Recessionary warnings are growing louder daily as the Federal Reserve deepens its hawkish stance to combat the highest inflation in decades.

First, the U.S. central bank raised its benchmark interest rate by 75 basis points at its June meeting, the most significant hike since 1994.

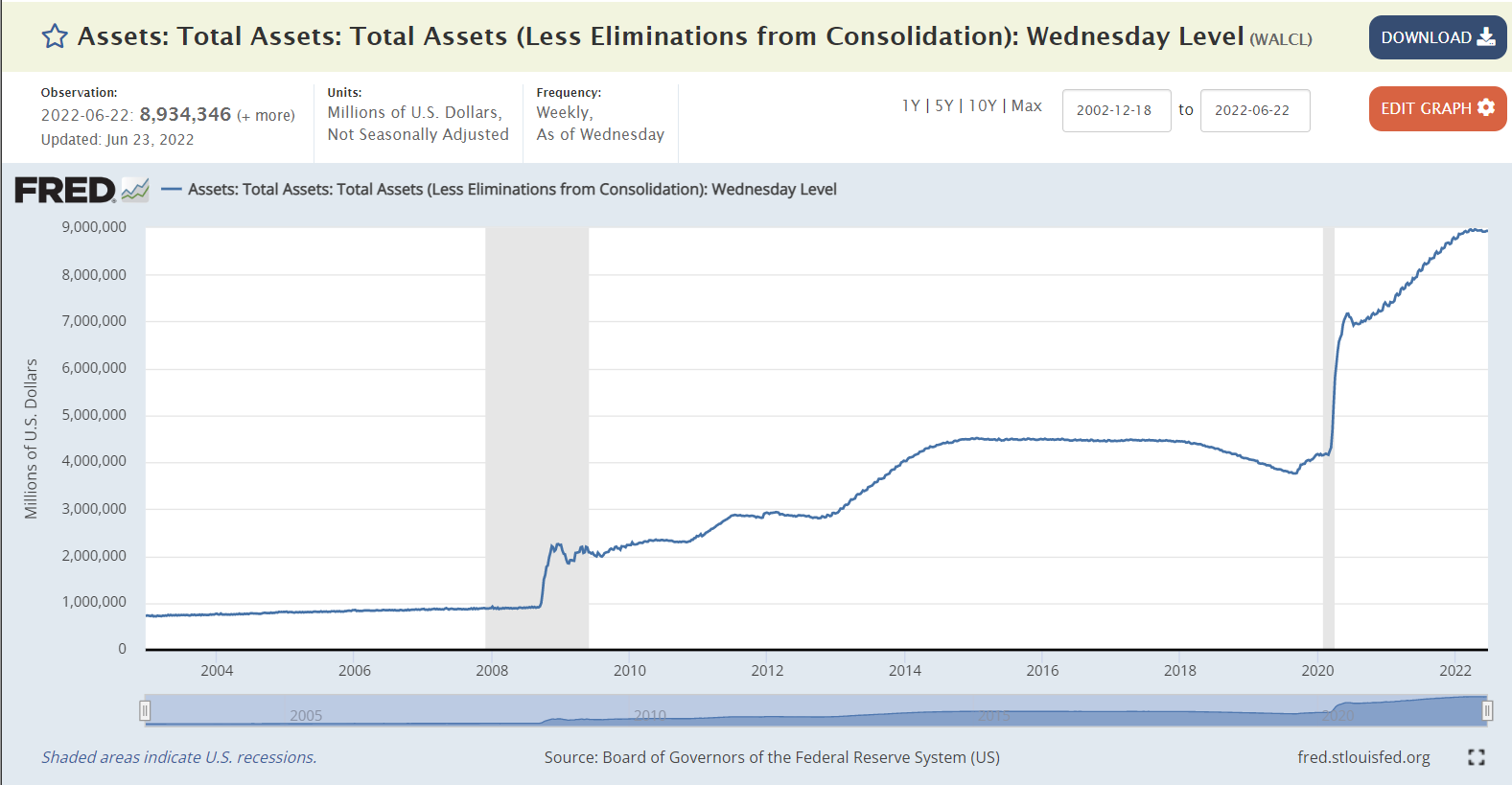

The Fed, which has increased its fed funds target rate by 150 basis points so far this year, also announced that it would start to reduce its massive $9 trillion balance sheet.

Indeed, Fed Chair Jerome Powell again stressed this week that fighting inflation is the central bank’s top priority, even at the risk of a recession.

Speaking at the European Central Bank’s annual conference in Portugal on Wednesday, he acknowledged that the process would involve “some pain.”

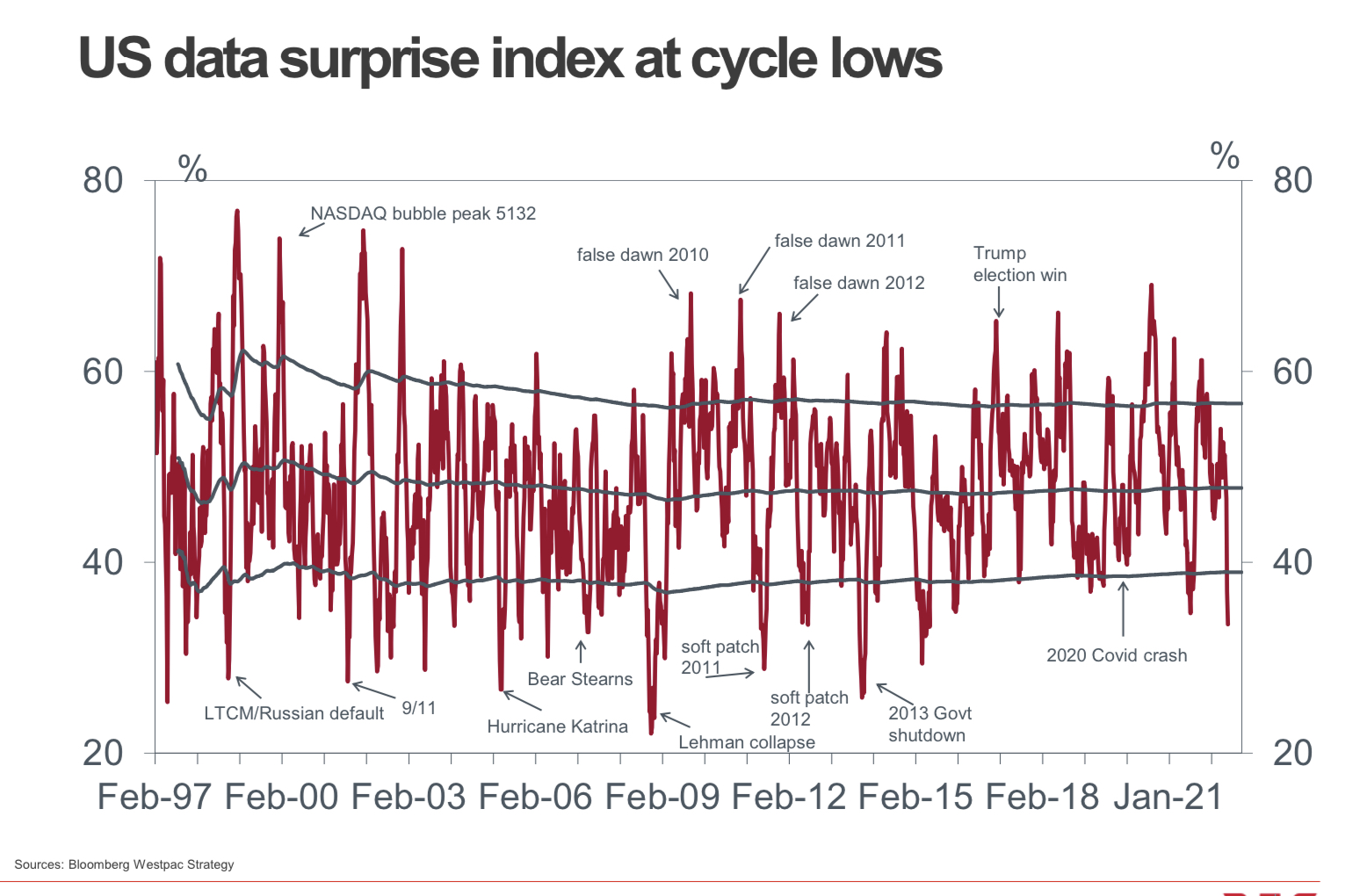

Judging by the latest data, U.S. economic growth slowed sharply in June, with deteriorating forward-looking indicators setting the scene for an economic contraction in Q3.

Additionally, consumer confidence is now at a level that would typically herald an economic downturn.

At this point, a recession seems inevitable.

The question is, when does it begin?

If going by the Atlanta Fed’s GDPNowcast tracker, which provides a running estimate of real GDP growth based on available economic data using a methodology similar to the one used by the U.S. Bureau of Economic Analysis, the economy is already in a technical recession.

According to the latest model estimate, growth in the second quarter of 2022 has been cut to a contractionary -1.0% as of June 30. That’s down from 0.0% on June 15 and compares to a growth of +1.3% on June 1.

With the U.S. economy contracting by 1.6% in Q1, that would meet the technical definition of a recession—two consecutive quarters of falling GDP.

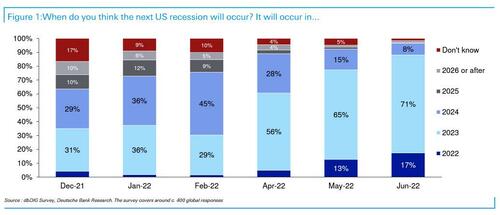

Interestingly, the latest survey of Wall Street professionals by Deutsche Bank showed that 17% believe the recession started this year, up from 13% last month and virtually 0 in February. Of these respondents, over a third think the recession has already begun.

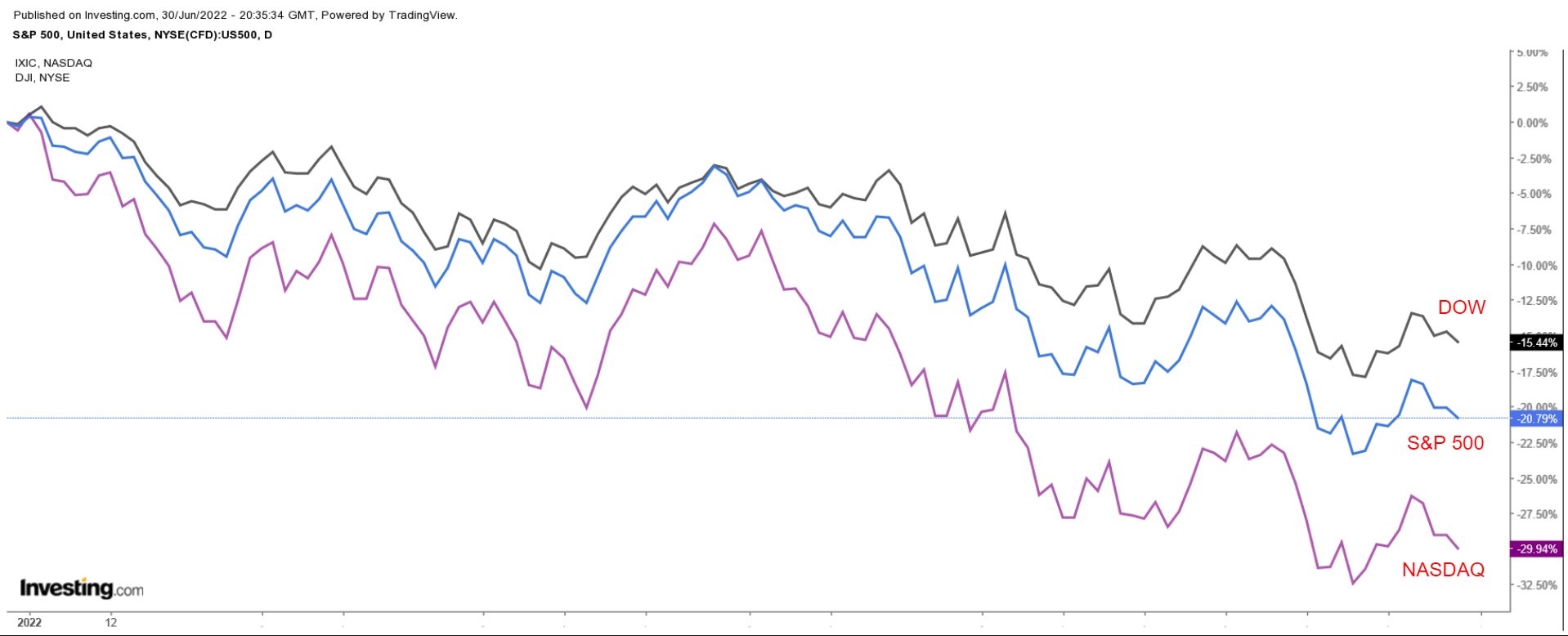

The benchmark S&P 500 index wrapped up its worst H1 since 1970, down 20.6% year-to-date and roughly 22% below its Jan. 3 record close, meeting the technical definition of a bear market.

Meanwhile, the technology-heavy NASDAQ Composite, which slumped into a bear market earlier this year, is off by 29.5% this year and 32% away from its Nov. 19, 2021, record-high—its largest-ever January-June percentage drop.

The Dow Jones Industrial Average is down 15.3% year-to-date—its most significant H1 slump since 1962—and approximately 17% off its all-time high at the start of the year.

With inflation hurting consumers and businesses and the Fed rapidly raising interest rates as a result—along with ongoing global supply-chain issues—the economic outlook for the second half of 2022 looks difficult at best.