Last week we discussed that after new highs in the Dow and S&P, the NASDAQ 100 has been “stuck in first gear” and that the Fed is stuck between a “rock and a hard place.”

We’re seeing 1970s’ style inflation being ushered in by easy money from Central Banks throughout the world.

Soft commodities got a bit ahead of themselves and were in a process of some mean reversion, but the metals market held up well because of geopolitical stress. Meanwhile, precious metals were strong while cryptocurrencies showed signs of a potential collapse under the same pressure, quite the divergence.

After two down days digesting this news, the “easy” money came roaring back into the market and the Dow, S&P 500 and even the NASDAQ rallied with a surge of buyers thinking the downdraft had ended (not likely). In fact, we issued a sell signal on Friday afternoon on one of our investment models.

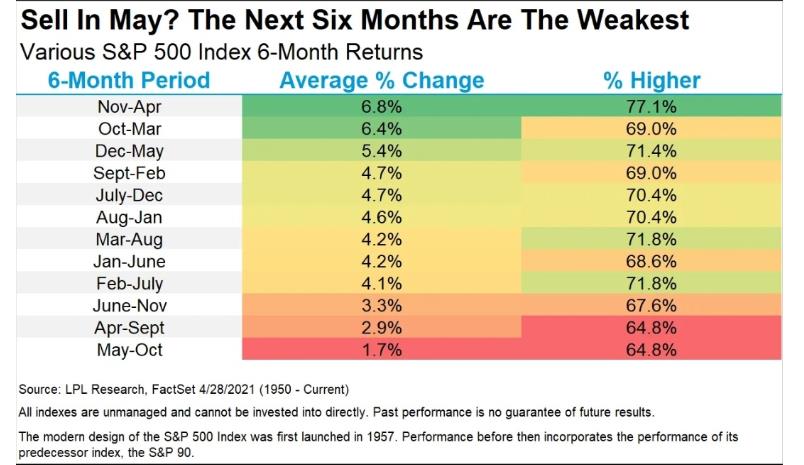

Typically, May is not as good a month as April; the average return for the S&P during May, since 1950, is 0.17%, and positive 59.1% of the time (see chart below for actual record).

May is so uncertain that market pundits and students of history have coined the phrase, “sell in May and go away.” However, the warning now is that you may come back in late October or November and must buy back at higher prices.

In recent years, this sell in May sentiment has waned. A perfect example of this was last year, as May was a strong buying opportunity.

Also, the NASDAQ rallied daily to new heights and you would have been unhappy if you were under invested during May to November.

To put this into perspective, the chart below shows the different 6-month market periods:

This week’s highlights

- DIA and SPY both Rejected 50-DMA, stayed above and regained their 10-DMA’s despite selling off for the week

- QQQ and IWM both closed under 50-DMA into warning phases. IWM was oversold on both Real Motion as well as price. We will continue to monitor for confirmation of a bullish breakout over the 50-DMA

- Despite the huge 2-day rally, all the key indices closed down between 1.0 - 2.4% for the week. NYSE Composite Index closed under its 50-DMA

- SPY’s sharp 2-day rally helped it regain neutral ground on our Risk Gauge. However, the QQQ’s could not escape a sustained bearish reading

- Value stocks are holding their outperformance vs. growth stocks

- Real Motion is breaking down on the weekly charts for IWM and the QQQ’s as well

- Volume on Friday was light, and the number of accumulation days over the last 2 weeks was showing a neutral, if not slightly negative reading

- Consumer staples was the leading sector last week, showing a move to safety plays.

- Weakest sector last week was semiconductors, confirming moves out of speculative plays into safer sectors

- VXX and GDX led last week, indicating a transition into more defensive plays

- Mean reversion is kicking in regarding soft commodities, while the bigger trend is still intact

- GLD seemed to be gaining traction with geopolitical stress, as well as a high-pressure week for the cryptocurrency market which had been drawing buyers away from GLD. Look for Gold to break its 200-DMA soon with instability across other markets inviting investment into safer plays

- 3 out of 6 members of Mish’s Modern Family are showing signs of weakness (Semiconductors, Biotech, Russell)

- Regional Banks (KRE) went up with a rise in yields

- USD has broken under its 10-wma and looks poised to take out multi-year lows going back to 2018