In yesterday's discussion on the technical underpinnings of the market, I pondered the question of whether Greece was really the primary issue of concern for investors.

"Whether, or not, a Greek exit from the Eurozone or a potential debt default is "the thing" that sparks the next major correction in the markets is unknown. Historically, such a widely "known" event is generally already factored into the markets and has much less of an impact when that event eventually comes to fruition. As Art Cashin suggested this morning:

'I think China may be more important than Greece. Stick with the drill – stay wary, alert and very, very nimble.'"

I think that Art may be onto something. While Greece is indeed an issue, and did confirm that they would default on their debt payment to the IMF, this is something that has been long in the making. China, on the other hand, is very a different story.

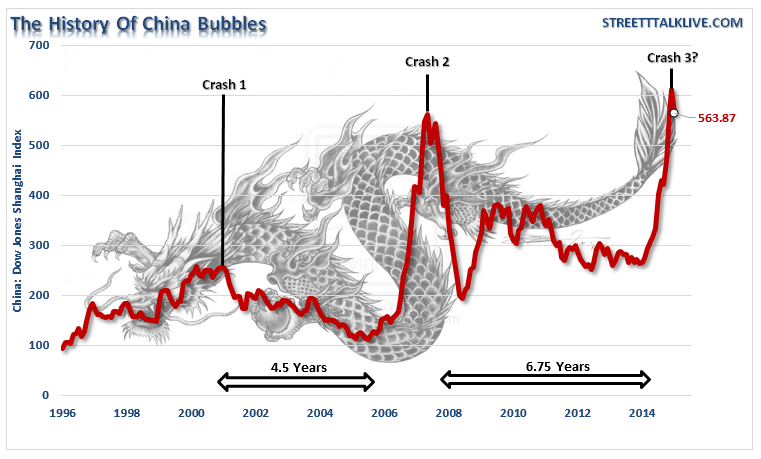

Today's chart(s) of the day is a look at the history of "bubbles and busts" of the Chinese Shanghai Composite.

Emerging markets have a long history of speculative investment bubbles and bursts. Whether it has been South American debt or emerging market stocks, they speculative push to garner higher yields or returns has always ended up badly.

As shown in the chart above, the first bubble and burst occurred in 2001. It took almost 4.5 years before that particular investment bubble was unwound.

The second bubble began in early 2006 and after a blistering run popped in mid-2007. Almost 7-years later that bear market ended as the fuse was lit for a new surge to record highs over the last several months.

STOP

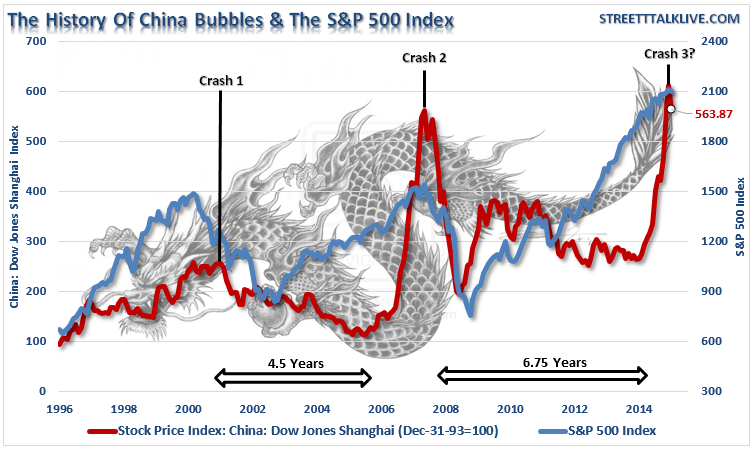

Take a very close look at the chart above as there is something eerily familiar about it.

As I stated, throughout history emerging markets have gone through a continuous series of booms and busts driven primarily by speculative greed. Whether it was chasing higher yielding debt instruments or just hopes of more lucrative stock market returns, these chases occurred very late in the market cycle when returns became lean in more mature markets.

The chart below shows why the chart above is so familiar.

The boom/bust cycle of the Chinese Shanghai index has a relationship to the S&P 500 index. The first bubble in China occurred as the Dot-com bubble in the U.S. moved into a full speculative frenzy.

After the bursting of that bubble, money primarily stayed domestically oriented until late in the "real estate/credit" bubble. At that late stage, speculation had once again reached the "irrational exuberance" phase as beliefs of ongoing stable economic growth, and the rise of emerging market dominance filled the airwaves. In just a few short months, those dreams were rapidly shattered as economic, and market realities, came to the fore.

Following the "financial crisis," money once again stayed focused primarily in domestic indices as the Federal Reserve flooded the system with liquidity to boost asset prices in hopes of stabilizing a weak economic backdrop. However, as the Federal Reserve ended its last liquidity program, money flooded into China once again chasing liquidity and hopes of higher returns.

The recent plunge in the Chinese market may, or may not be, the sound of the latest bubble popping as I write this missive. However, there are two very important warnings be given here:

1) The current bubble will eventually end, just as the last two have, in a rather disastrous plunge for those chasing returns.

2) The plunge will also likely be coincident with an unwinding of excesses in the S&P 500.

The current belief is that the economic environment is stable, and growing enough, to support and foster continued expansion in domestic markets for the foreseeable future. Of course, that was also the belief at the peak of the previous two bubbles as well.

I think that Art Cashin could very well be right. Greece may not be "the thing." We need to keep a close eye on China as it may well be the leading indicator for what happens next in the U.S.