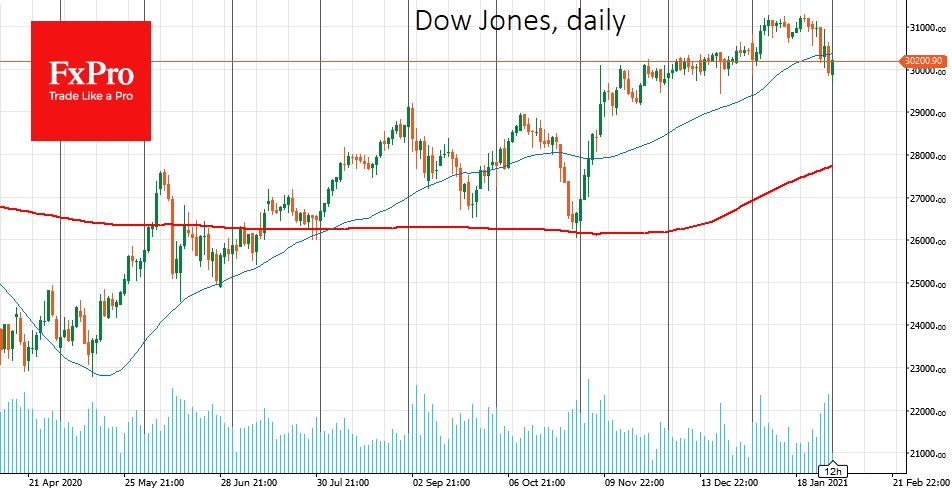

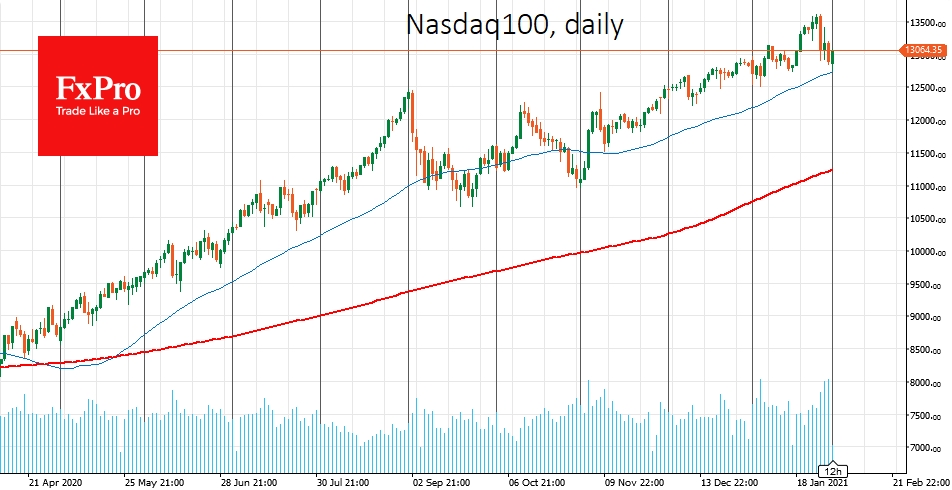

Global markets are starting a new month with a strong rally, showing a recovery in risk demand after a dip at the end of January. The Dow Jones futures are back above 30K, and the S&P 500 is above 3700.

However, in both cases, indices remain under the 50-day average, potentially reflecting a break of the last months' short-term upward trend. The monthly candles close of the key US indices also look worrisome as the S&P 500, Dow Jones and NASDAQ formed a "shooting star" pattern. We see the same reversal pattern on many other indices.

Despite the positive start of trading on Monday, it is still worth watching out for near-term prospects for the indices, as the news background does not yet indicate any new optimisms. Contrary to expectations, there is no consensus among US lawmakers on the $1.9 trillion support package. There are increasing calls to discuss halving the bailout.

Vaccine distribution continues to face difficulties. Israel's case suggests that even with abundant vaccination, the medical system is rapidly approaching the tipping point without strict lockdowns.

Much of the good news and hopes have already been priced into the market. At the same time, worrying information can reinforce profit-taking and deepen the correction.

Today, as markets are trying to rebound from the local lows, it is worth observing to see if indices manage to return above the 50-day averages.

If they succeed, it would indicate buyers' strength and an increased buying activity during the declines.

A pullback, however, looks more likely, potentially turning the former support into resistance. The 200-day average lines could become a technical target for a correction for the three major US indices.

Buying at these levels is justified by the continued ultra-soft monetary policy of the key central banks. Moreover, a decline in these averages will generate enough noise in the markets, managing to attract regulators and lawmakers, who now prefer to keep new stimulus from markets and the economy.

For S&P 500, this opens up the potential for a 10% decline from current levels, versus 8.2% for Dow Jones and 13.7% for Nasdaq100.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

January's Weak End Opens The Way To A 10% Market Decline

Published 02/01/2021, 04:55 AM

January's Weak End Opens The Way To A 10% Market Decline

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.