•Greece is the word All eyes will be on Greece today as the deadline for reaching an agreement approaches. Greek PM Tsipras will meet with the leaders of the three international creditors (the EU, the ECB and the IMF) today ahead of a summit meeting of EU leaders. He reportedly presented new proposals over the weekend, although the details were not available and the FT reported that no formal written proposal had arrived. The Greek newspaper Kathimerini said that at the EU summit, Tsipras will be presented with two options: either accept the reforms proposed by the creditors, potentially with some Greek amendments, or prepare for a default. If Tsipras is willing to compromise, the creditors would probably extend Greece’s bailout program and perhaps make a commitment to discuss debt relief. The paper said that “sources indicate that Tsipras could be ready to accept a compromise, with amended proposals on value-added tax and even possible pension reforms in exchange for a firm commitment from creditors on debt relief and a growth-boosting package.”

• If they don’t reach agreement today, then discussions may be suspended until Thursday, when there will be a regularly scheduled EU summit. But some participants reportedly believe that today is the “end of the road” and that if no agreement is reached, the EU will be prepared to “let them go,” according to the FT.

•Meanwhile, the head of the Bank of Greece warned that Tuesday would be a “difficult day” and that “decisions will have to be taken” if the two sides don’t reach agreement on Monday. Some EUR 4.2bn was reportedly withdrawn from the banks last week, and there were said to be orders for another EUR 1bn to be withdrawn today. If withdrawals continue at that pace, a bank holiday and/or capital controls would soon be necessary unless the ECB greatly increases its Emergency Liquidity Assistance (ELA) to the county. The ECB raised the ELA on Friday, but reportedly not by as much as the Greek central bank asked for. The ECB board is expected to discuss the liquidity of the Greek banking sector in a special meeting at 0830 GMT today. I expect them to remain supportive so long as there is a chance of a settlement. But if there is no compromise today, then the ECB could institute what has been called the “Cyprus solution:” threatening to stop supporting the banks unless the government agrees to the lenders’ conditions. That was basically what forced a settlement on Cyprus, and it could have the same effect on Greece – or it could cause the dreaded “Grexit.”

• If they do reach agreement today, I would expect Tsipras to put it to a referendum in order to get popular backing for an agreement that his party would probably object to. It’s hard to see how the politics would be carried out in time to meet the end-month deadline, but I expect that the creditors would bend the rules as necessary to give Tsipras every chance to get an agreement through.

• Looking at the market’s response to the problems in Greece, it’s clear that investors think either that A) a solution will be reached, or B) a Greek default will not have much of an impact on other borrowers or on the private sector. I agree that a solution seems the most likely outcome, given that the failure to agree would be much more expensive for both sides, plus polls show the Greek public wants an agreement. The difficulty lies in getting any agreement through the Greek parliament. That could require a change in the ruling coalition.

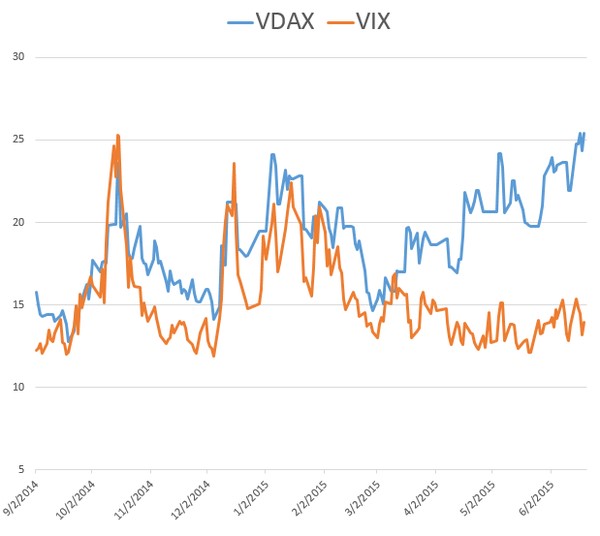

As for default, most of the Greek debt is now held by governments or agencies, not by banks or investors, so there is not much reason for a Lehman Bros.-like collapse. Portuguese business confidence, for example, is almost back to pre-2008 levels, while Portuguese bond spreads over Bunds actually tightened last week. The only visible sign of distress in European financial markets has been in the equity markets’ implied volatility, where the VDAX (the German equivalent of the VIX index) is now substantially higher than the VIX. But even that is partly due to the strength of the euro, which is putting downward pressure on German stocks.

• Personally, I’m not so sure. I think a default with Greece remaining in the Eurozone would be likely to engender contagion at least to the other peripheral countries, while a default and exit from the Eurozone (which I think is much less likely) could be catastrophic for the currency union and the currency.

• Today’s indicators As for the indicators, we have a relatively light agenda. We have no major indicators to be released during the European session.

• In the US, existing home sales for May are forecast to have increased a bit. The housing starts and building permits released last week were consistent with an improving housing market. If the existing home sales are in line with a strong housing sector, this may be USD-supportive.

• As for the speakers, ECB Executive Board member Benoit Coeure speaks.

• As for the rest of the week, Tuesday is PMI day. China’s preliminary HSBC manufacturing PMI for June is expected to increase a bit, but to remain below 50, the threshold dividing expansion from contraction. From Europe, we get the preliminary manufacturing and service-sector PMI data for June from several European countries and the Eurozone as a whole. The expectations are for the manufacturing PMIs to decrease a bit, while service-sector PMIs are forecast to decline or remain unchanged.

• The US preliminary Markit manufacturing PMI for June is also coming out, along with durable goods orders and new home sales, both for May.

• On Wednesday, the main indicator will be the German Ifo survey for June. The weak ZEW indices last Tuesday increase the likelihood of soft Ifo indices as well. This could add to evidence that Eurozone’s growth engine is losing steam.

• In the US, the 3rd estimate of Q1 GDP is expected to show that the US economy contracted less compared to the 2nd estimate. The 3rd estimate of the core personal consumption index, the Fed’s favorite inflation measure, is also coming out. An improvement in the GDP figure could strengthen USD.

•On Thursday, US personal income and personal spending for May are both forecast to accelerate. This could prove USD-supportive. The yoy rate of the PCE deflator and core PCE are also coming out.

• On Friday, we have the usual end-of-month data dump from Japan. The focus will be on the National CPI rate for May and the Tokyo CPI rate for June. The national CPI rate for May is expected to slow to 0.4% yoy from 0.6% yoy. That could raise expectations of further BoJ easing, although as we have mentioned several times, this isn’t likely to come for several months at the earliest. At the same time, we get Japan’s jobless rate and job-offers-to-applicants’ ratio, also for May.

The Market

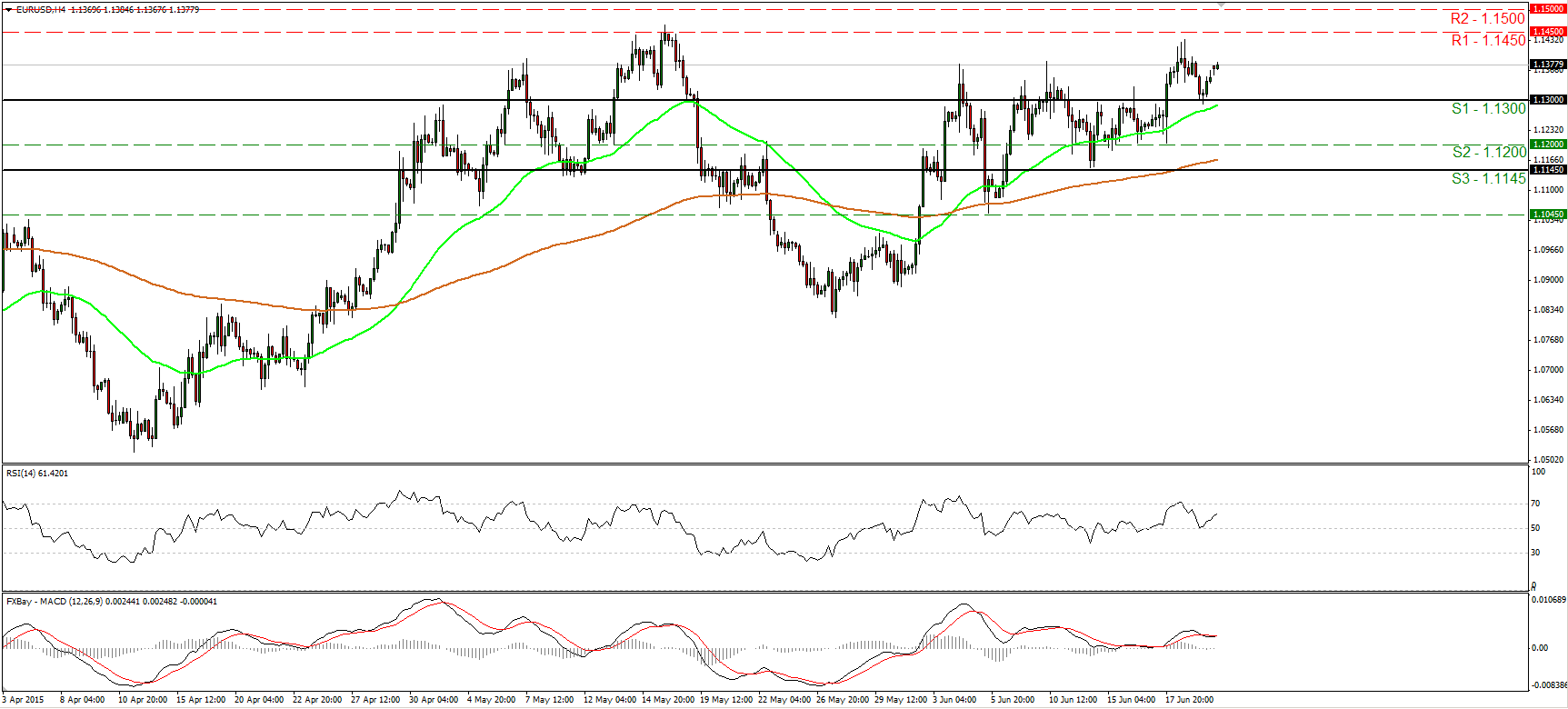

EUR/USD gaps up after Greece’s last-minute proposals

• EUR/USD traded higher on Friday after hitting support at 1.1300 (S1). On Monday, the pair gapped higher as Greece tried to avoid defaulting with last-minute proposals aimed at appeasing its lenders. I would now expect the bulls to target the 1.1450 (R1) area. A break above that resistance is likely to target the psychological figure of 1.1500 (R2). Our oscillators detect positive momentum and support the case for further advances. The RSI rebounded from its 50 line and edged higher, while the MACD, already positive, looks ready to turn up and to cross above its signal line. As for the broader trend, I believe that a move above the psychological zone of 1.1500 (R2) is the move that could carry larger bullish implications.

• Support: 1.1300 (S1), 1.1200 (S2), 1.1200 (S3)

• Resistance: 1.1450 (R1), 1.1500 (R2), 1.1650 (R3)

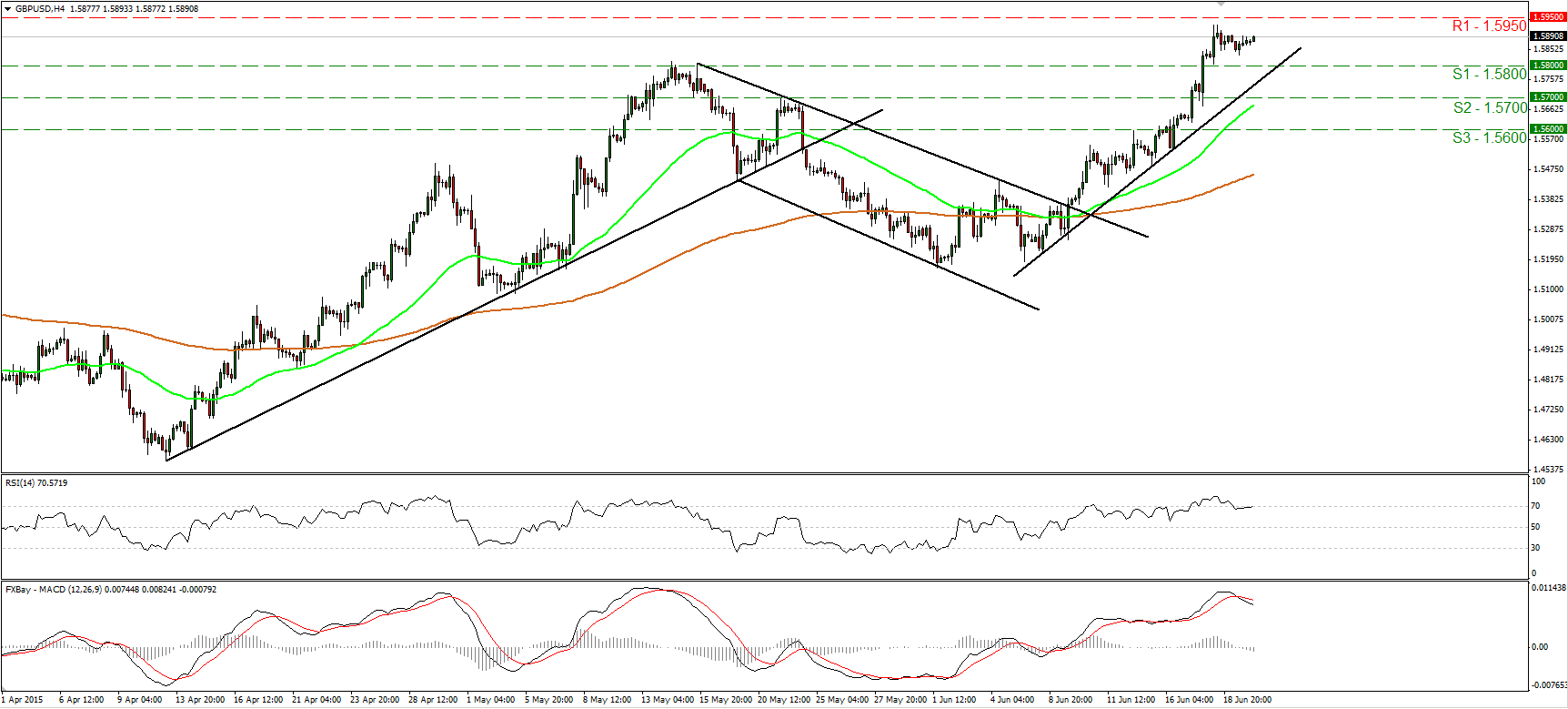

GBP/USD stops slightly below 1.5950

• GBP/USD moved in a quiet mode on Friday, after it hit resistance slightly below the 1.5950 (R1) resistance zone marked by the high of the 11th of November. The short-term picture remains positive in my view, and therefore, I would expect the pair to continue trading higher and perhaps challenge the psychological area of 1.6000 (R2). However, taking a look at our short-term oscillators, I would be careful of a possible pullback before buyers seize control again. Switching to the daily chart, I see that after rebounding from the 50% retracement level of the 14th of April - 15th of May up leg, GBP/USD moved back above the 80-day exponential moving average. In my view, the move above 1.5800 on the 17th of June confirmed that the overall picture has turned positive as well.

• Support: 1.5800 (S1), 1.5700 (S2), 1.5600 (S3)

• Resistance: 1.5950 (R1), 1.6000 (R2), 1.6175 (R3)

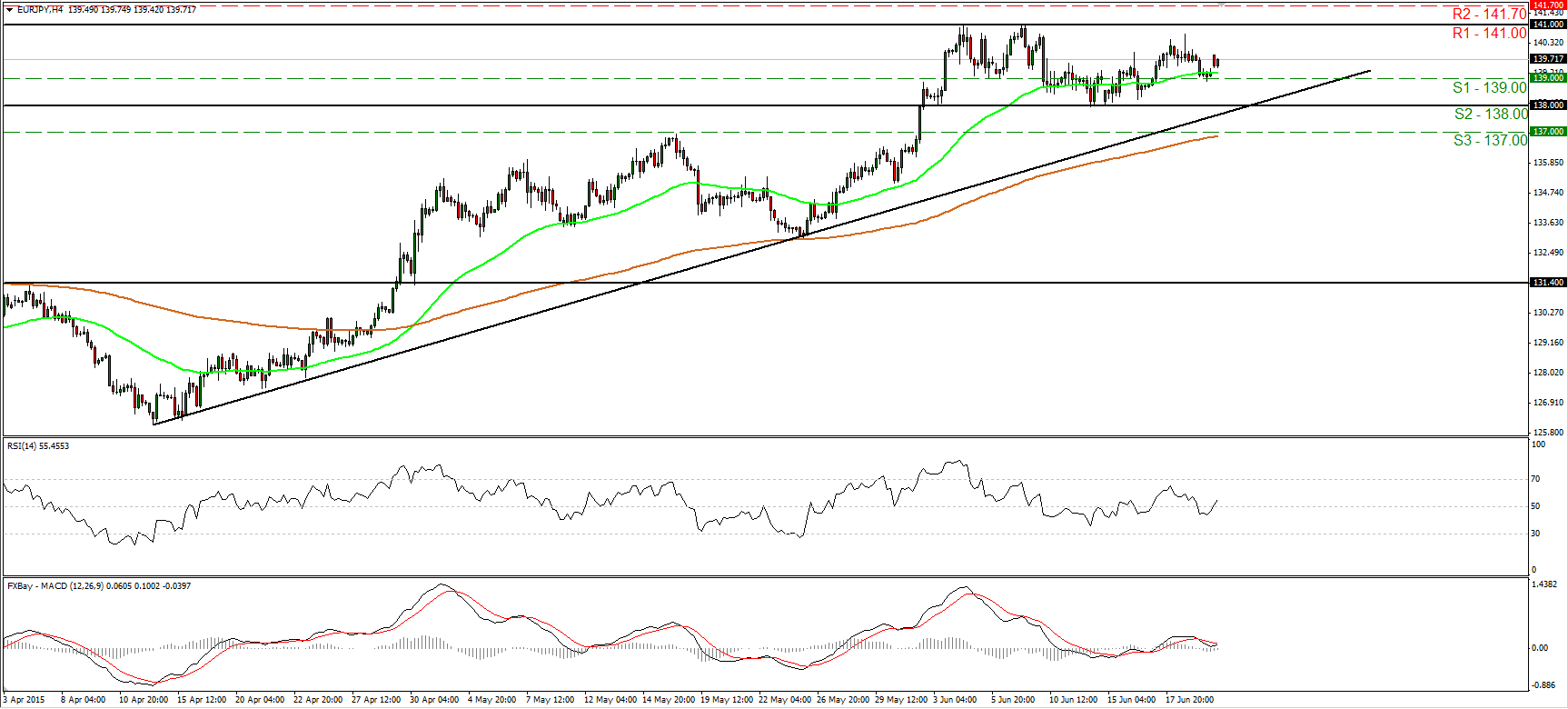

EUR/JPY rebounds from near 139.00

• EUR/JPY gapped higher on Monday as well, after it hit support near 139.00 (S1) on Friday. If the rebound continues, I would expect the bulls to aim for another test at the 141.00 (R1) zone. Further upside is also supported by our momentum studies. The RSI moved back above its 50 line, while the MACD, already positive, shows signs that it could move above its signal line in the near future. However, although we may see the continuation of the rebound, the rate is still trading in a sideways channel between the support of 138.00 (S2) and the resistance of 141.00 (R1). Therefore, I would see a neutral short-term picture. On the daily chart, the break above 131.40 on the 29th of April signaled a possible trend reversal in my view. As a result, I would consider the medium-term trend of EUR/JPY to be positive. Nevertheless, a daily close above 141.00 (R1) is needed to confirm a forthcoming higher high on the daily chart and signal trend continuation.

• Support: 138.00 (S1), 137.00 (S2), 135.15 (S3)/p>

• Resistance: 139.60 (R1), 141.00 (R2), 141.70 (R3)

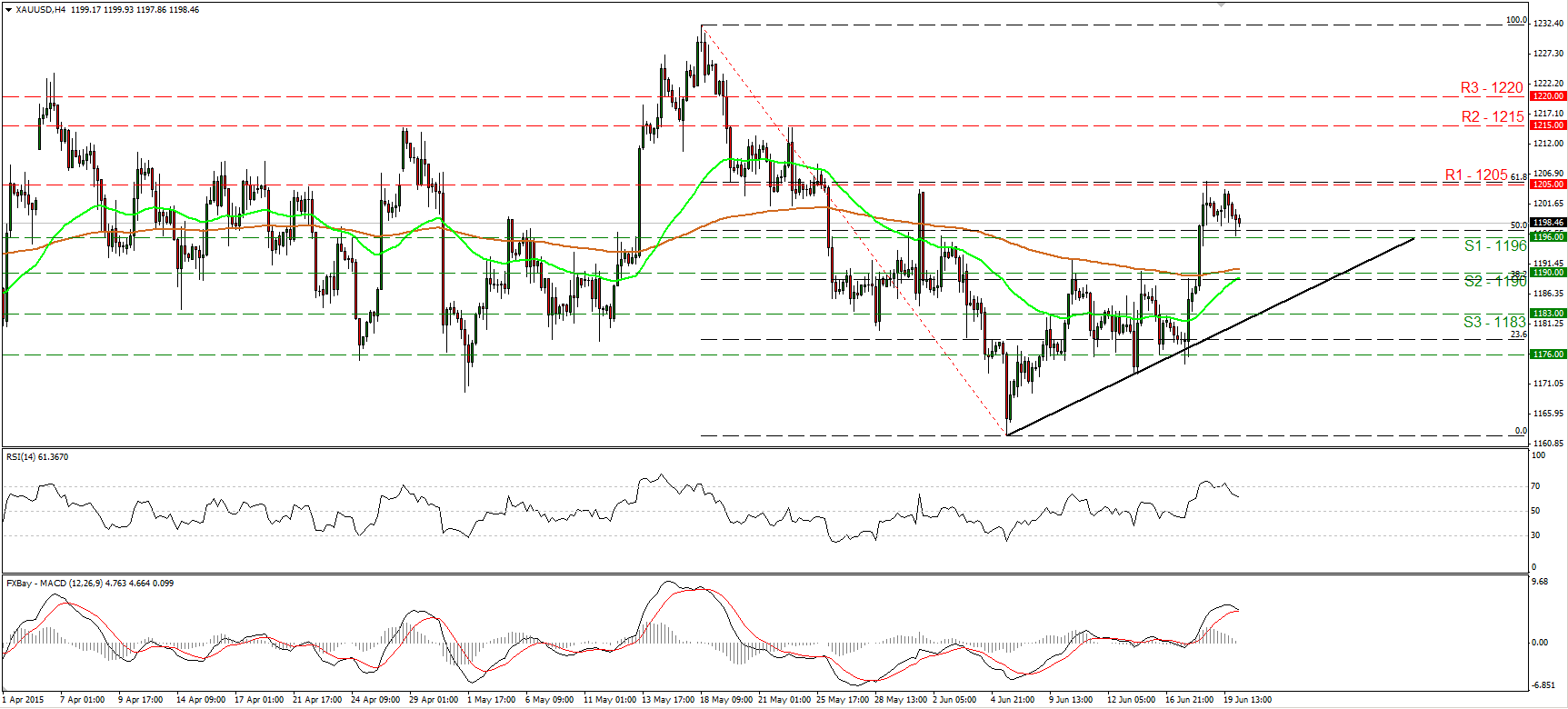

Gold hits again resistance near 1205 and pulls back

• Gold traded lower after finding resistance once again near the 1205 (R1), which stands fractionally close to the 61.8% retracement level of the 18th of May – 5th of June decline. Currently the metal is headed towards the support line of 1196 (S1), where a clear break is likely to extend the retreat towards the next support zone at 1190 (S2). Although the short-term picture looks somewhat positive, a further tumble is favored by our momentum studies as well. The RSI exited its overbought zone and now points down, while the MACD has topped and could fall below its signal line soon.

• Support: 1196 (S1), 1190 (S2), 1183 (S3)

• Resistance: 1205 (R1), 1215 (R2), 1220 (R3)

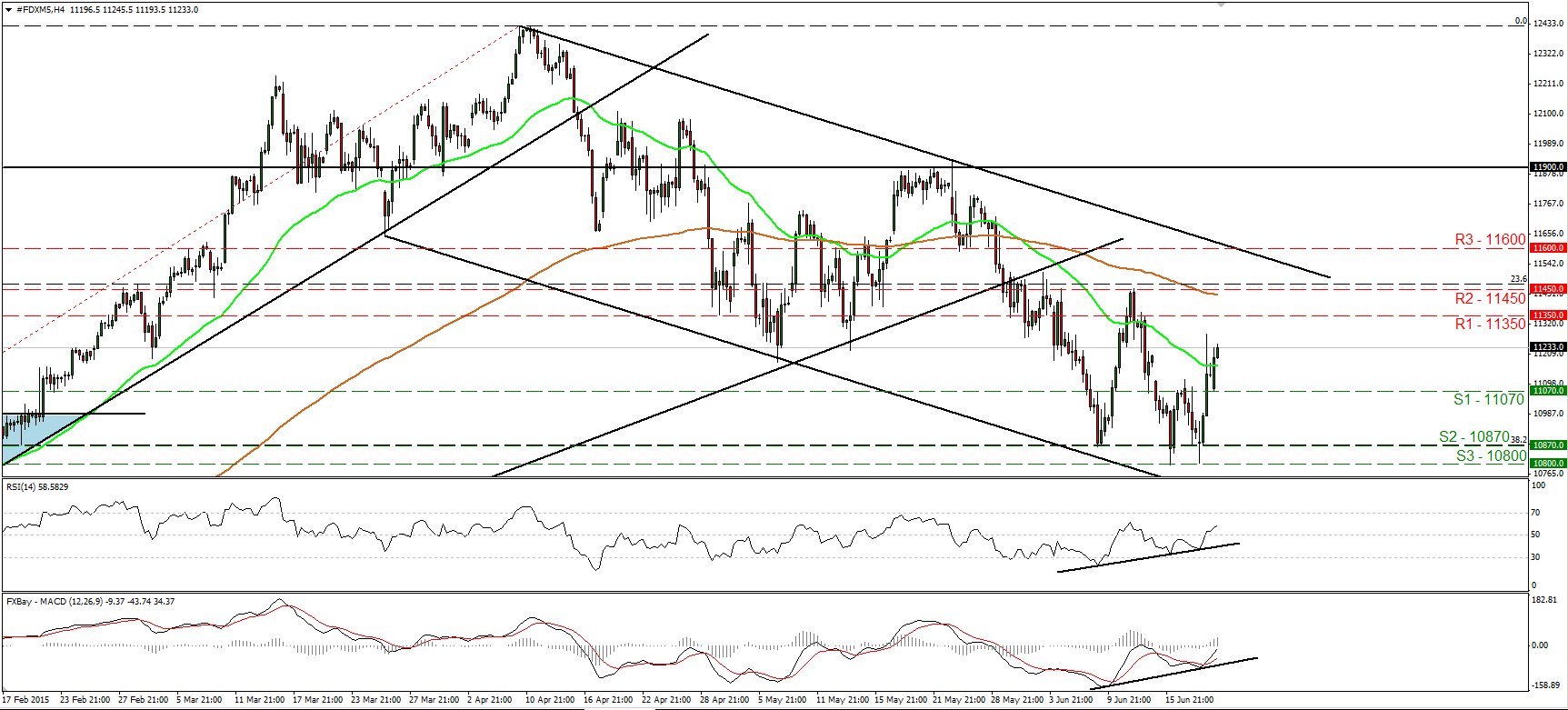

DAX shoots up after finding support at around 10800

• DAX futures surged after hitting support at the 10,800 (S3) line. This was the 3rd time sellers failed to close the day below the 10,870 (S2) area, which happens to be the 38.2% retracement level of the 16th of October – 10th of April advance. Now the index is headed towards the resistance line of 11,350 (R1), where an upside break is likely to challenge the next obstacle of 11,450 (R2), determined by the high of the 11th of June. Our short-term oscillators reveal upside speed and amplify the case that DAX could trade higher in the near future. The RSI emerged above its 50 line, while the MACD crossed above its trigger and is now headed towards its zero line. In the bigger picture, although the index is trading within a downside channel and below the uptrend line taken from the low of the 16th of October, I would switch my view to neutral. Only a clear close below the 10,800 (S3) zone could make me confident on the medium-term downside path.

• Support: 11070 (S1), 10870 (S2), 10800 (S3)

• Resistance: 11350 (R1) 11450 (R2), 11600 (R3)