A big turnaround in the NASDAQ 100 and S&P 500 cash session has raised a few questions if the lows have been seen and whether it’s time to add risk into the portfolio, at least as a short-term trade.

With the VIX index (S&P 500 implied volatility) still above 20% it's hard to have any genuine conviction here. We have to have multiple charts open on different time frames because when a move happens it can be powerful and it can be rapid. It feels as though both mentioned indices are hanging on for dear life, and while we have seen the S&P 500 close below the 200-day MA, we have seen the bulls defend both the 11 October low of 2710 and the 55-week moving average at 2734. The 55-week MA having been identified as defining the longer-term trend, so this is getting some attention.

We can also look at the S&P 500 on the monthly timeframe and look at the price action to get a clear roadmap of the supply/demand dynamics. To those who assess price action in trading, the fairly punchy bearish outside month reversal at the all-time high will be a talking point and rarely does this end well.

There are signs these indices could be headed higher in the session ahead though, but we need the buyers to follow-through on last nights move to give real credence to yesterdays bullish candle. Asia is starting head up here, led by good buying in China and Hong Kong and S&P 500 and NASDAQ futures are off their lows, and we should see European equity indices open between 0.5% to 1% higher.

However, as we have learnt when the VIX index is above 20%, we can see moves play out in a fairly rapid fashion and often it doesn’t need to co-exist with a key news release. When the market acts in a herd mentality, the moves can be swift and can hurt if you don’t cover quick enough.

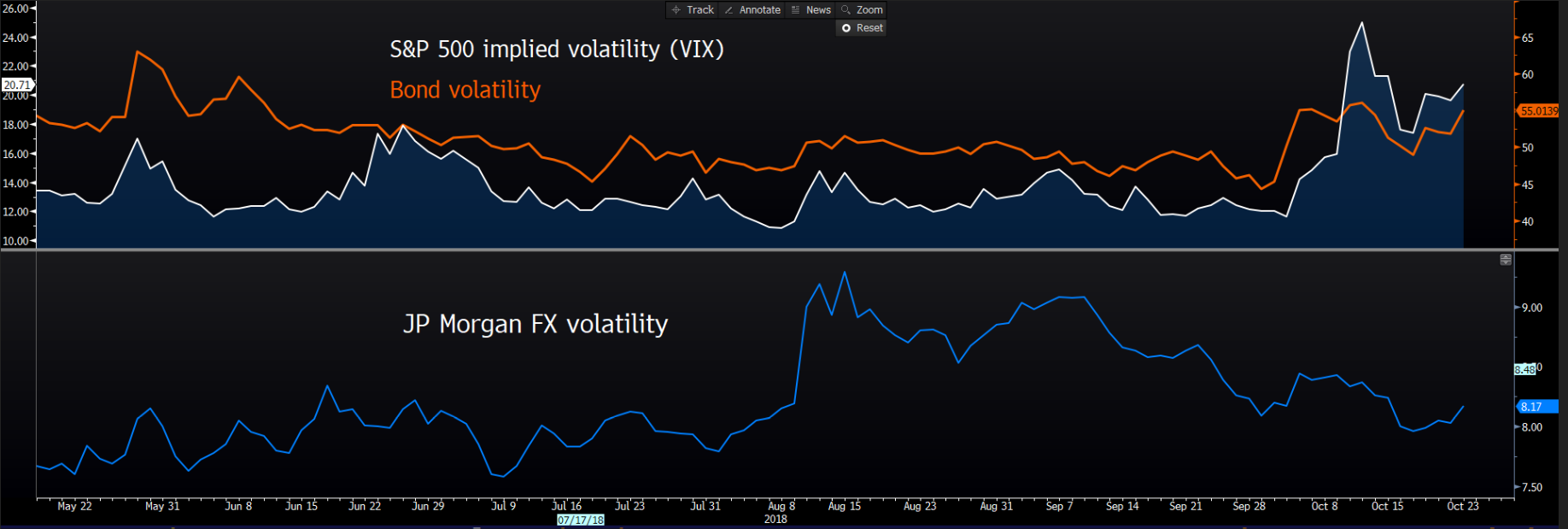

With implied volatility in mind, it’s interesting to see this is playing out in equities, commodities and fixed income, while volatility in FX markets is hard to find. The intra-day range yesterday in G10 FX was pathetic, and this is also the case in Asia today, with AUD/JPY seeing the most significant percentage move today in G10, gaining 0.4%. It feels as though FX traders are sitting back and watching for a guide on whether the S&P 500 can break below its primary trend, or push higher, as corporate buy-backs ramp up lowering implied vols. Certainly, we are not fully getting the inspiration from US earnings, even if the absolute level of beats on EPS or sales have been high, and the outlooks haven’t blown the lights out yet.

Whether US bond yields can head back into their cycle highs or roll over through support at 3.12% (on the 10-year notes Treasury) is another factor that fundamentally-focused traders are watching. And, we have the trifecta of political sagas which is causing traders to sit on their hands - these being Brexit, the Italian budget negotiations and US mid-terms, and whether they actually turn into a genuine shock to the system. We have learnt over the years that politicians need to make it look as though it has been a hard-fought battle and, in the end, they get things done. Politics is about getting a deal at the last minute that can be sold to a majority of politicians, who in turn can sell this outcome to the electorate.

We can’t be complacent though, as all of these political events have the potential to create huge volatility, but traders are cutting through the noise, for now at least, and looking for real meat on the bone and something tangible.

The rapid decline in WTI and Brent crude has seen inflation expectations lowered, and this has led ‘real’ yields pushing higher, and that is never good for equities. Most have looked at comments from the Saudi’s about making up the shortfall from a loss of output from Iran, and that hit a commodity already finding sellers easy to come by. In the twilight zone, between the US close and the Asian open, we heard about a monster 9.88 build in API crude inventory data, and that is never going to be taken well by oil traders.

Paradoxically, we are seeing US crude gaining modestly here in Asia, with risk coming back into the markets and tonight’s official DoE oil inventory report at 01:30AEDT will be interesting, as the market will go into this positioned for upside risks to the consensus estimate for a 3.5m barrel build. US crude closed below the 200-day MA, and I maintain a bearish view on the barrel here, with the 16 August low of $64.43 a huge level the oil bulls will have to defend. Happy to sell rallies into $67.70.

Another market getting good attention is gold. We have seen managed money reduce its record net short position (on gold futures) of late and given this position was reported last Tuesday then clearly; we are back to more neutral positioning. That said, if gold is going to work, now is the time as the USD is subdued, implied volatility is elevated, and there is little love for equities or fixed income. I have no position here, but I have the set-up looking ominously poised to push a trade. A break of $1240 would undoubtedly be bullish, as we can see a confluence of resistance levels between $1238/40 – the 2017 double-top neckline, the 38.2% fibo of 2018 sell-off and top of the channel.

However, should we see implied vols head lower, with the S&P 500 headed higher then I would expect gold to trade into $1215, with momentum oscillators crossing over and confirming the move. The gold bears need a move through $1230 to gain any traction here, but until equities or fixed income find their mojo this is the golds time to shine, although lower real yields would be helpful too.