A somewhat bizarre night when looking at price action in various key markets, and while we saw a number of good news stories, on the whole, the bears would argue they had the upper hand.

One positive focal point was the US (August) manufacturing ISM report, which was red hot and at 61.3 the index printed the most robust levels of expansion since May 2004. Drilling into the sub-components and we can see both new orders and production are flying (these sub-indices printed 65.1 and 63.3 respectively), while prices paid easily held the 70 level, which continues to support US inflationary trends. New export orders grew at a slower pace at 53.9, and perhaps that re-enforces the story that there are economic vulnerabilities outside of the US and that external demand is not as rosy as some believe.

We can deduce from this US data point that the US is looking good, and growing to just over 3% in Q3, while the rest of the world is in a different league. Two points that back this view was Korean core inflation (released yesterday), which came in at 0.9% - the lowest levels since January 2000, while South Africa hit the market with an awful GDP print, with the country falling into a technical recession. Naturally, the ZAR was savaged on this news and USD/ZAR is eyeing a test of the recent highs of 15.5.

With this divergence in economic trends in play we could argue that this should have benefited the USD and for the large part it did, with the USD index gaining 0.3% on the session and pushing higher on the session against all G10 currencies, except the SEK. However, the strong US manufacturing data (released at 00:00aest) actually coincided with EUR/USD rallying 50 pips from its lows of $1.1530. This is odd when we saw US Treasuries finding sellers across the curve, with the US 5-year Treasury closing the cash session up four basis points (bp) at 2.77% and perhaps this is partly reflective of a wave of Investment-Grade credit supply due to hit the market this week.

The 16bp narrowing of the Italy 10 Year vs Germany 10 Year Spread yield spread would have certainly helped the EUR, and 1.6200 in EUR/AUD looks likely to be tested in the short-term. Happy to stay long this cross.

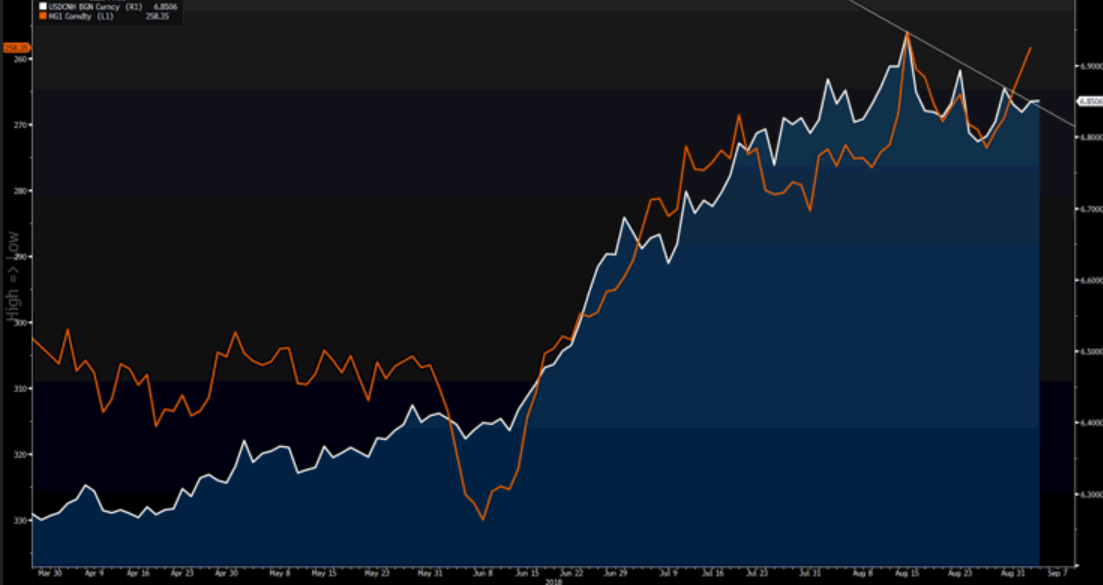

If copper is a bellwether of the economy, then the fact copper futures closed -2.6% and eyeing a test of the 15 August low of $2.58lb tells me that traders see the US growth story as idiosyncratic and we should be focused externally. Perhaps most pertinently we should watch USD/CNH as it seems copper has its sights set here. This correlation makes sense, as the market is trying to understand if China is genuine in its guidance for a stable RMB, or whether the authorities will offset the trade tariffs with greater purchasing power for US importers by giving them a stronger USD. We shall see, but should the PBoC take the view that they need to offset a full suite of 25% tariffs, then the RMB is going lower. Although concerns of capital outflows and equity drawdowns will ramp back up again and this is the balancing act the PBoC need to face.

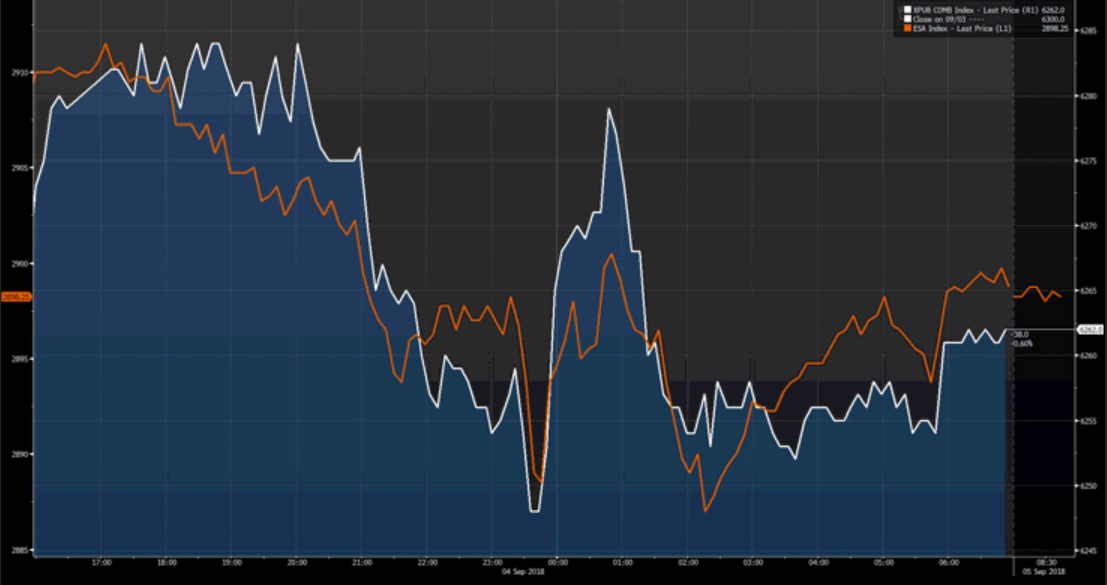

The weakness in emerging markets (EM) is not just a currency story, although big moves again in ARS, TRY and COP have been noted. EM equity markets have been sold-off too, with the MSCI EM futures -2.0%, which is a similar story in the ETF market with the EEM ETF also lower by 2% and this bearish trend isn’t changing anytime soon. This flow did impact US equities, with the S&P 500 overlooking the manufacturing report and falling in appreciation with EM concerns, pushing -0.9% to 2885, before traders do what they do best and bought the dip, pushing the US index into the flat line. Taking these leads, I would expect a softer start for Asian equity markets, and if I take the ASX 200, it would not surprise to see sellers get the upper hand on the open, although this is more down to a lack of reasons to buy rather than moves in the S&P 500 futures.

The event risk in the session ahead is centred on watching EM equities and currencies. However, traders will be treated to Aussie Q2 GDP, with expectations of a 70bp increase on the quarter, which takes the year-on-year print towards 2.9%. I wouldn’t expect a strong reaction to this data point, although that obviously depends on the outcome. AUD is very much on the dog house again and is flirting with the 2016 lows of $0.7160. What we need to understand here is that debt absolutely matters, as it puts the sovereign in a weak position on a number of levels. So, yesterday’s Aussie Q2 current account, at 2.9% of GDP is a sell signal in itself, especially if we are potentially going to see gridlock in the Australian Congress, making it hard to put in the initiatives to reduce the deficit.

At 00:00 AEST we hear from the Bank of Canada, while NAFTA talks resume. USD/CAD is on the radar, and the daily chart is shaping up nicely for long positions, although this comes with obvious risk. Here, we see price closing firmly above the June downtrend, and pushing above the recent significant high of $1.3180, so the balance of probabilities is for higher levels. But, as we know trading around announcements is always tough and often ill-advised, and while there is only an 8% chance of a hike tonight, there is a 76% chance of a hike priced for the October meeting and Canadian data seems to support that fate.