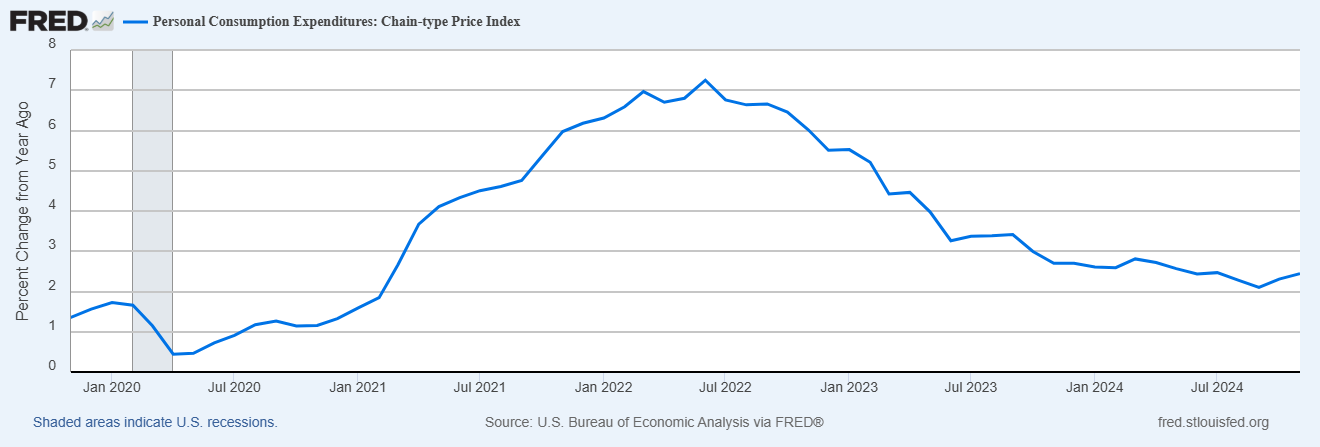

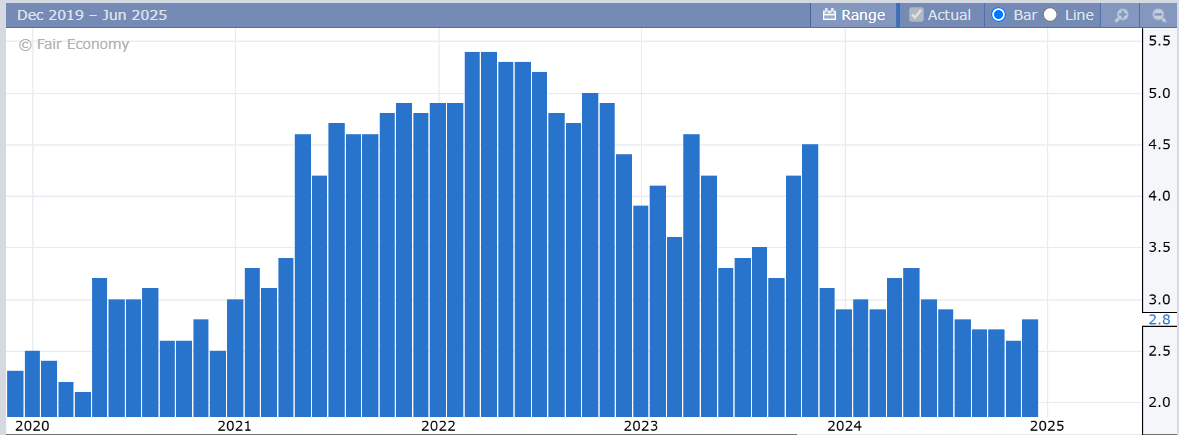

Personal Consumption Expenditures (PCE) read on inflation (an alternative to the CPI, preferred by the Fed) increased +0.1% in November, and +2.4% over the last 12 months. With food and energy prices both rising +0.2%.

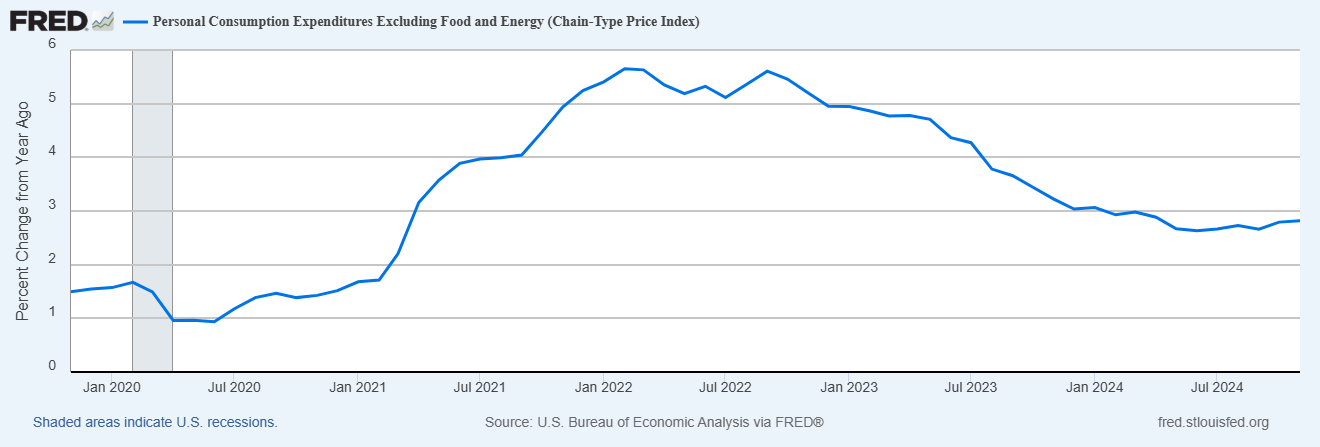

If we exclude food and energy prices (core PCE), inflation rose +0.1% in November and +2.8% over the last 12 months (6 month high).

This was actually slightly below street estimates of +0.2% for November, but the second straight month of “hotter” inflation readings.

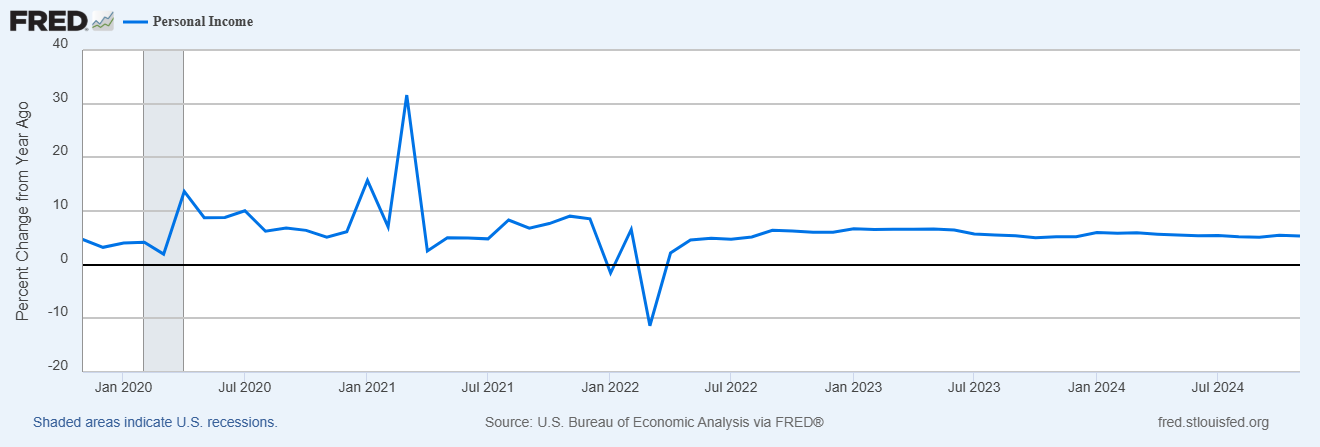

Personal incomes missed street expectations, rising +0.3% in November (+0.4% estimate), but holding steady on annual basis around the +5.0% level.

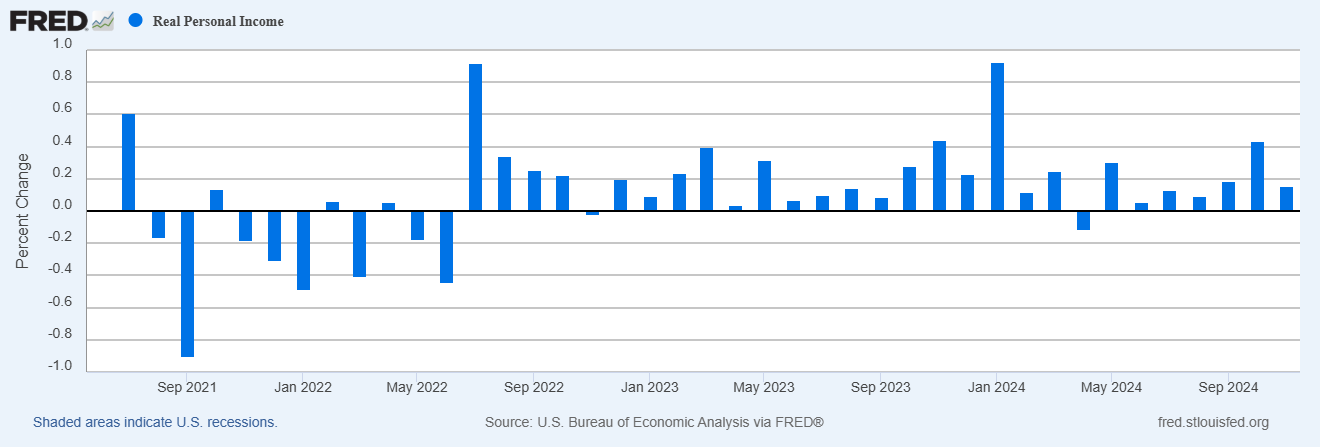

Real personal incomes (income minus inflation) rose +0.2% in November and +2.8% over the last 12 months. This is the 7th straight month where incomes have risen above the rate of inflation and 27 out of the last 29 months.

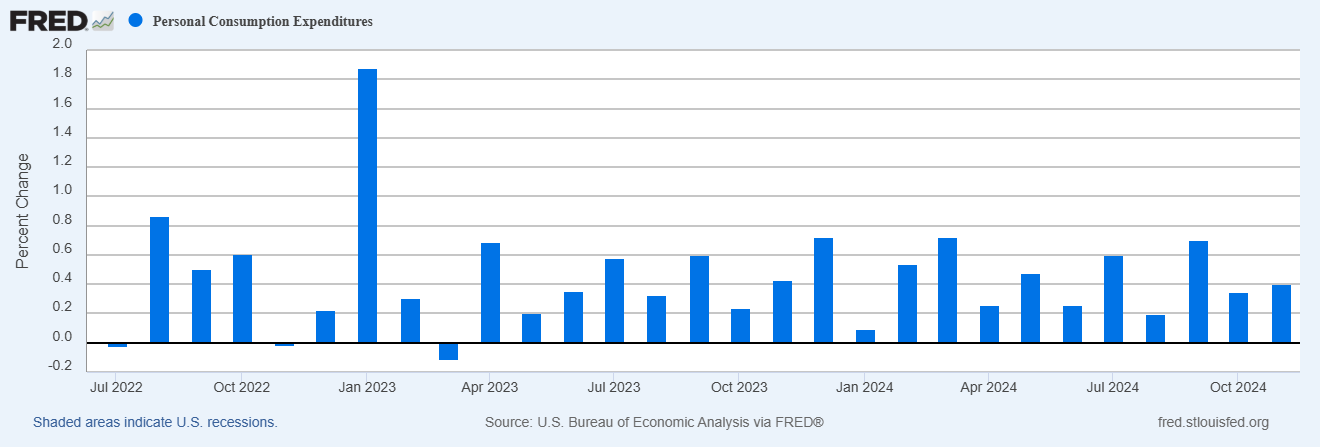

Personal spending (contributes about 2/3rds of GDP) grew +0.4% in November, below street estimates of +0.5%, but an increase over last months +0.3%.

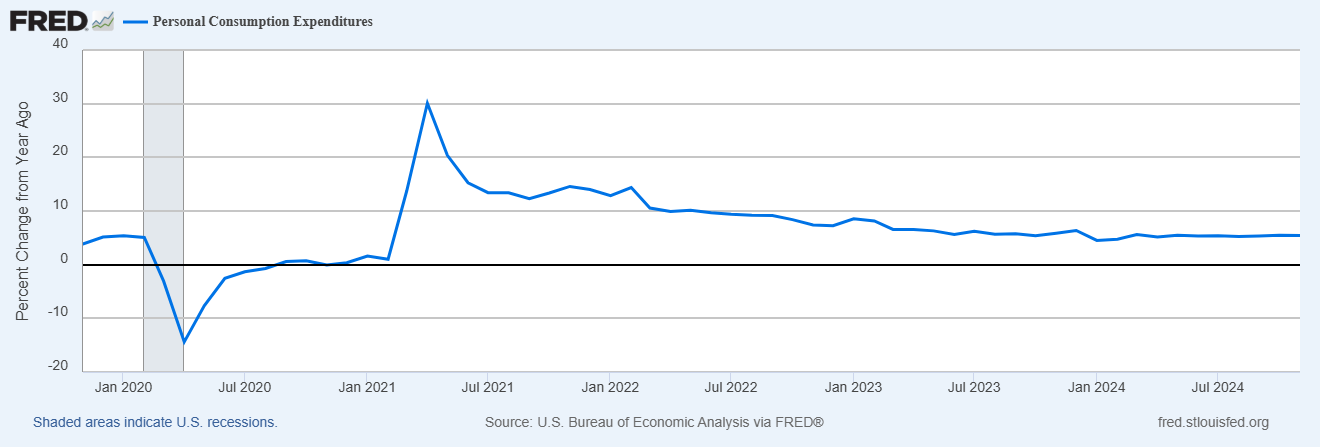

Consumer spending grew +5.5% over the last 12 months, remaining at a level consistent over the last few years.

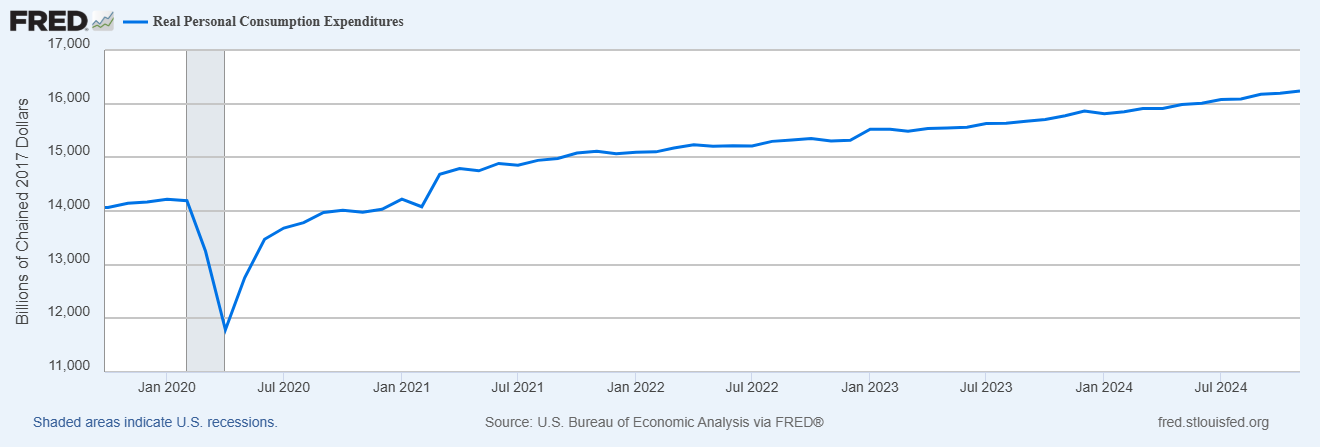

Real personal spending (consumer spending minus inflation) is now +15% above its pre-COVID highs, coming in at +0.3% in November, and +2.9% over the last 12 months. In contrast to the retail sales numbers (which all the gains were on account of price increase and not an increase in demand) total consumer spending has shown growth over and above the rate of inflation. Retail sales monitors goods, while consumer spending includes goods & services. And its clear the services sector has been the one driving the economy for the last few years.

Year-ahead inflation expectations ticked up to +2.8% in November. The first monthly increase since May. Long-term inflation expectations remain in the 3% range.

Lots of data released before the holidays. Paints a picture of stable growth with inflation that remains steady at a level higher than the Fed wants to see it. They lowered short-term rates another 25 basis points on Wednesday, which was widely expected. But their forward projections for 2025 called for 2 more rate cuts, instead of the 4 rate cuts in 2025 that they projected at the September meeting. The market sold off a little bit after the press conference, which led many to speculate that investors didn’t like the “hawkish” cut. I’m not entirely sure about this. First off, no one should take those projections that seriously anyways. It’s nothing more than an educated guess at best. Second, if you’ve been following the data over the last few months, then it really shouldn’t come as much of a surprise that the Fed may not be able to cut rates as much as the market would like. I mentioned this last week after the CPI report.

I have a hunch this may have more to do with the looming government shutdown. As ridiculous as it sounds. There is a history of market volatility around these deadlines until the deal is eventually reached. But when it comes to these short term market fluctuations, my guess is as good as yours.

One thing worth keeping an eye on is interest rates. The above chart shows a potential break out on the 10-year treasury yield, above the 4.5% level. If this break out is real, and rates move back to test 5.0% again, it could have a negative effect on stocks. Stock valuations are sensitive to interest rates. As we discussed before, the equity risk premium (S&P 500 earnings yield minus treasury yield) turned negative for the first time since the great financial crisis. And the higher that rates go, the more expensive stocks become. It’s a pretty good time to be a bond investor, as long as maturity dates are around 5 years and below.

That’s all for 2024. Thanks for reading. Much appreciated. Happy holidays to you and yours!