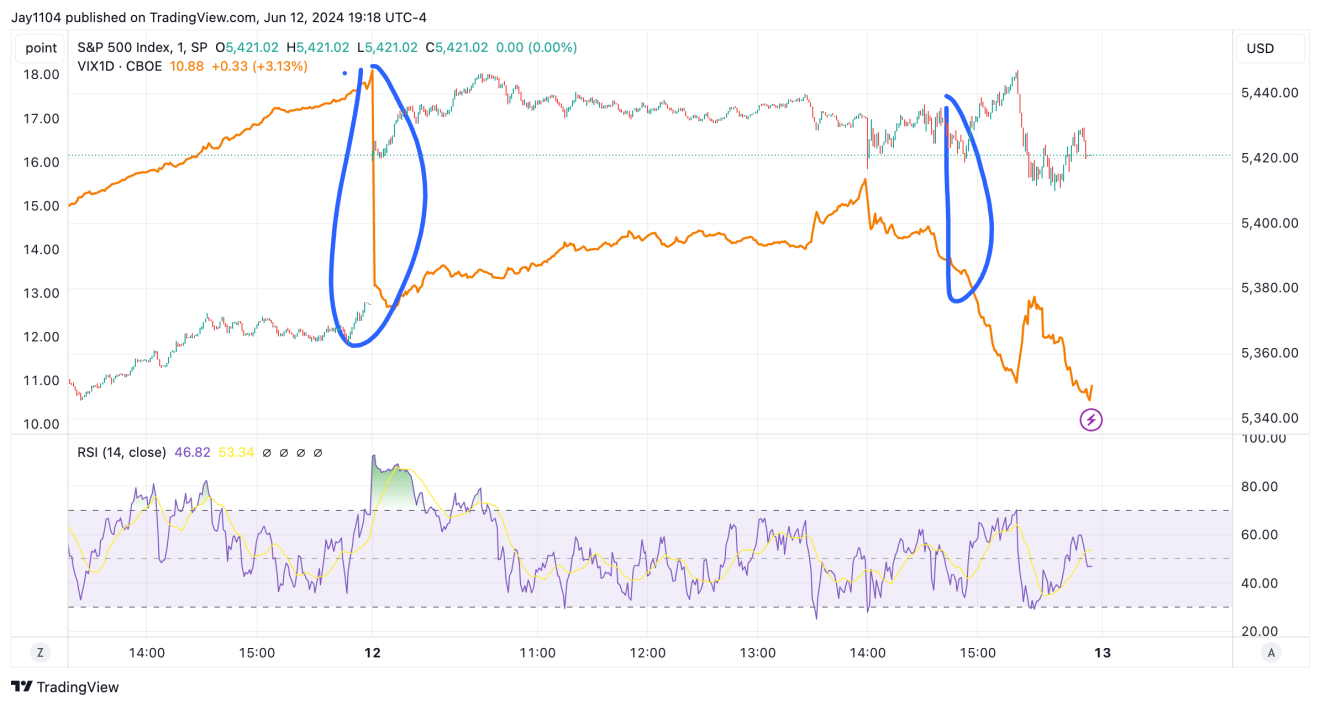

Stocks finished higher after the CPI report fell below analysts’ expectations and swap pricing. The CPI headline y/y and m/m missed swap pricing, something we haven’t seen frequently in recent memory. Swap pricing is still one of the best ways to gauge the CPI and inflation direction. So, just because Swaps got it wrong one time, I wouldn’t change my process at all; it has worked extremely well for the most part for some time.

The Fed’s dot plot was kind of odd. The Fed now projects just one rate cut in 2024, down from 3, but it also raised its core PCE target for 2024. I’m not really sure why the Fed would cut rates in 2024 if it thought the inflation rate was going to be higher than previously thought and higher than the latest data points.

At this point, the Fed seems to be trying to conduct a tightrope balancing act, with inflation on one side and the labor market on the other, while gliding the economy in for a smooth landing, blindfolded, a near circus act. Maybe they pull it off; maybe they do not.

I am not smart enough to know, but history suggests that the odds are stacked against them doing that. I would undoubtedly prefer a sluggish growth rate and 3% inflation and higher rates than a rising unemployment rate and recession, but we will have to continue to assess the data as it comes in.

So far, the Fed has been relatively lucky because oil has been tame and has not been a problem for them. That may continue to be the case, but it is a risk in the future. Oil is trying to break a trend line, and it is getting close to that happening, at least as of this evening it looks like it has.

Meanwhile, 10-year rates fell following the CPI report but recovered a good portion of those losses following the FOMC. Right now, a clear consolidation is taking place in the 10-year, with the only direction being sideways.

So far, the relationship and guide that used to be the USD/MXN and the S&P 500 have magically broken down in the last few trading sessions. It seems odd at this point because it has been a long-standing relationship that goes back some time, more than a year.

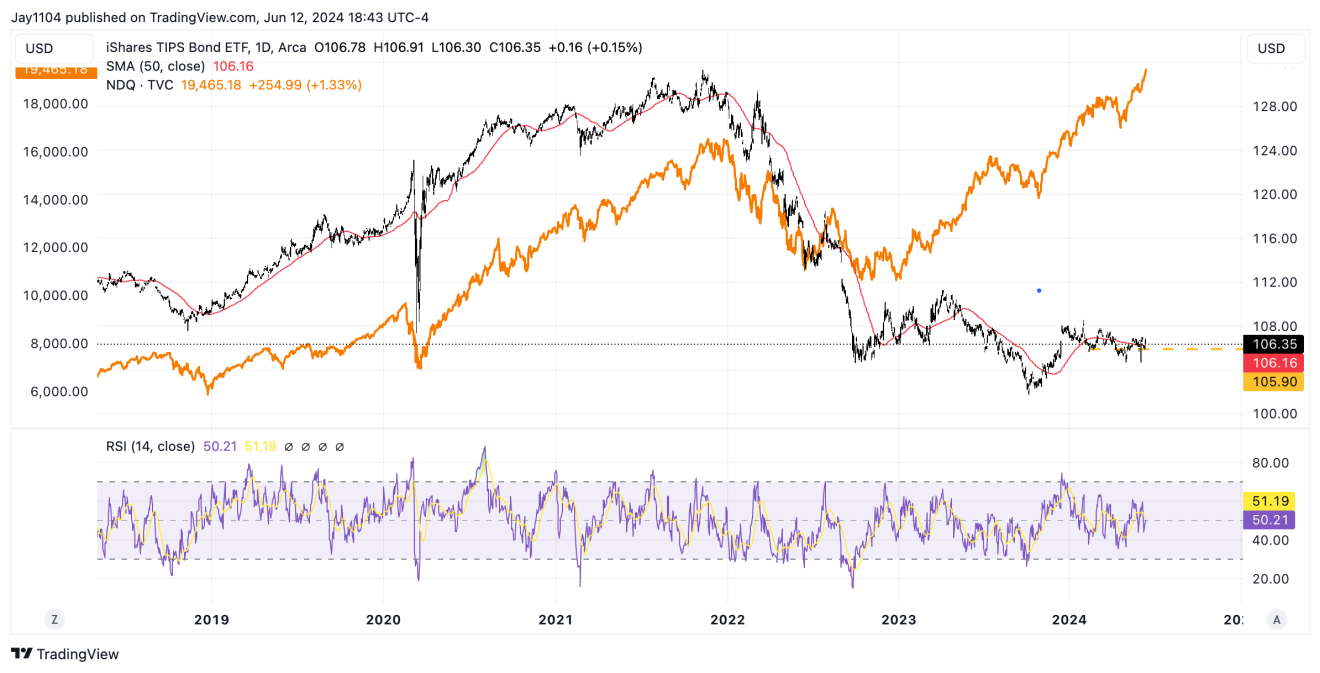

For nearly five years, the NASDAQ 100 just followed the iShares TIPS Bond ETF (NYSE:TIP), and that relationship seemed to change with no warning and no reason last year at this time. I couldn’t tell you why since all I heard throughout 2020 and 2021 was how lower real yields drove stock present values higher. Rising real yields do not have an effect on stock prices going lower.

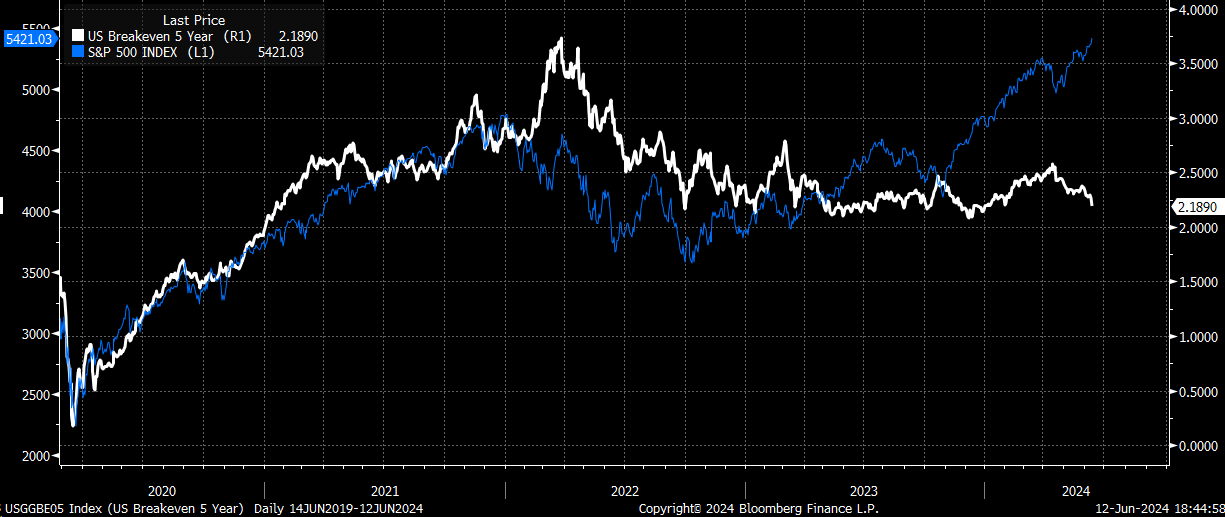

But it also used to be the case that stocks followed breakeven inflation expectations since inflation expectations essentially can act as a barometer for growth. That clearly changed in the Spring of last year, too.

Yesterday, we also discussed the relationship between stocks and credit spreads. So it will be interesting to see how all of this plays out in the days to come, especially if we see credit spreads move higher because of what we are seeing taking place in Europe with spreads as well. Additionally, if the markets start to feel that the Fed’s tightrope is starting to get a bit shaky, spreads will widen.

S&P 500 Nearing a Local Top?

From a technical standpoint, the 5,380 region seemed to make a lot of sense for a top, given that it was the 1.618% extension, and it appeared as if there was an ending diagonal. That clearly hasn’t happened yet, but it could if yesterday’s rally turns into a throw-over. However, I think that is a tough call at this point.

It is certainly possible. Yesterday, the S&P 500 closed a full bar above its Upper Bollinger band and had an RSI above 70. Now, I know a lot of people seem to think I am just being bearish when I point out things like, but that is the current state: overbought. You can look up the definitions, it is just in my experience when you get both signals simultaneously, it is an even more powerful meaning.

There was also the usual IV crush Yesterday, as expected and noted in yesterday’s write-up, even though the Powell rally started 10 minutes late and was pretty weak.

Anyway, good luck.