We start a new week in financial markets, and it promises to be one with plenty of landmines and event risk for traders to navigate through.

Implied volatility, whether you are looking in the equity, bond or FX markets is relatively sanguine, that is, perhaps outside of Italian assets, and certainly not indicative of an explosion in price. Take USD/JPY one-week implied volatility (vol), where we can see this at 6.19% which is at the bottom of the 12-month range, despite discounting Friday’s non-farm payrolls, where of course the focus should be on two aspects; the underemployment (U6) rate and the average hourly earnings. Recall, last month wages kicked up and got people talking about the Federal Reserve being ‘behind the curve’, so it would not be out of the question to see implied vol pick up a touch through the week.

Staying on the data front, we also get US ISM manufacturing at 00:00aest tonight, where expectations are for a slightly slower pace of growth (the index is expected at 60.00), while ISM services and vehicle sales could also influence through the week. So, plenty to affect price, as will the case with a raft of Fed members due to speak, highlighted by Governor Powell speaking at the NABE conference on Wednesday (02:45AEST).

The USD could naturally be thrown around developments here, as the market needs new information to push the implied probability of a December hike above 80% (currently 74%). Perhaps, more importantly, is whether the Eurodollar futures curve can price in more than 50 basis points between December 2018 and December 2020.

Interest rates aside, if we look at price action, the USD bulls won a clear battle last week, with the USD index printing a bullish outside week reversal (EUR/USD printed a bearish outside reversal). From here, we need to see if the buyers can build on this and it would undoubtedly help if asset managers, who are heavily short the USD, can reduce their position here. That would need to come from a steeper US yield curve and a 10-year Treasury that can re-test and break the 3.11%/3.12% level. That is not assured, and there are growing reasons to think 10-year yields could test the 3% level this week and this to me is the centre of the financial world this week.

Moves in US fixed income will dictate flows in USD/JPY, which has been a preferred and certainly cleaner way to express a bullish USD view. The weekly close through the breakout high of ¥113.17 shows the strength behind the trend higher, but the preference, for now, is to take some profits here and buy pullbacks into ¥113.25/20.

There is clear opportunity in Europe with the Italian budget front and centre, and the preference for a while has been to be long Euro Stoxx 50 and short Italian FTSE MIB Futures as a vehicle to trade concerns here. If we look at a ratio of the two indices this trade still looks promising. Italian banks were hit hard on Friday, but if we take a broader view of the European banking space, we can see this index working nicely in a bearish channel, where probability suggests we still have to trade these from the short side. Italian yield spreads over German bunds are still the preferred measure of risk here, with traders highlighting increased risk of a credit downgrade from at least one of the agencies here, and perhaps the EUR could hold a stronger correlation with this yield differential should we see it push into the 2.90% level again.

We shall see, its interesting that EUR moves were not broad-based on Friday, where we can see that despite signs of vols picking up in Euro banks and Italian fixed income markets (the Italy/German 10-year spread widened a sizeable 32bp on Friday) the EUR actually caught a bid relative to CHF and GBP, and it would not surprise if this outperformance continued in the short-term. For those trading EUR/GBP, fundamentally the focus switches to the Tory party conference and with it the growing tensions between Theresa May and Boris Johnston. However, Theresa May’s mid-week speech should be the highlight here but its hard to see her anything but defiant and whether the narrative affects markets is another thing.

Also keep in mind in mind that we saw around $19b mature of bonds held on the Fed’s balance sheet mature yesterday, where the funds will not be re-invested. This will represent a liquidity drain through the session ahead, which in theory, and we have other recent examples by which to guide, should be a net positive for the USD. One to watch, and tactically it feels that if looking to sell USDs here that waiting aside to see how the land lies tomorrow maybe the better stance.

If we look at the G10 FX open this morning, there have been no real moves to talk about, despite China’s manufacturing and service PMI growing both growing at a slightly slower clip. S&P 500 futures should open largely unchanged, with the call for the ASX 200 modestly lower on open at this stage, while the Nikkei 225 could build on last week’s 1.1% gain. Although given my stance on USD/JPY, I will be looking for a sign that the buyers are less active in the index this week.

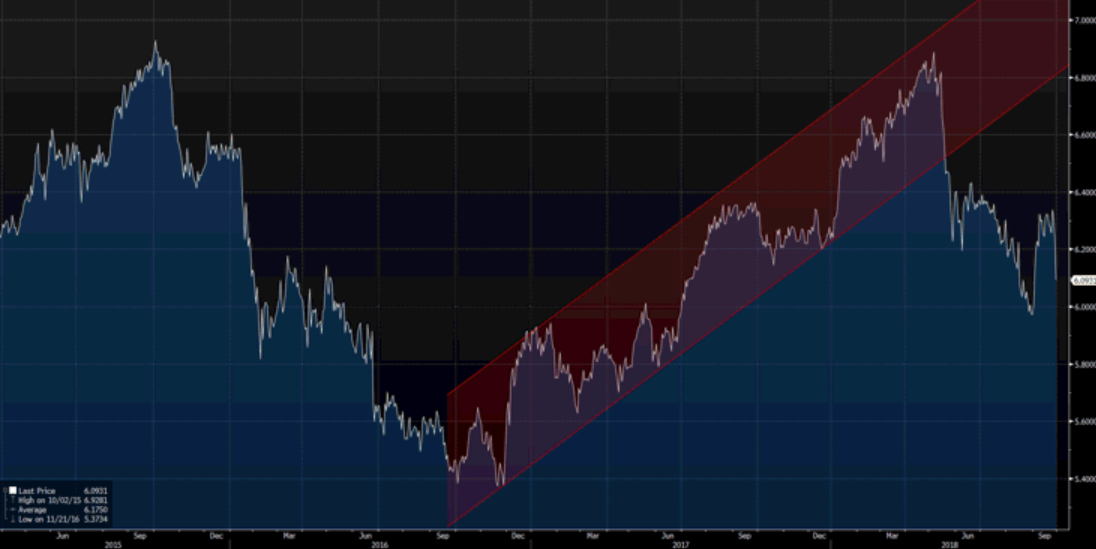

AUD/USD is unchanged from Friday's close, as is USD/CNH, although that is no real surprise. There are few technical reasons to be long AUD/USD here with any conviction, as the trend in the pair is firmly lower and is working within a bearish channel, where the line if best fit sits a $0.7160. Tomorrow’s RBA meeting should be a somewhat drab affair, and we can see the rates market not holding an above 50% probability of a hike through to July 2019, and given limited moves in Aussie fixed income, AUD, and iron ore since the prior meeting we so few reasons for the statement to change too greatly.