Credits to @ryandetrick

MrTopStep’s Index Futures Recap – Tuesday December 29th

Last night on the globex open, the S&P futures opened at 2049.75 and maintained a sideways range during most of the Asian session until rallying near the Asian close into the open of the Euro session, and maintained a bid throughout the remainder of globex, making a high of 2063.75 before settling the globex session just 2.5 handles off the high.

At the US regular trading hours open, the S&P opened at 2061.25, and almost immediately buy programs entered the market and kept the equity index futures at a steady bid higher throughout the morning session; and after a lunch hour sideways move, the rally continued into the close as the MIM was showing as much as $350 million to sell, and the actual MOC came out at $150 million to sell. The ESH6 settled the day at 2072.75, up nearly 25 handles on the day.

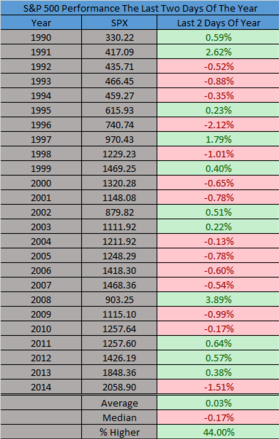

Heard across the news wires today was minimal as global markets are maintaining a quiet calendar for the duration of the holiday shortened week. Heading into tomorrow, the global calendar is again light, and noticeable in the U.S. will be pending home sales due to be released at 9 a.m. CST. The S&Ps have rallied nearly 40 handles from Monday’s low, and with the final two sessions of the year remaining, one has to wonder how much portfolio rebalancing will drive the markets. Currently, as of today’s close, the S&P 500 index futures are up about 1% for the year, and we seem to think that going into the year-end settle, the futures will likely be pinned to either 2050.00 or 2100.00.

Credit Agricole (PA:CAGR)

The tug of war between central bank policy divergence and global currency wars should continue to drive price action in G10 FX markets next year. The relatively strong domestic fundamentals in the US and the UK should allow the Fed, and to a degree the BoE, to tolerate further currency appreciation against low-yielding funding currencies like EUR, CHF and JPY.

With many positives in the price, we expect both USD and GBP to peak next year. In the case of USD NEER the peak should come towards the end of 2016 once the Fed tightening cycle is well underway. GBP should fare less well and we expect renewed weakness in H216 ahead of the EU referendum.

Policy divergence should keep EUR/USD and EUR/GBP under pressure. EUR should remain relatively more resilient against risk-correlated and commodity currencies as well as CHF and JPY. We expect EUR/USD to trade through recent lows in 2016 but parity is not our base case. The cyclical recovery in the Eurozone should accelerate and ultimately limit the scope for aggressive easing by the ECB, paving the way for a EUR rebound in late 2016 and 2017.

The risks to global growth and inflation should linger and prolong the global currency wars. Worries about China in combination with tighter global monetary conditions on the back of Fed tightening should continue to darken the outlook for G10 commodity and risk-correlated currencies. In that, we expect the antipodeans to underperform CAD and NOK. SEK should outperform but only once the Riksbank has declared an all clear on the risk of deflation later in 2016.

Citi analysts expect that USD/CAD may rise toward 1.4200 for the coming 0-3 months.

“Since petroleum products are Canada’s major export, the persistent oil weakness may dampen Canada’s export income. This will likely be CAD-negative.

Besides, Citi’s Canada Economic Surprise Index plunged to -71.5 recently, the worst among major currencies, reflecting that economic data in Canada continues to trail market expectations. For instance, Canada’s Core CPI growth (MoM) moderated from +0.3% to -0.3% in Nov. GDP growth (YoY) fell from +0.1% to -0.2% in Oct, Citi argues.

On the technical front, Citi notes that USD/CAD continues to be supported by 20MA

“Technical indicators suggest USD/CAD may rise toward 1.4001-1.4200 upon consolidation, with support at 1.3721,” Citi projects.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.