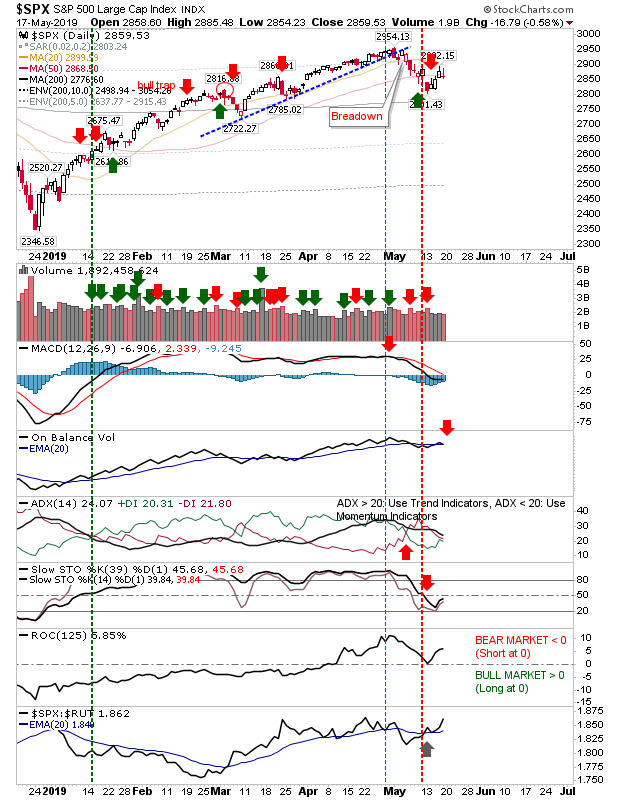

Friday saw indices turned at moving averages after Thursday's tests. Volume was light, so it may be a mix of profit taking and some aggressive shorts.

In the case of the S&P 500, the bounce in the market was not enough to reverse the bearish technicals and may have even pushed them into a shorting zone. The 50-day MA is acting as resistance. On the plus side, there is a continued advance in relative performance against the Russell 2000.

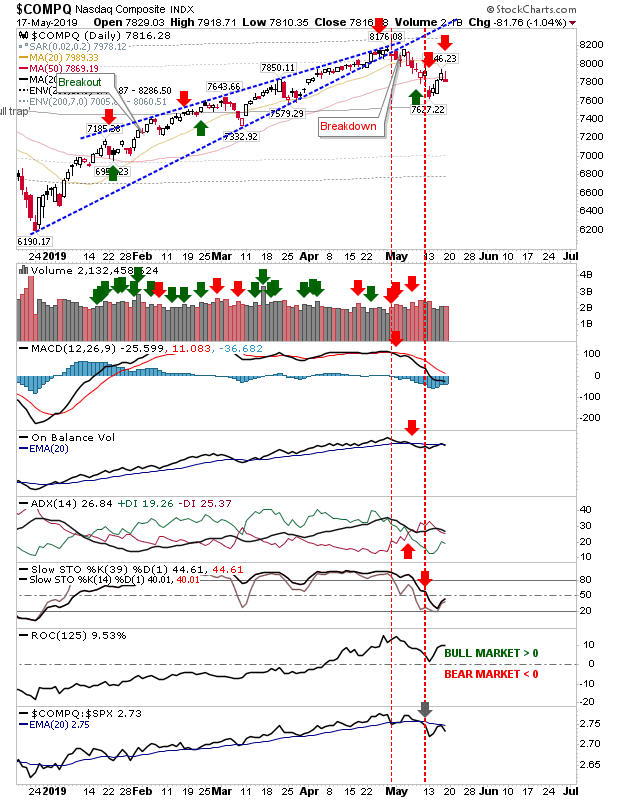

Likewise, the Nasdaq also was turned by its 50-day MA. And again, technicals remained net bearish. The index has under-performed the S&P and is now looking at the 200-day MA for possible support.

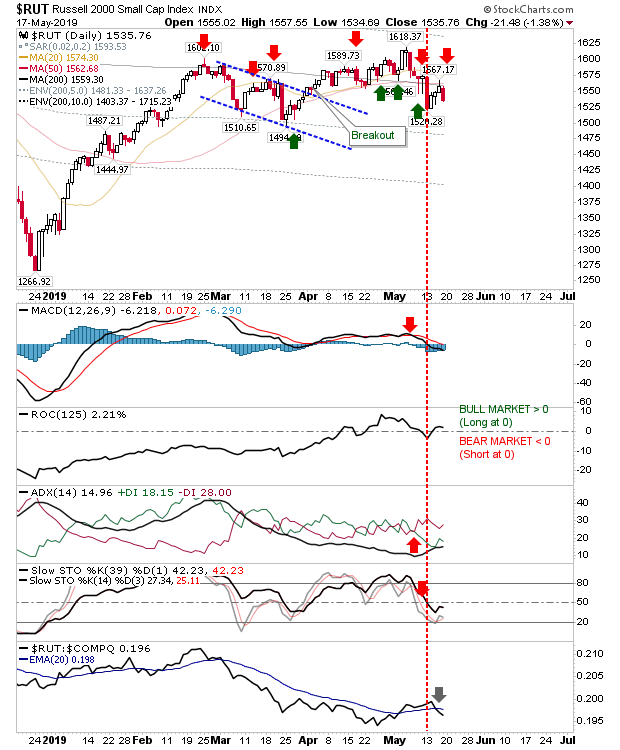

The Russell 2000 took the biggest hit on Friday as it reversed off converged 20-day, 50-day and 20-day MAs. This index remains range bound, although a loss of 1,495 will send the rats scurrying. Technicals are not oversold, so further losses remain favoured in the near term (and sharp drops typically don't occur until an asset is already oversold).

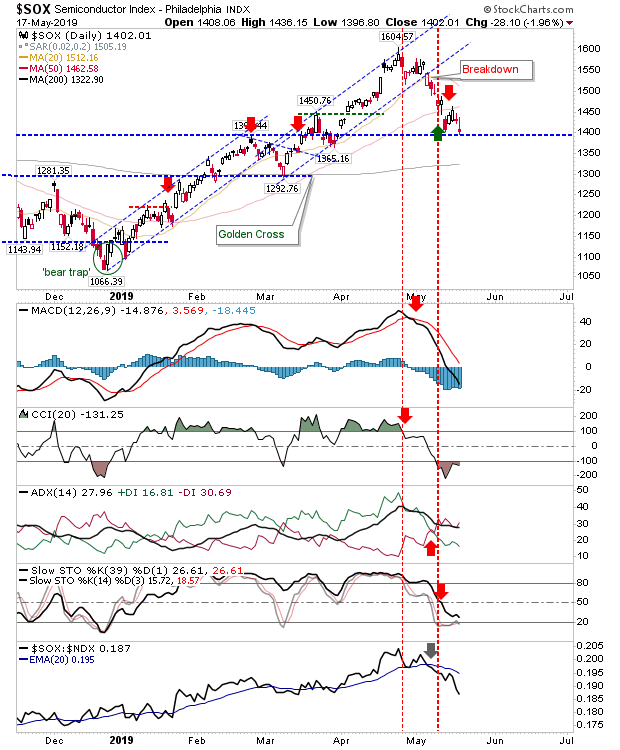

The Philadelphia Semiconductor Index is looking somewhat problematic as it finds itself back at 1,400 support. The brief bounce off this support up to its 50-day MA has lost what little momentum it had, which now suggests a move to test the 200-day MA looks favoured.

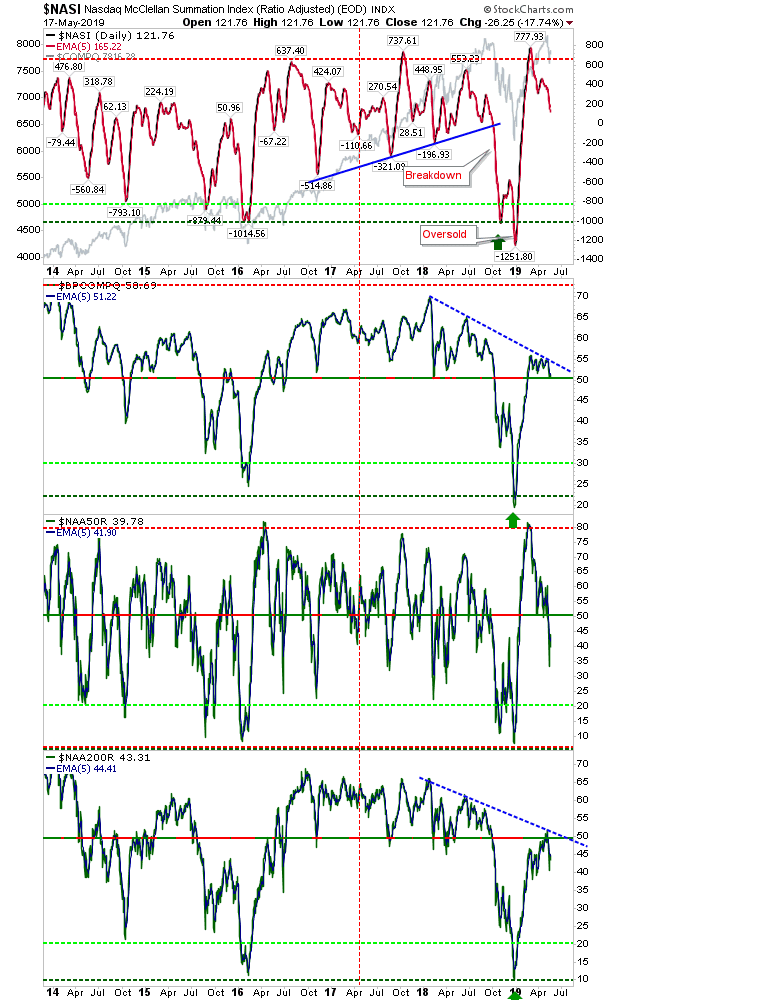

Breadth metrics are also shaping divergences, in particular, Nasdaq Bullish Percent (Buy) Signals; struggling at 50% despite new highs and Percentage of Nasdaq Stocks above their 200-day MA only at 43%. Buyer Beware.

A big next few days are in store for the indices. Losing more ground tomorrow and Tuesday opens up for tests of 200-day MAs. However, as the Russell 2000 has already lost 200-day MA support, the chance Large Cap and Tech indices will be able to hold on to theirs looks slim. Future guidance should come from the Russell 2000 - and the initial prognosis for this index is not good.