What’s the most dangerous investing strategy you can imagine?

In other words, if you were trying to systematically lose money, how would you go about doing it?

Well, we know that value stocks tend to outperform over the long term. So an easy way to lose cash should be to buy the most overpriced stocks, and nothing else.

How overpriced, exactly?

A trailing price-to-earnings (P/E) ratio of 50x should certainly do the trick. But let’s go even higher in this stock-picking experiment, and focus on 100 times earnings and higher!

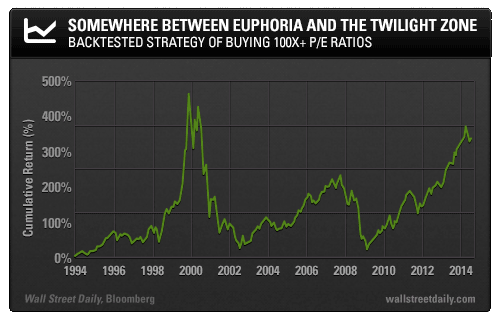

Each month, we’ll select and hold U.S.-listed stocks with trailing P/E ratios greater than 100x and market caps greater than $1 billion. We’ll have an equal weighting in each stock that passes the screen.

Sounds like a pretty foolproof way of watching your wealth plummet, right?

To see how this strategy would play out, I’ve calculated the results. And they’re surprising…

As you can see, if you followed this strategy over the past 20 years, at no point would your account have dropped below its starting value. In fact, even though the drawdowns would have been significant along the way, you’d be up 348% today.

Now, I’m not bringing this up to suggest that you follow this strategy. But we can draw several conclusions from this backtest:

Conclusion #1: Stocks Go Up. Experienced traders know that you can’t short a stock based on a high valuation alone. The equity curve above is the quantitative backup for this principle. Stocks tend to rise during bull markets – even the equities with super-expensive valuations.

Conclusion #2: It’s Getting Crazy. Through the media, we hear a lot of opinions about the overall valuation of the U.S. stock market. The performance of stocks with astronomical valuations over the past five years should put things into perspective. It’s not as crazy as the tech bubble, but we’re getting close.

Conclusion #3: Glamour Gets Grounded. The so-called “glamour stocks” are popular among investors because they’re streaming online videos, curing diseases, printing in more than two dimensions, etc. So they’re growing quickly. But very few will actually grow into their asinine valuations without some help from the price returning back to Earth. It’s why the 100x P/E strategy gave back virtually all of its gains – twice – in the past 20 years.

Put simply, the longer this bull market lasts, the greater the risk posed by these glamour stocks.

Remember, I limited my screen to stocks with market caps greater than $1 billion. That’s because I don’t want micro caps or penny stocks to skew the performance.

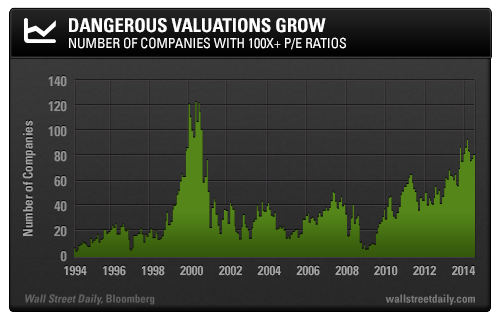

Also, the average market P/E ratio doesn’t tell us enough about the dispersion of those P/E ratios, and I want to keep track of the absolute number of relatively large stocks with excessive valuations.

There are now 82 such U.S.-listed stocks with trailing P/E ratios above 100x, and the number reached as high as 94 this year. The chart below shows how the 2014 totals stack up against past figures:

Granted, during the tech bubble, there were as many as 124 companies in the 100x+ P/E category.

But is this something we’re hoping for? The total market cap of the current 82 high-P/E companies is already an astounding $580 billion.

Next time someone tells you this market is fairly valued based on P/E, tell them that there’s a valuation time bomb totaling over half a trillion dollars waiting to blow.

Invariably, they’ll say that they stick to value stocks with low P/E ratios. Next, suggest that they utilize the EV/EBITDA ratio, which is a superior valuation metric to the P/E ratio.

After all, those who are unaware of the magnitude of the valuation problem are going to need all the help they can get. There’s going to be a lot of collateral damage when that bomb goes off.

Safe investing,