After I arrived in Tokyo last week, the first stop I made was at McDonald’s (NYSE:MCD).

It may seem strange to visit the iconic American chain restaurant in such an exotic location, but that meal gave me some valuable insight into the condition of Japan’s economy. You see, I ordered a Big Mac meal and paid 699 yen for it, which works out to around US$5.82 based on the current exchange rate.

That same meal costs US$8 in New York City right now. But back in 2012, my burger would’ve been US$9.98 in Tokyo.

So one thing is obvious: The value of the yen has collapsed against the U.S. dollar.

But the same can’t be said for Japan’s economy. Thanks to several key factors, Japan has burst into a new golden economy – with plenty of room for gains.

Rise of the Eastern Sun

Over the past few years, the yen has fallen by more than 69%. In 2012, it took just over 70 yen to buy one U.S. dollar. Today, it takes 120 yen to buy that same dollar.

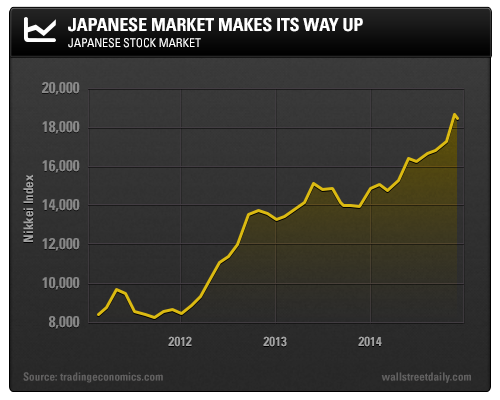

But this weakness is one of the reasons the Japanese stock market has rallied by more than 100% over the same time period! It has even outperformed the S&P 500, which only gained about 42%.

And it’s not over yet…

Even with the rise in the Nikkei to over 19,000, it’s still trading at less than half the peak it reached 25 years ago. That’s when the property price bubble in Tokyo dwarfed all other bubbles seen since, even the United States’ in 2007.

While the Nikkei may not reach its all-time high anytime soon, the Japanese market is poised for profitable investing in the months and years to come.

The government of Shinzo Abe can take credit for a good chunk of the rise. It increased economic stimulus and pumped trillions of yen into the marketplace, causing the yen devaluation and the spike in exports and internal economic activity.

While GDP growth still isn’t robust by any means, the stage is being set for the future. One of the keys to growth is going to come from the most unexpected of sources: cheap energy.

The Glow of Nuclear Power

Japan has no energy resources to speak of besides nuclear power. After the Fukushima disaster, the country shut down more than 50 nuclear reactors and relied instead on greater imports of oil and liquid natural gas (LNG). It was Japan’s added demand for LNG that caused prices to spike to more than $19 per million British thermal units (MMBtu).

But over the past two years, the country has begun to restart its reactors…

The glut in oil combined with increasing nuclear fuel usage has helped push prices of LNG down to less than $10 per MMBtu.

This crash in energy prices has offset the crash in the yen since both are occurring simultaneously. For an economy that’s reliant on exports and manufacturing, there couldn’t be a better scenario, as input costs are falling and the prices of exports have dropped by almost 20% over the past 12 months alone.

The streets of Tokyo are buzzing as a result – shops and restaurants packed.

Creating a Zen Portfolio

This has yet to show up in the official numbers, as there’s a lag effect, but they will. And that should add further stimulus to the stock market.

One way to invest in Japan’s golden economy is through a straight export play like Toyota Motor Corp. (NYSE:TM), which gives you a global play on both a weaker yen and growth in markets like the United States. For a more diversified play that takes into account both domestic and global growth, the iShares MSCI Japan Index Fund (NYSE:EWJ) would make a great addition to your international portfolio.

The yen is still on a downward trajectory, and I wouldn’t be surprised to see it fall to around 140 in the coming months. Unlike past stimulation efforts, which have failed miserably, this one has finally re-priced Japan at levels below parity to the United States.