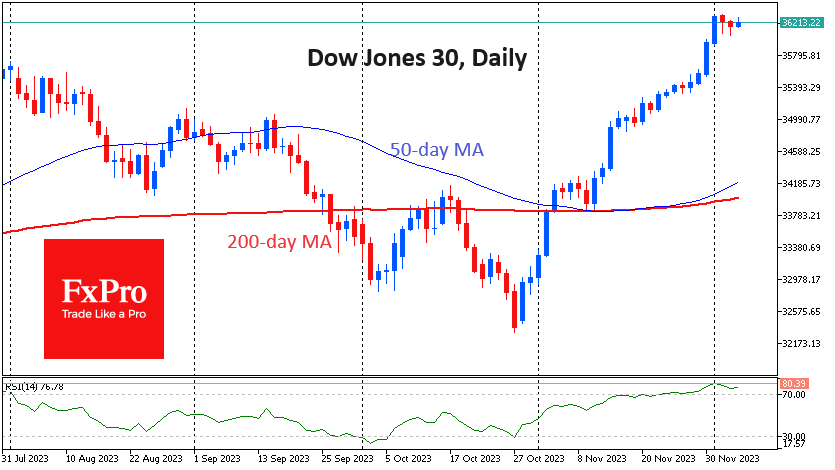

The Dow Jones index has switched into consolidation mode, joining the S&P500 and Nasdaq 100, which did so almost two and three weeks ago, respectively. This could be consolidation before a spurt to new highs, but it's more likely that we're seeing a depletion of growth.

The Dow Jones index is trading just 0.8% away from its record close in December 2021 and 2% away from its all-time high, having added nearly 12% during the rally over the past five weeks. The rally has been so rapid that the RSI on the daily charts has exceeded 80, an extremely overbought zone. Sometimes, a move into this territory kicks off an even wilder rally, indicating extreme investor greed.

But a different pattern of behavior seems to have been chosen this time. The Dow Jones index slowly slid on Monday and Tuesday. The S&P 500 and Nasdaq 100, the broader equity indices, did not connect to the upside and continued to consolidate at recent tops.

Equally important is the behavior of the currency market, where the dollar has been adding since late November, which is usually a bearish factor for the market. And this is clearly visible in the dynamics of other indices. Dow Jones, contrary to simple logic, has accelerated its ascent these days.

Such character of movement reminds one of active liquidation of short positions. We saw ruthless equivalents of such liquidations in gold, with the capitulation peak on the 1st and at the beginning of trading on the 4th of December. We saw the opposite situation in April 2020, with negative prices in some oil futures.

That is, technically, from current levels, it is now more comfortable to be bearish in the Dow Jones, assuming that the index is more likely to fall by 5% than rise by another similar amount.

Fundamentally, it's also not easy to buy stocks whose prices include expectations that the Fed will cut rates by 150 points over the next year, with final demand and corporate profits remaining as strong.

The FxPro Analyst Team