The wheels look like they are coming off in the Asian session today. The stabilisation we saw yesterday now appears to have only been a pause. China’s somewhat mystifying 3% rally in the Shanghai Composite was quickly lost at the open, killing sentiment across the whole Asian region. But the biggest pain point in Asia was in the Hong Kong dollar and Hong Kong-based equities as speculation grows that the HKMA may not be able to keep the peg to the US dollar.

Speculators are betting that the HKMA will not be able to hold the peg for the Hong Kong dollar against the USD. The dire deflationary environment in Hong Kong would usually prompt a currency depreciation in any normal economy. But the intrepid city-state has kept the USD/HKD rate firmly within the HKD 7.75-7.85 band since 1983. Although the elimination of liquidity in offshore Chinese yuan has pushed devaluation speculation over to the HKD, the HKD is being pushed to the upper limit of its band, rising over 7.83 to its highest levels since 2007. Short bets on the HKD offer huge potential profits with limited downside risk, just like other successful bets on pegged currencies such as the Thai baht in 1997 and the British pound in 1992. When pegged currencies are let go they really fly; just take a look at the Kazakhstan Tenge’s recent performance.

But these bets are also hammering the Hong Kong-based indices. The Hang Seng China Enterprise (CEI) Index has now reached its lowest level since 2009 after losing 4.9% today, while the Hang Seng has lost 3.8%. This has created some dissonance with the more-than-3% gain on the Shanghai Composite yesterday.

The somewhat mystifying 3%+ rally in Mainland equities yesterday has proved short-lived and this is likely to punish commodities on European and US exchanges. Some more of the Chinese GDP data has filtered out today and concerns about Chinese economic growth seeing a very weak Q1 in 2016 are growing.

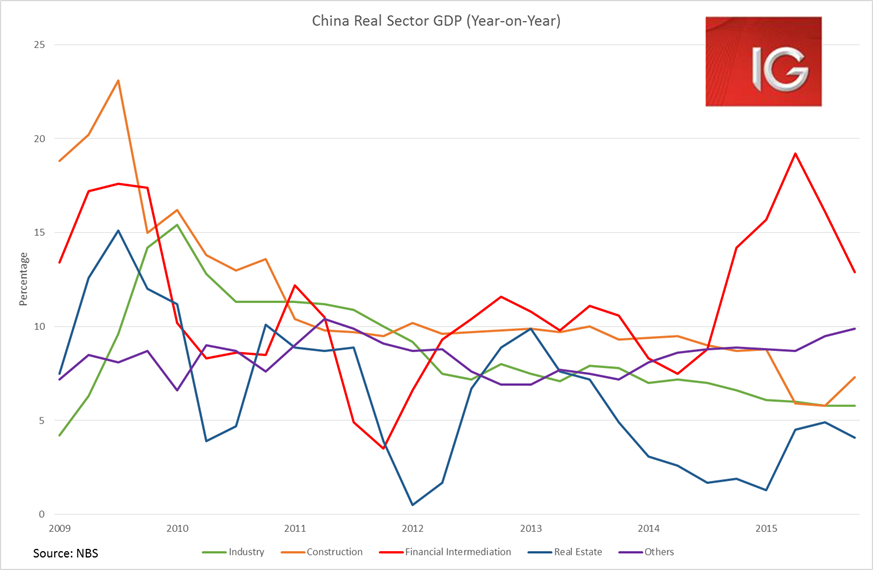

The benefits from financial intermediary growth in the GDP figures have dropped dramatically in Q4, growing to 12.9% YoY from a prior 16.1%. With the gains in financial intermediation largely being related to the big rally in the Chinese stock market, financial intermediation is set to drag on GDP growth in 2016. Construction has also notably increased from 5.8% YoY to 7.8% YoY, correlating to increased fiscal spending in Q4. This also raises concerns for GDP growth in Q1 as much of that fiscal spending was brought forward and there does not seem to be any indication that China will continue the same level of spending.

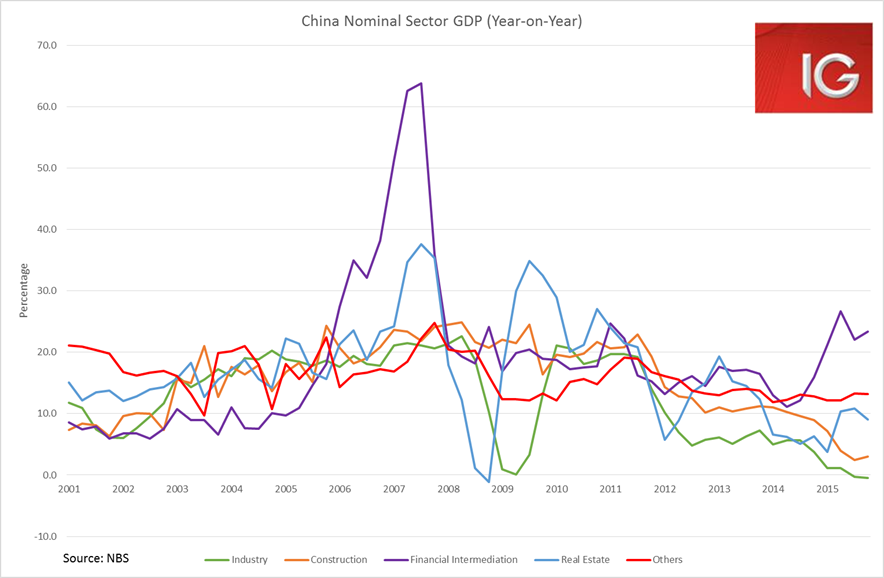

The GDP breakdown also raises questions about the appropriateness of the GDP deflator that China is using. In real terms, industry grew at 5.8% YoY - same as the previous quarter. Yet in nominal terms, industry declined 0.5% YoY, its second straight month of YoY declines. This does, of course, raise the well-worn trope that Chinese GDP is actually far weaker than the headline real GDP number implies (Shock! Horror!).

ASX: After seeing some steady gains early in the session, the ASX has been unable to buck the trend of selling seen throughout Asia. It has been an odd session, however, with the selling heavily focussed on the energy, materials and financial sectors. A number of favoured growth stocks were actually catching a buy today, such as Domino’s (N:DPZ) and Treasury Wines (OTC:TSRYF), after investors were keen to get in on the stocks after their lofty valuations had come down a bit.

BHP's (N:BHP) miss on its output numbers and its lower 2016 forecast weighed down on the stock, but China concerns saw heavy selling across the space with RIO (N:RIO) and Fortescue (OTC:FSUGY) also seeing heavy selling.

The banking sector was in a world of pain. The selloff in Asia seemed to be behind the reason why the heaviest selling was seen in ANZ (OTC:ANEWF), which has the biggest leverage to Asia of the Big Four.

Ahead of the European open we are calling the:

FTSE 5767 -110

DAX 9438 -221

CAC 4176 -96

IBEX 8401 -154