Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Wednesday was a monumental day for the financial markets, as the Federal Reserve announced the official end of its latest quantitative easing (QE) program.

At the height of its glory, the Fed was buying $85-billion worth of bonds each month, unleashing a torrent of liquidity into the markets throughout 2013. Unsurprisingly, this caused a bonanza in risk assets…the riskier, the better.

But at the beginning of 2014, the Fed began to taper these monthly purchases.

Now, the market is beginning to realize that QE didn’t keep U.S. Treasury rates low, as was once popularly believed. Instead, it encouraged risk-seeking behavior in the global financial markets.

With QE officially ended, perhaps Janet Yellen should have dressed as the grim reaper for Halloween. After all, she may have put the final nail in the coffin for many popular investments, including growth stocks.

As I’ve explained before, stocks with high perceived growth prospects tend to trade with expensive valuations. The popularity of these growth stocks increases demand for their shares, driving up their multiples.

These growth stock darlings are sometimes called “glamour” stocks. Indeed, most stocks that trade with outlandish price-to-earnings (P/E) ratios of 100X or more would qualify as glamour stocks.

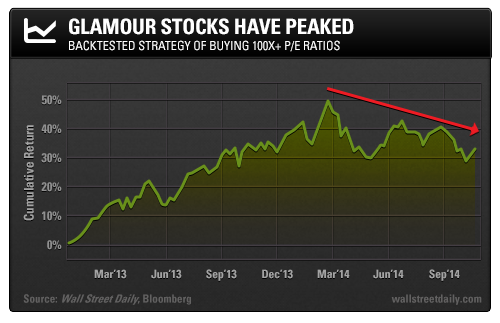

The backtest below, which is a subset of the one I showed in June, reveals how you would’ve performed if you owned nothing but stocks with trailing P/E ratios of at least 100X and market capitalizations greater than $1 billion.

As you can see, the strategy of buying the most expensive U.S. stocks would have produced an amazing 50% gain in a little over a year.

But in the second half of 2014, something curious started to happen…

As the S&P 500 continued higher and made several fresh all-time highs, expensive stocks lagged.

Amazon.com (NASDAQ:AMZN), Netflix (NASDAQ:NFLX), 3D Systems Corporation (NYSE:DDD) – all glamour stocks – are down an average of 20% since my high-P/E warning.

Basically, the Fed’s tapering has led to decreased risk appetite… and stocks with egregious valuations are getting pummeled.

The Power of Value

Stimulus aside, a separate major announcement on Wednesday illustrates the perils of owning growth stocks instead of stocks that are attractively valued.

Not long ago, investors were absolutely in love with 3D Systems. The company’s stock traded as high as $97 a share in January 2014 and sported a trailing P/E of over 164X. But the stock has since collapsed to around $37.

And now, Hewlett-Packard Company (NYSE:HPQ) has unveiled a 3-D printing system that’s cheaper and faster than existing products offered by rivals, such as 3D Systems and Stratasys (NASDAQ:SSYS).

An industry analyst even commented that HP’s technology is so revolutionary that it could “put some other companies out of business.”

It’s ironic that Hewlett-Packard, whose stock is abhorrent to most investors, could potentially wipe out 3D Systems, a company that was once among the most prominent glamour stocks. What’s more, DDD is down 60% this year, while HPQ is up 28%.

Bottom line: Now that the Fed’s QE program has ended, more and more sanity will return to the markets.

Some individual glamour stocks may do well for a time, but as a whole, they’re dead in the water. Markets experience long-term cycles, and the multi-year glamour stock trade is over.

Of course, this is great news for discerning value stock investors with diversified portfolios.

Safe investing,

BY Alan Gula, CFA