Deciphering the central bank rhetoric is a little like doing the cryptic crossword in your local Sunday newspaper. The paper says one thing, but it’s not actually the point they are trying to make! Janet Yellen’s speech on ‘outlook, uncertainty and monetary policy’ in New York overnight did exactly that.

You can read the full speech by clicking the link to the Federal Reserve website in the text above, but here are a few key extracts that the market has read and reacted off of:

“I consider it appropriate for the committee to proceed cautiously in adjusting policy.”

“Reflecting global economic and financial developments since December, however, the pace of rate increases is now expected to be somewhat slower.”

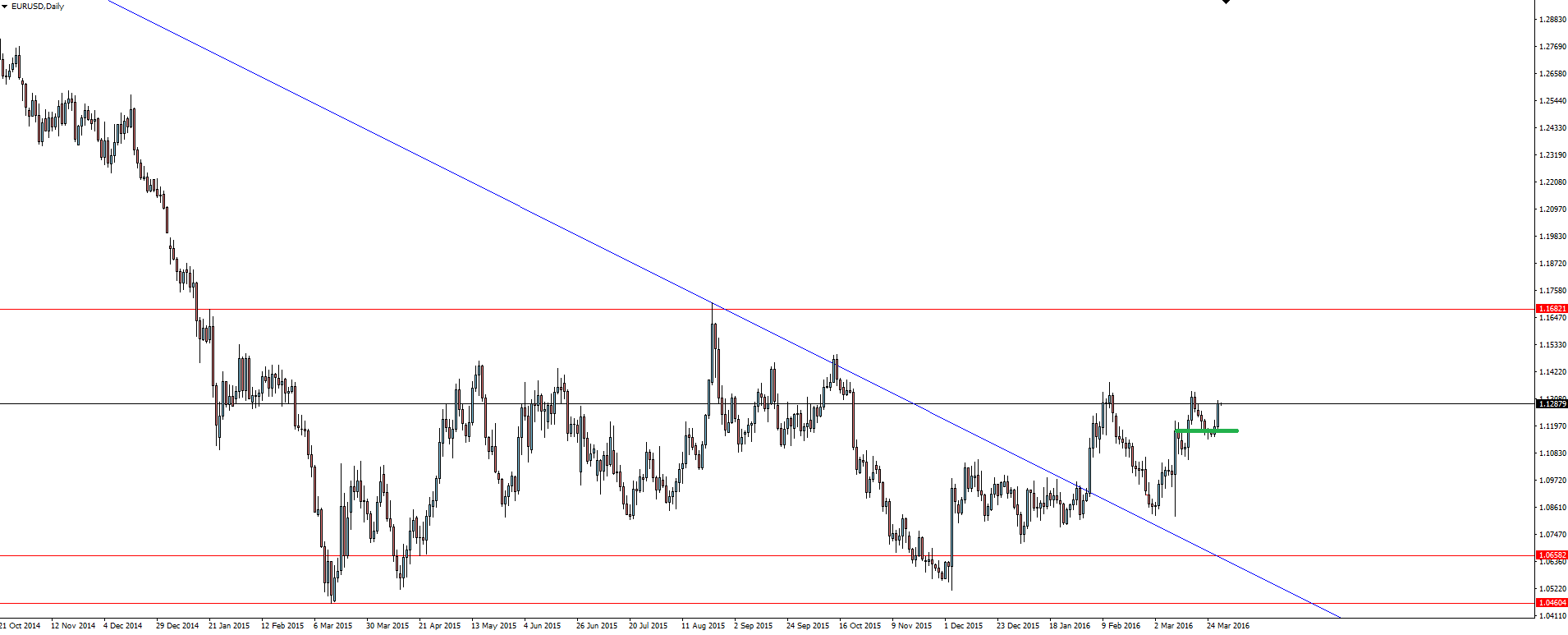

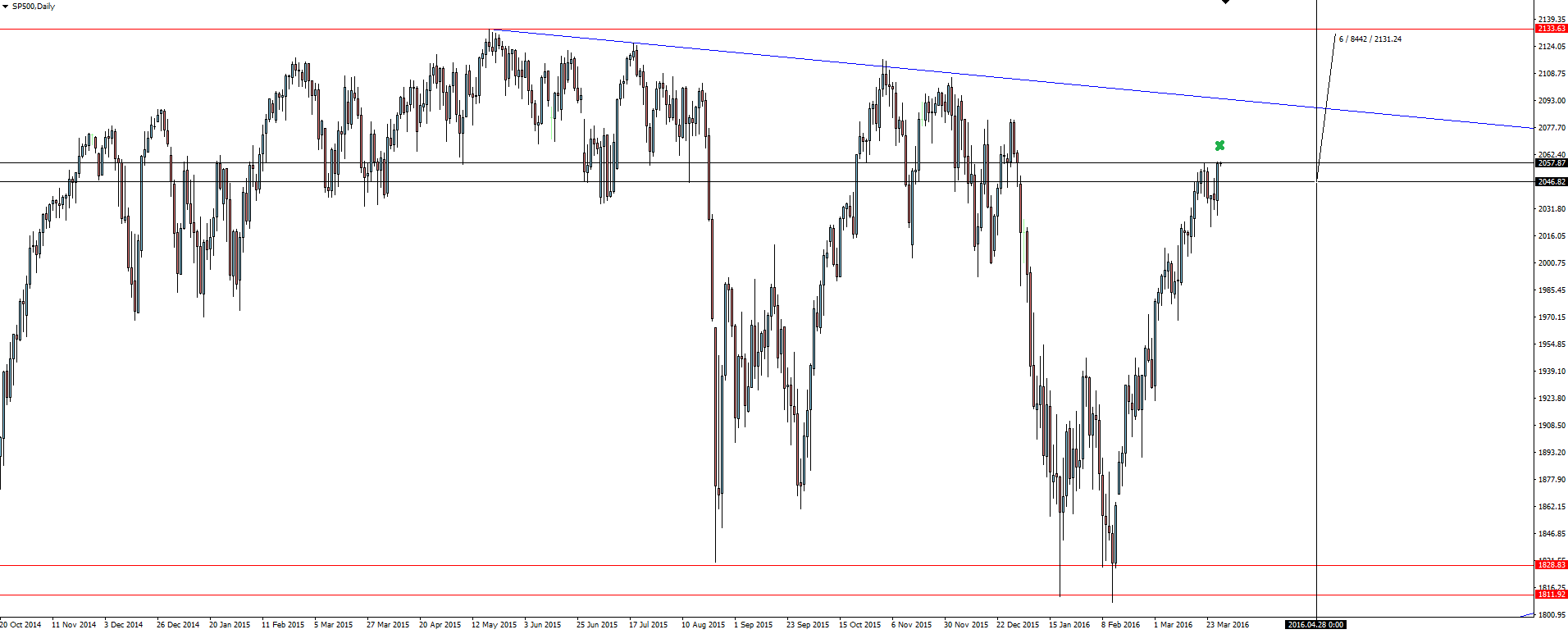

The US dollar of course took a hit on this renewed swing back to the dovish side from the Fed, making sure that markets weren’t getting ahead of themselves with optimism. This meant that the EUR/USD and the S&P 500 index rallied.

‘Money stays cheap’ for longer still it would seem, and that’s good news if you’re long equities or any of the indices markets that you can trade on MT4 with Vantage FX.

EUR/USD Daily:

S&P 500 Daily:

Running with the newspaper analogy, the speech was just as much a ‘finder word’ for markets as it was a cryptic crossword. Words like: ‘cautious’ and ‘slower’ both jumping out of the screen when you read the transcript.

But the dovish tone was tarnished slightly during the Q&A session when Yellen went on to say that the US economy has proven to be ‘resilient’.

One for the finder word that you can highlight in a different colour because that is the one that stands out against the doom and gloom.

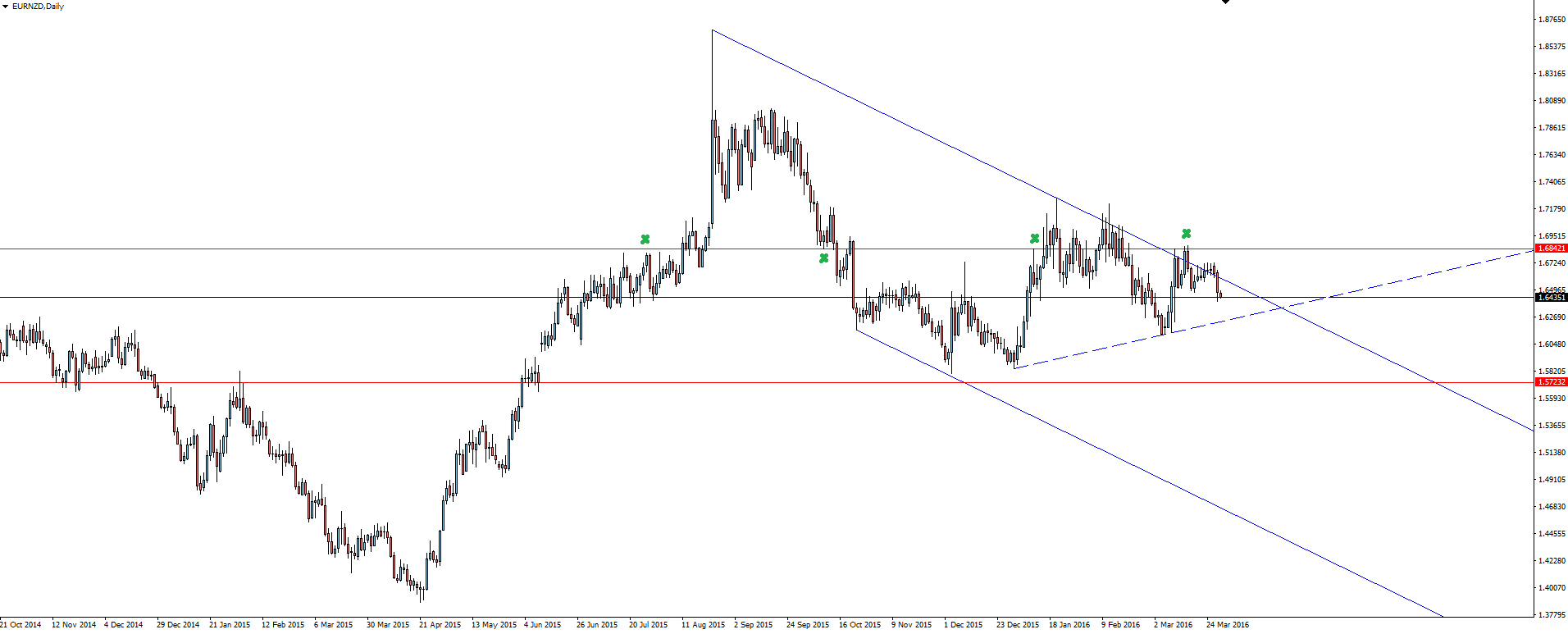

Chart of the Day:

Following yesterday’s kiwi in play, chart of the day, I encouraged you guys to get involved with sharing your charts on Twitter. I’m really proud of the active online trading community that we’re building with @VantageFX and want to thank everyone that got involved in yesterday’s NZD/USD discussion.

There was a great mix of ideas on how to trade the kiwi from both the long and short side which is exactly what makes the markets we trade.

We’re going to try to make #TuesdayFX a weekly thing from now on, so give @VantageFX a follow and come get involved!

EUR/NZD Daily:

During yesterday’s NZD/USD chat, @Pipstealer_ shared this gem of a chart on the related EUR/NZD.

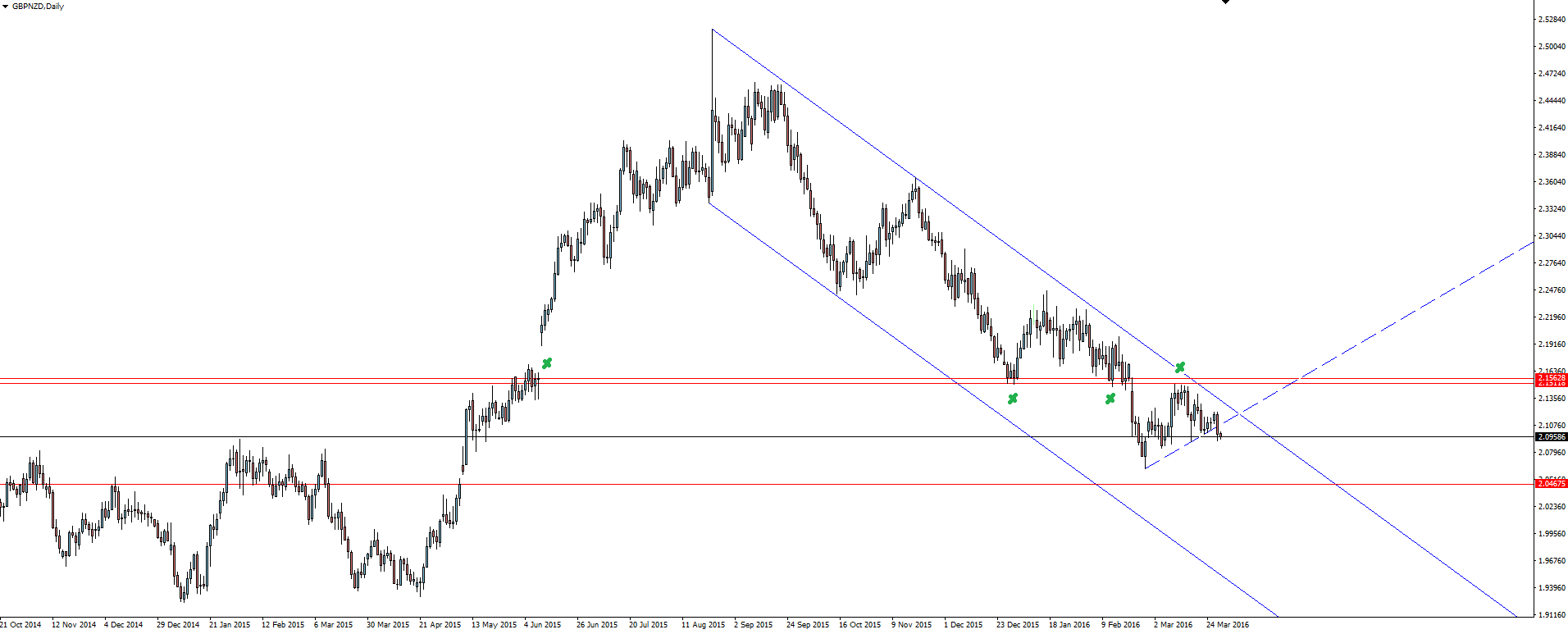

The chart has inspired me to catch Kiwi fever and I soon added both EUR/NZD and the following GBP/NZD daily charts to my MT4 watch list.

GBP/NZD Daily:

Both charts present the same type of setup where price is trending down inside a bearish channel. Again, both pairs have been rejected off channel resistance and are testing/breaking their short term flag pattern and looking lower.

This is the sort of trade where fighting the trend just feels like unnecessary pain for yourself and your account. Will be looking to sell strength on both these pairs.

On the Calendar Wednesday:

USD ADP Non-Farm Employment Change

USD Crude Oil Inventories

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Australian Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX on the MT4 platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.