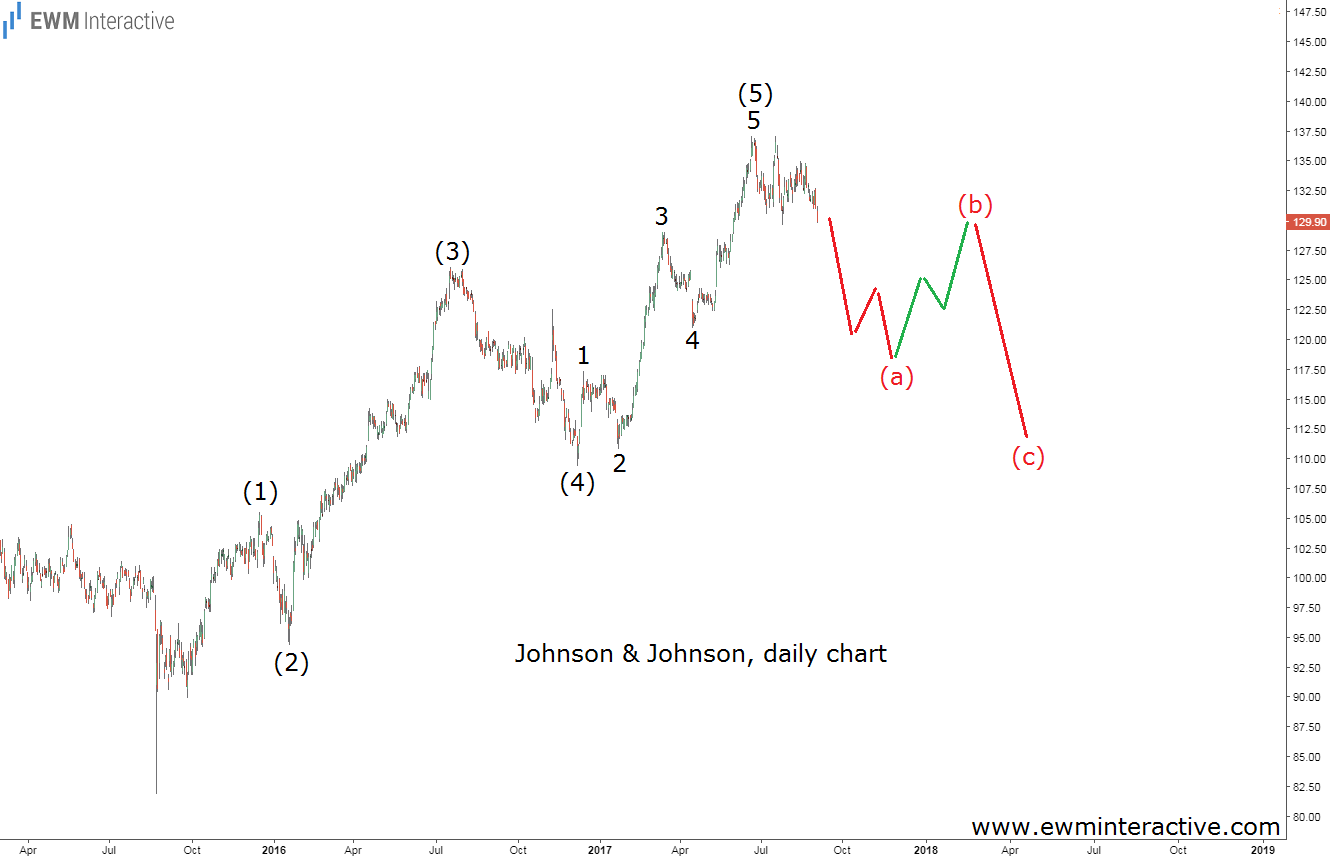

The daily price chart of JNJ shows the stock’s entire progress since the low in August, 2015. As visible, it took the shape of a perfect five-wave impulse. The sub-waves of wave (5) are also clearly recognizable. According to the Elliott Wave Principle, a three-wave correction in the other direction follows every impulse, erasing most or all of the fifth wave. This means that instead of loading up on JNJ stock near $130 a share, investors would be better off staying away for now, because a notable three-wave decline could drag the price down to the support of wave (4) near $111.

Johnson & Johnson is one of the biggest enterprises in the world with annual sales exceeding $70 billion. The anticipated 15% decline in its capitalization would hardly matter in the long-term, but it would create a much better buying entry than the market is currently offering.