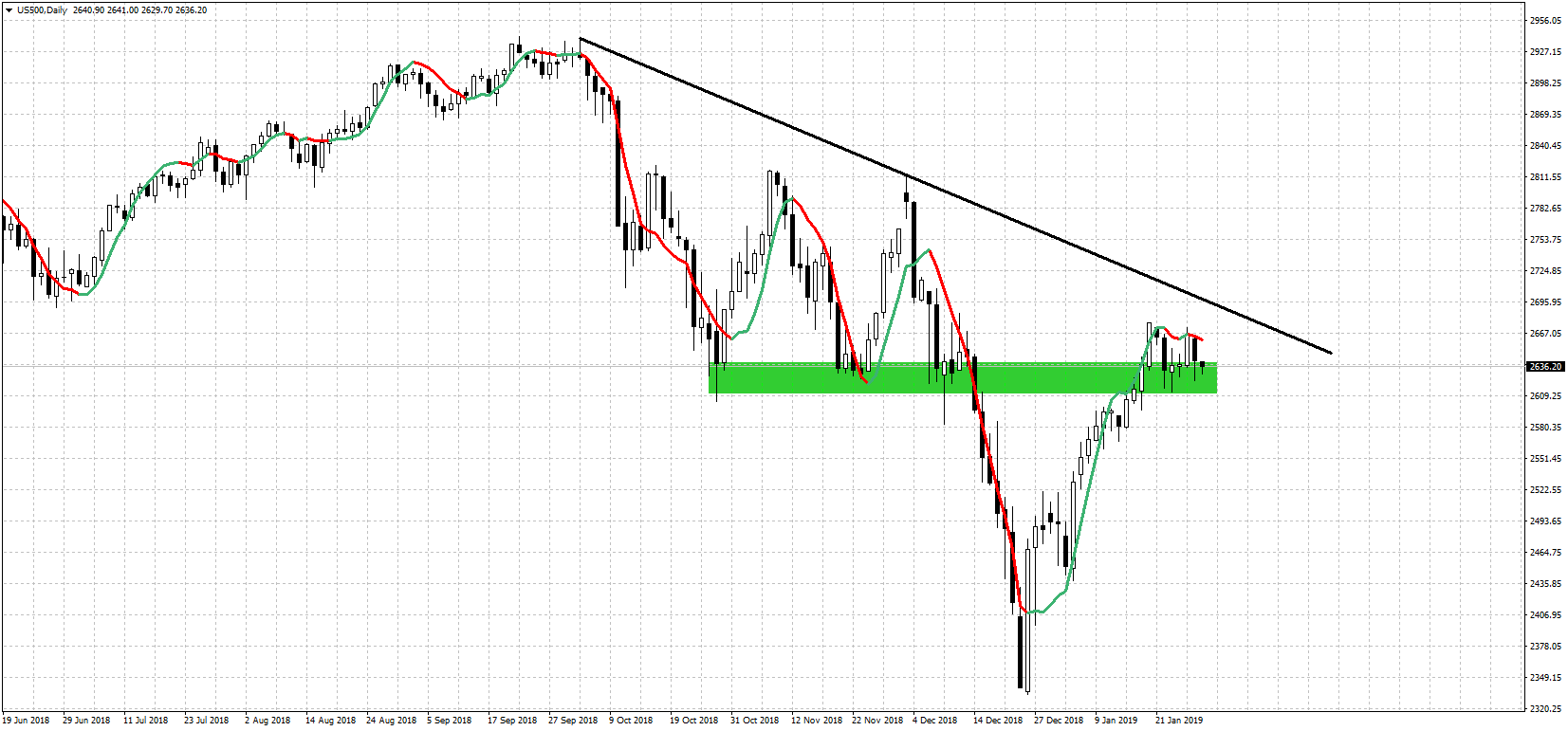

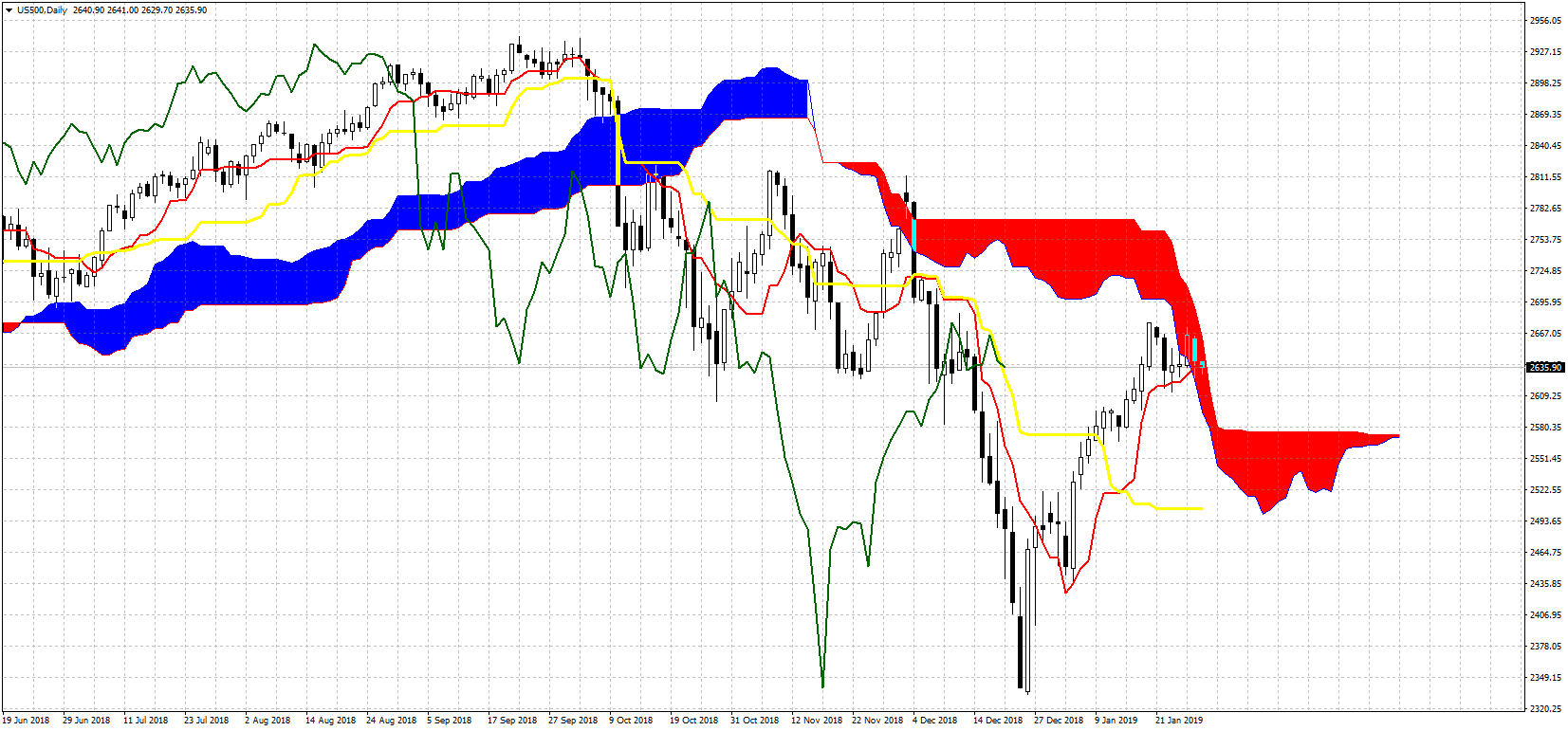

SPX

Holding above 2630-2620 in the SPX is a sign of strength. However, the inability to break cleanly above 2680-2690 is a sign of weakness. This is portrayed better in the Ichimoku cloud chart. Breaking below 2630 will lead to a move below 2600 with bearish implications for the medium-term. With 2580 the most probable target, I remain slightly bearish at current levels. A higher low around 2550 would be ideal for the next leg higher, 2470 key support level for the longer-term trend. Breaking below it will increase dramatically the chances for a new low towards 2200-2000.

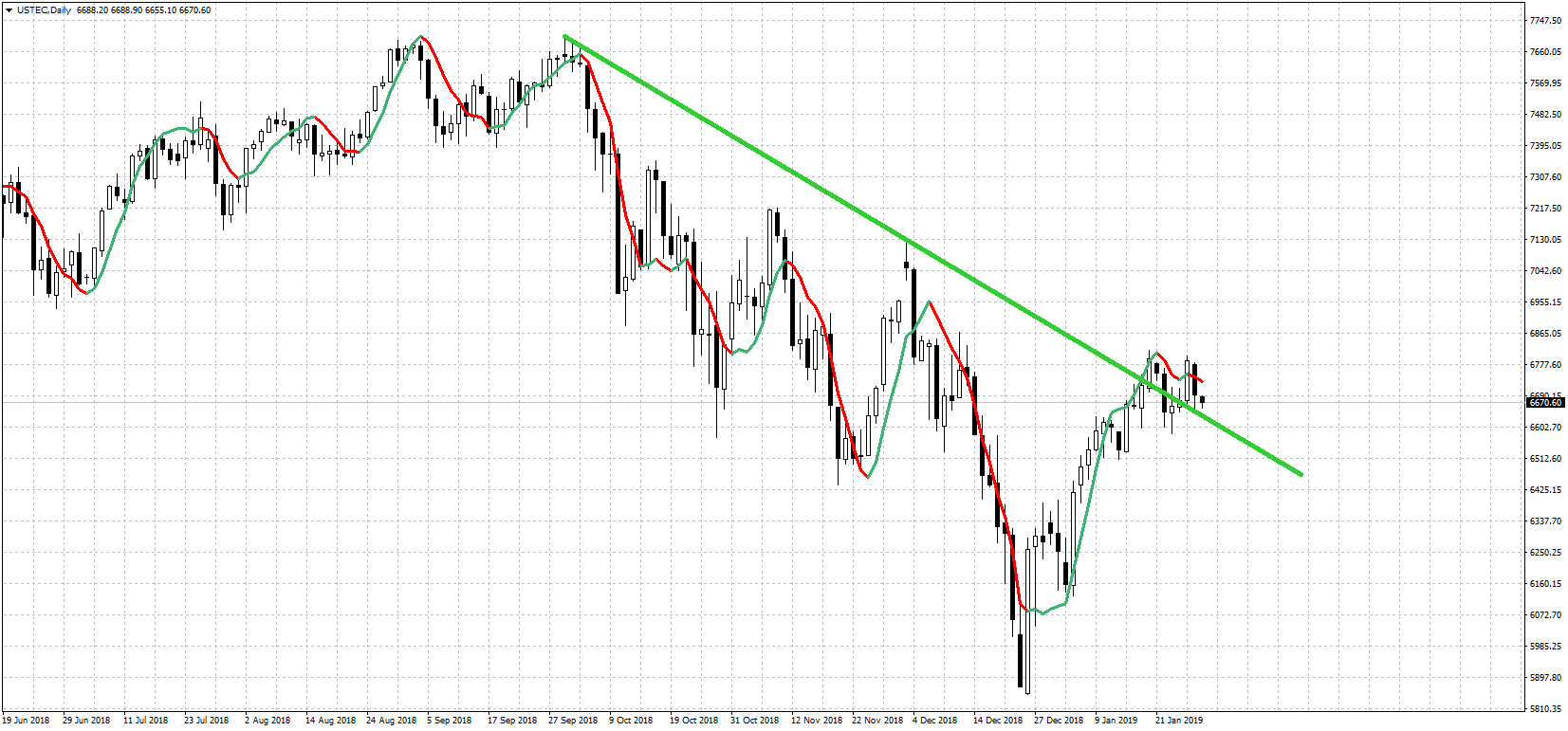

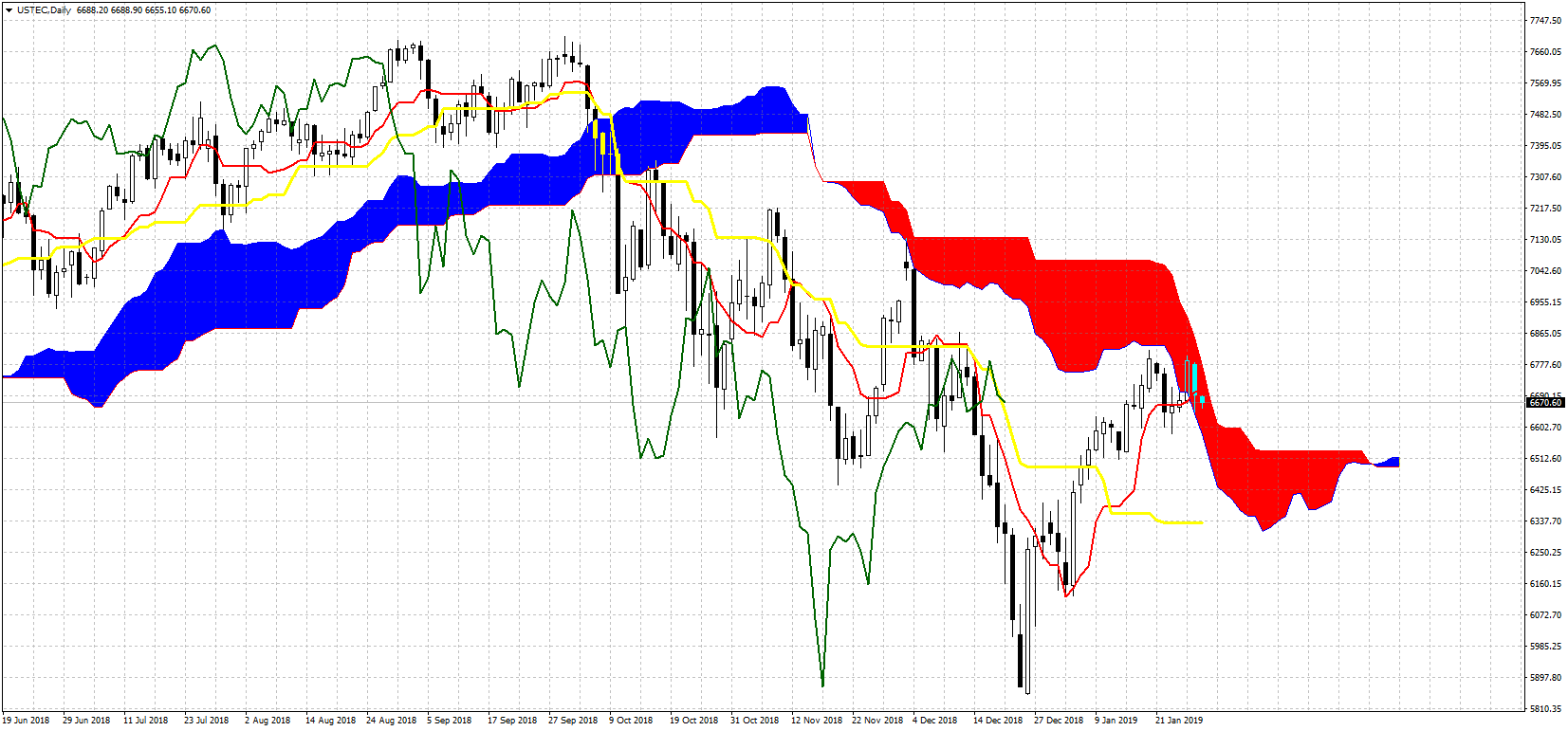

NASDAQ

Key short-term support is at 6600, while I expect a pullback towards 6450 at least. The longer-term bullish scenario gets fewer chances of success on a break below 6220.

A higher high now will only add to the RSI bearish divergence. Pull back now is the most probable scenario.

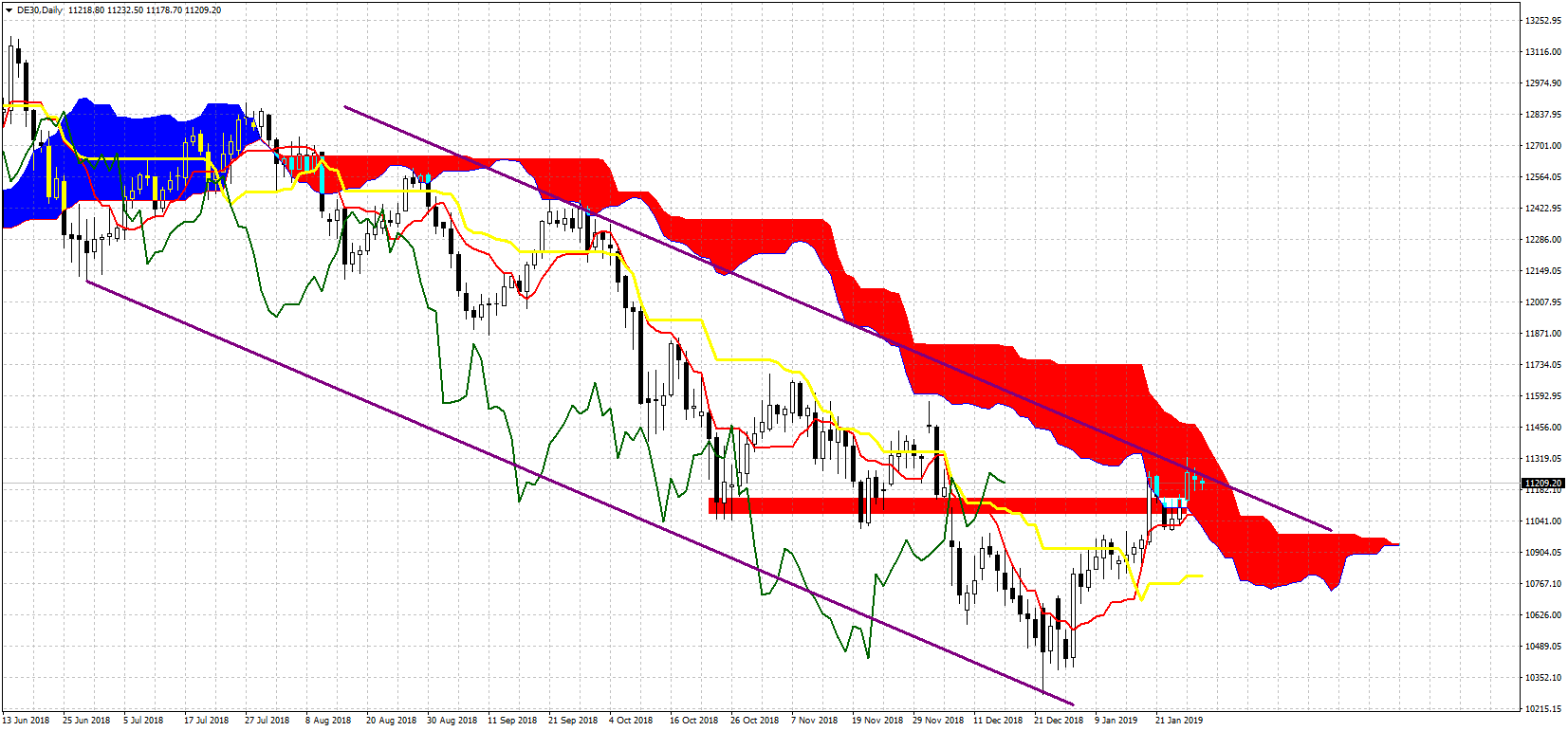

DAX

Time for a pullback here as well as price is sliding on top of the long-term upward sloping support trend line

DAX remains inside the longer-term bearish channel and I expect the price to get rejected here.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.