Today is a rather important day for the market because it will tell us if we have further to recover or if we are about to take another sharp leg lower.

S&P 500

The SPY is trading a touch higher in the pre-market, about 34 bps, and complete whatever is left of the gap filll from Monday’s drop. Typically once a gap gets filled, it results in the continuation of the previous trend, which has been lower. However, a breach of $332.90 likely results in a further push higher to $342.25, and retest of that break down from last week.

South Korea

It was a wild night in South Korea, with the index rising by 90 basis points to start the night, then fell sharply, by nearly 3%, until to finish the day flat. Please don’t ask me what went over there, but that is massive volatility.

Tesla

Tesla (NASDAQ:TSLA) is falling this morning after Battery Day. I watched some of it, not all of it. The company essentially reiterated guidance for the year around 500,000, give or take. The stock is trading lower, and I’m not sure if it is because the low-end of the range for guidance is shy of the 500,000 or because much of what I saw was focused on things that aren’t likely to result in anything soon. Either way, the stock has struggled at $440 and should find some support at around $390.

PayPal

PayPal (NASDAQ:PYPL) broke a short-term downtrend and has some room to rise to around $198.

Amazon

Amazon (NASDAQ:AMZN) has been pushing higher in the pre-market, and there appears to be some more room to rise, perhaps to around $3,160, before resuming lower.

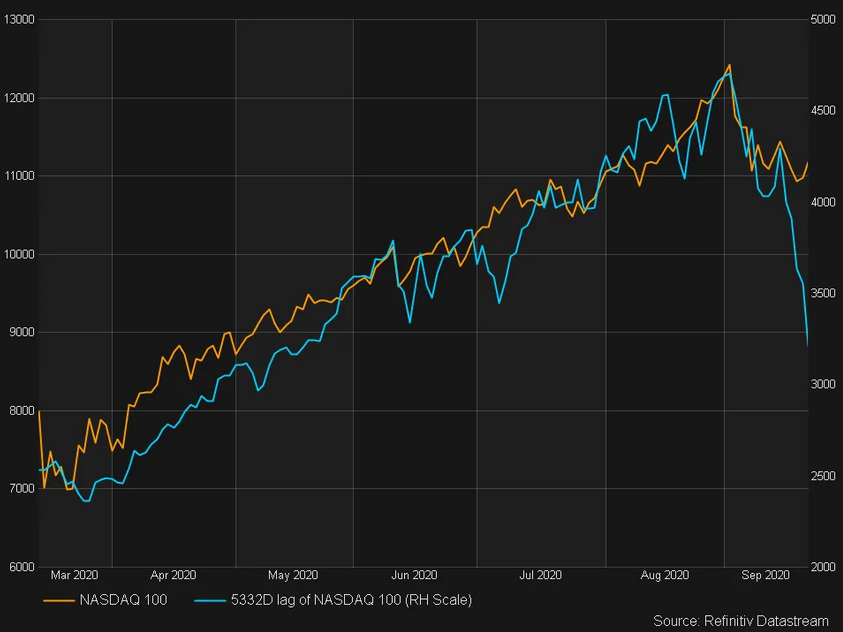

Anyway, I will leave with this last thing to think about. I found this to be stunning and shocking. I hope this turns out to be wrong, by the way. It is a chart of today’s NASDAQ 100 overlayed with the NASDAQ 100 in late 1999.

But here is the amazing are part:

From the March 2020 lows, the NASDAQ rose about 84% over 163 days.

Meanwhile, from the November 1999 break out to the peak, the NASDAQ 100 rose about 86% over 151 days. I don’t know, maybe it is just chance, but still awfully strange.

I guess we are going to find out soon whether the similarities end there.