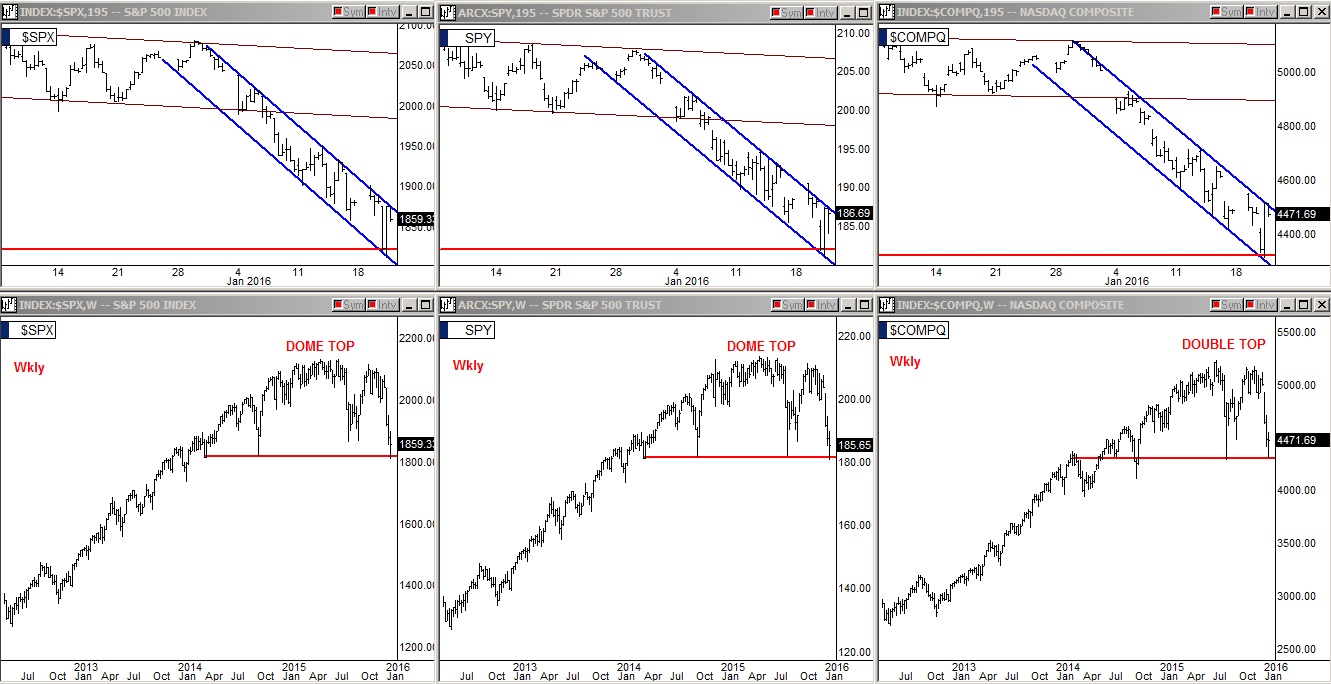

In the market Wednesday, the S&P 500, SPDR S&P 500 (N:SPY), and the NASDAQ each had a nasty early morning, but climbed most of the way back up in the late afternoon. The low of the day tagged the lower line of the three week declining channels on these indices and closed Wednesday at the top line of the three week declining channels as shown in the three 195 minute bar charts in the upper half of the cluster below.

Looking at the lower weekly bar charts, we can see that yesterday's low was a bounce from the neckline of the huge Dome topping formation on the S&P and SPY and the neckline of the double top on the NASDAQ. These two-year red necklines can also be seen in the 195 minute charts at the top.

Everything had looked good through the day when traders saw that the necklines held. There was disappointment at the close however, as the three indices failed to break out of their declining channels and sold back down in the last hour. Note, however, that the SPY climbed back up to the line but that did not happen until after the bell as the 195 minute bars pick up after hours activity also. That after hours activity has the bulls excited because as soon as the SPY closed it was driven a couple of dollars higher in the thinly traded after hours session and the early overnight futures trading followed suit.

While the day was a failed breakout of the three week declining channels, it looks like the powers that be are determined that this one has to hold and also break out at all costs because if it doesn't then the last levy, the two year necklines, holding back a tidal wave of sellers could give way and a 2008 style flush would likely be upon us.